1099-NEC Tax Forms

Use Form 1099NEC to report non-employee compensation.

Freelancers, contractors, attorneys and other non-employee compensation in 2023 is reported on 1099-NEC forms.

- Everyday discounts on 1099NEC forms – save big over retail!

- 1099NEC Forms, envelopes, software and online e-file options

- Fast shipping and friendly service

- Compatible with accounting software

**NEW** 1099 E-filing requirements — E-file Copy A if you have 10+ W2 and 1099 forms combined in 2023

DiscountEfile.com makes it easy! Simply enter or upload data, and we e-file with the IRS and can even print and mail recipient copies in one easy step. Learn More >

Printing 1099NEC Forms is simple with the right forms, envelopes and more at every day discount prices.

Year-End is Easy with The Tax Form Gals!

Major E-File Requirement Changes for 1099 & W2 Filing

The new e-file threshold for the 2023 tax year is only 10 W2 and 1099 forms, combined, per EIN.

For example, if your business has to file 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2024.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes.

Penalties apply if you don't - $60 per form if you file on time and up to $310 per form if you file late.

NEW E-FILE RULES + ONLINE FILING = EASY 2023!

E-file, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

If you have 10 or more 1099 & W2 forms combined for a single EIN, you must e-file 1099 & W2 Copy A in 2023.

Use DiscountEfile.com to enter or upload data from QuickBooks® or other programs, and we'll e-file with the IRS or SSA for you and can even print and mail recipient copies!

Create a free account and get started today!

WHAT IS 1099NEC?

Income reporting for non-employees.

It is used to report $600+ in non-employee compensation for the tax year. It changed to a dateless format last year, requiring you to fill in the year on each form.

WHEN IS IT DUE?

Forms must be mailed to recipients by January 31.

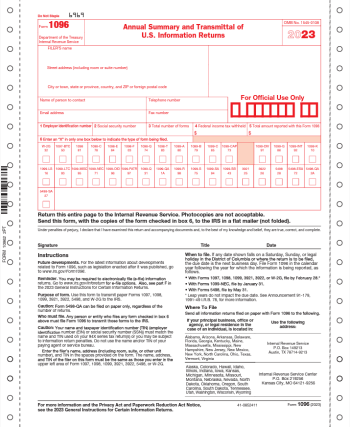

1099NEC forms must be also be e-filed or mailed to the IRS by January 31, along with a 1096 transmittal summary form to summarize the batch from a payer.

WHO SHOULD USE IT?

Businesses required to report payments of $600+ to non-employees.

Any business who pays contractors, freelancers, attorneys or any person considered a non-employee must report payments of $600+ during the tax year.

WE'LL DO THE WORK FOR YOU!

Easy 1099 Filing Online

Simply enter or upload your data and we'll e-file with the IRS and can even mail recipient 1099NEC forms!

Use DiscountEfile.com to make 1099 filing easier than ever. Learn More >

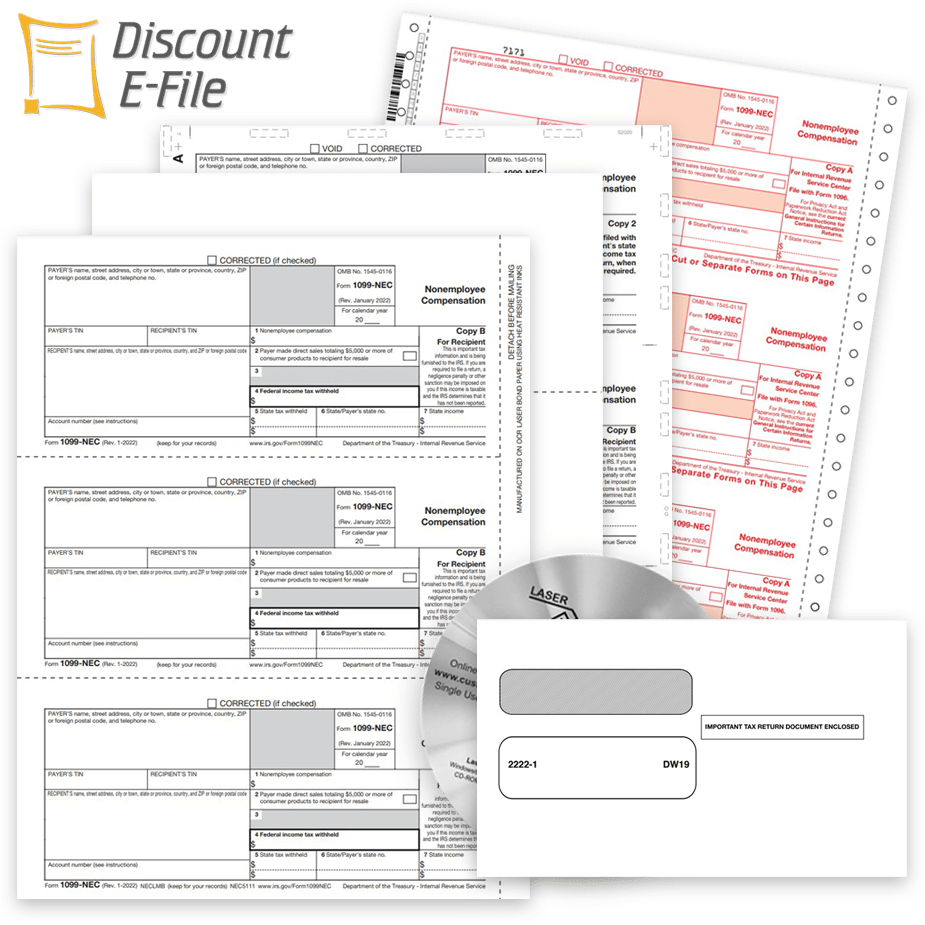

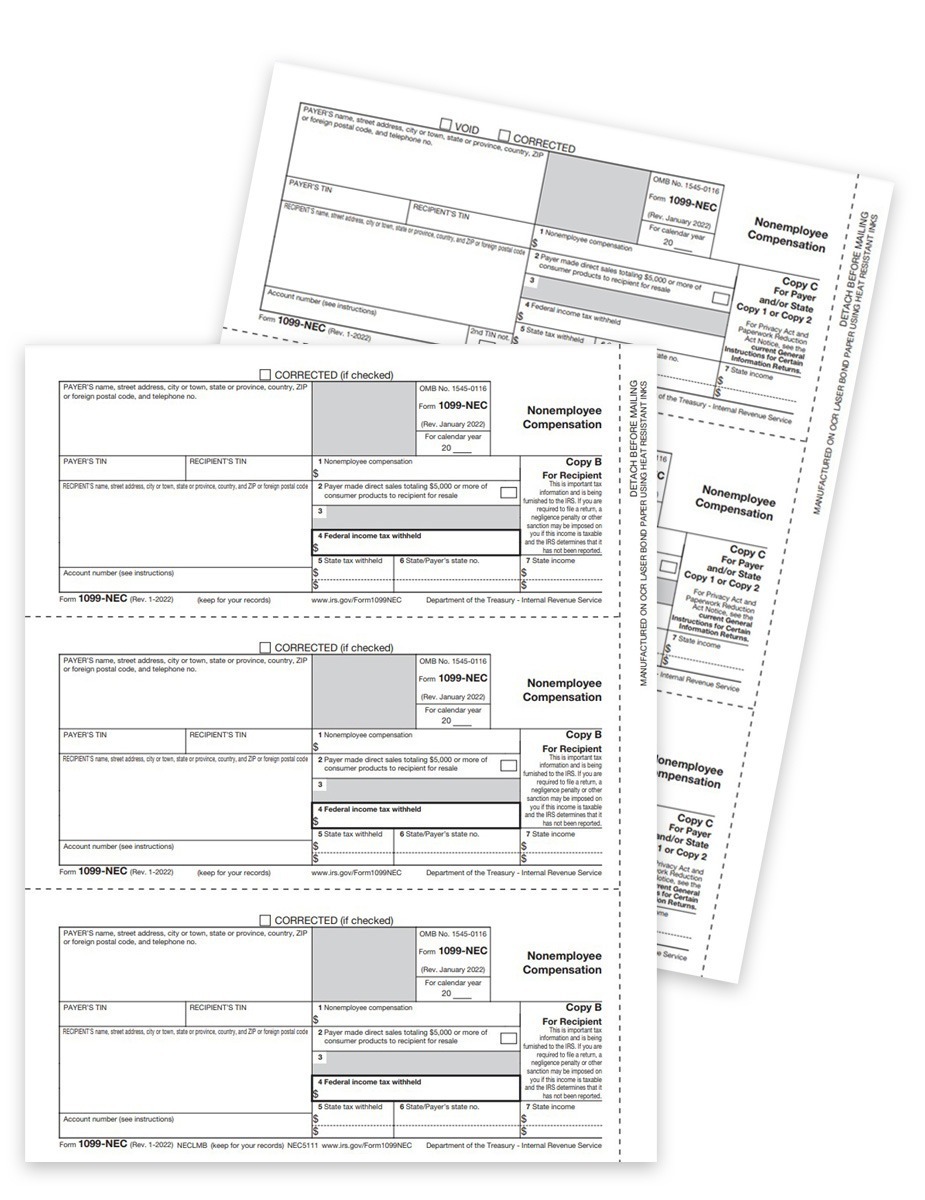

Order Official IRS 1099-NEC Tax Forms

-

1099 Envelope – 3up

-

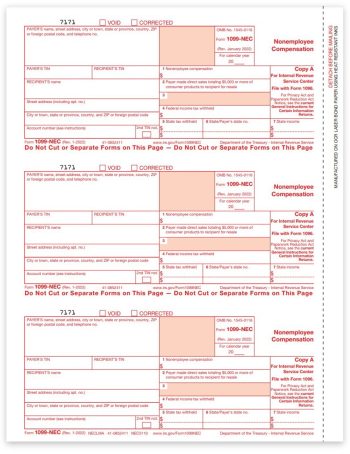

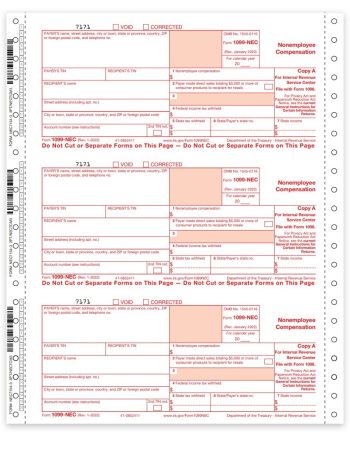

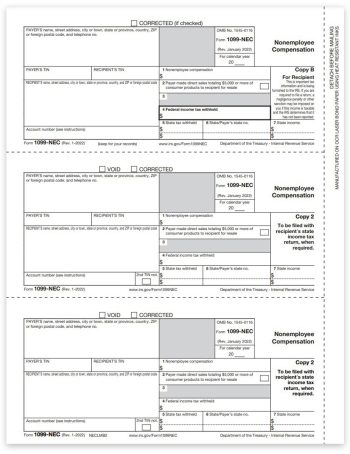

1099-NEC Form – Copy A – IRS Federal

-

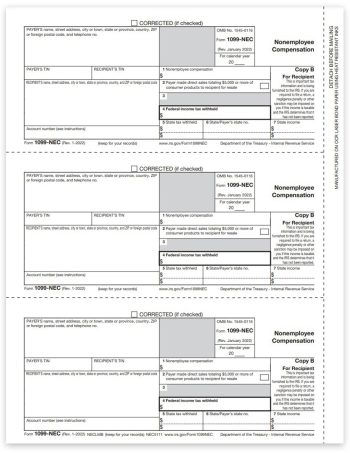

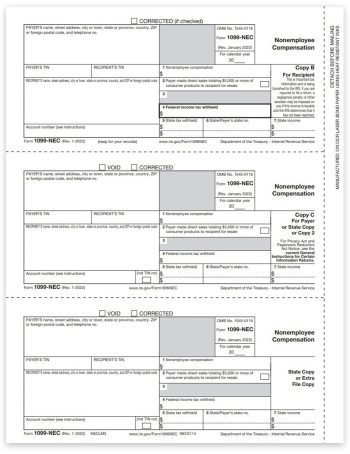

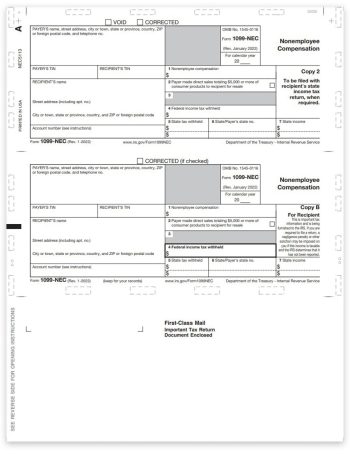

1099-NEC Form – Copy B Recipient

-

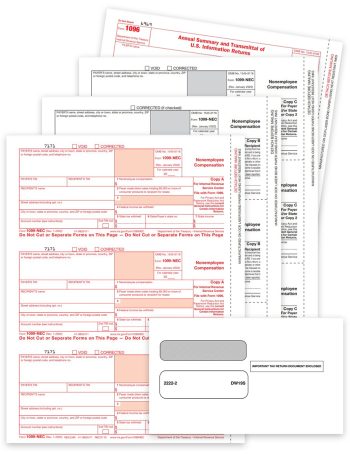

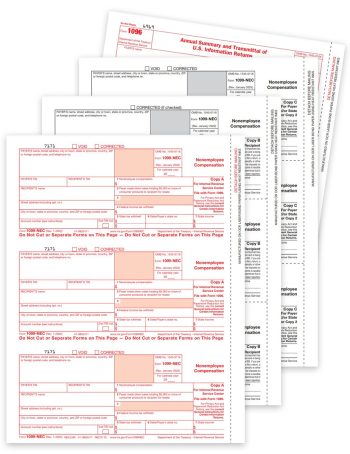

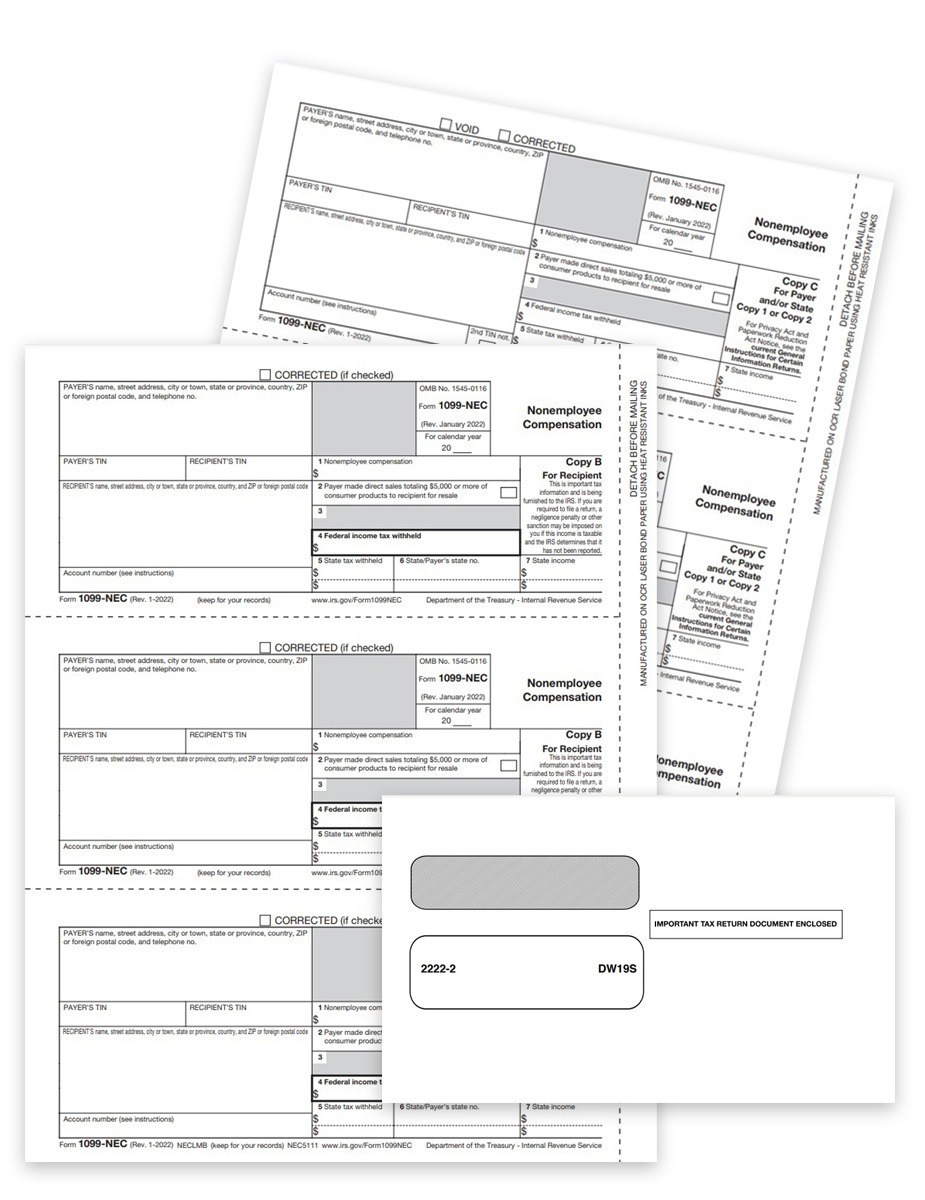

1099-NEC Forms Set with Envelopes

-

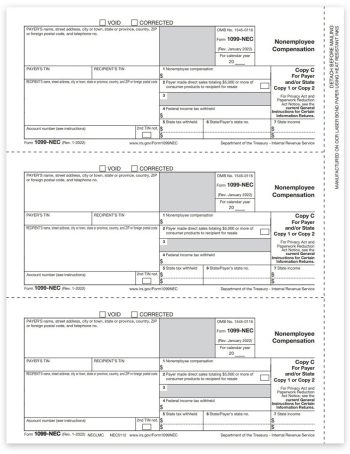

1099-NEC Form – Copy C-2-1 Payer State

-

1099-NEC Form – Copy B-C-Extra 3up for Recipient & Payer

-

1099-NEC Forms Set

-

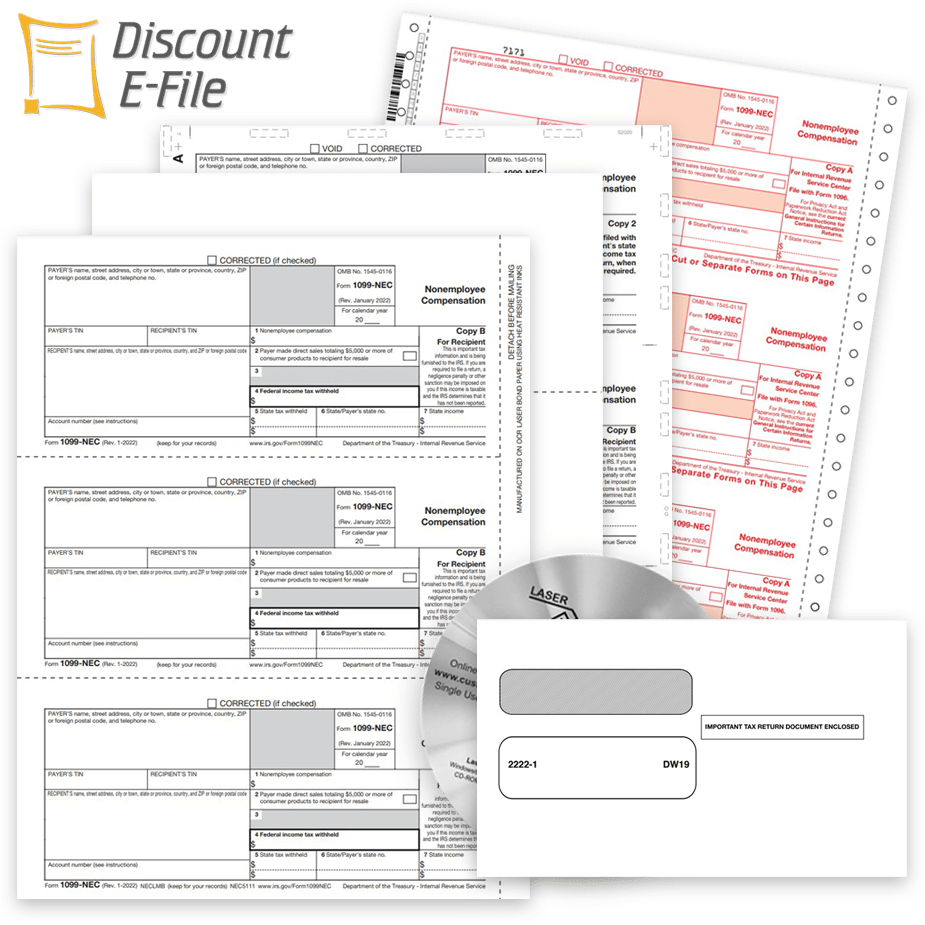

1099-NEC Carbonless Continuous Forms

-

1099-NEC Pressure Seal Forms Copy B-2 – 11″ Z-Fold

-

1099-NEC Forms Sets with Envelopes for E-filers – 3-part

-

1096 Transmittal Forms – Carbonless Continuous

-

1099-NEC Form – Copy B-2-2 3up for Recipient

-

1099-NEC Forms Sets for E-filers – 3-part

Blank 1099-NEC Perforated Paper Forms

1099-NEC Software

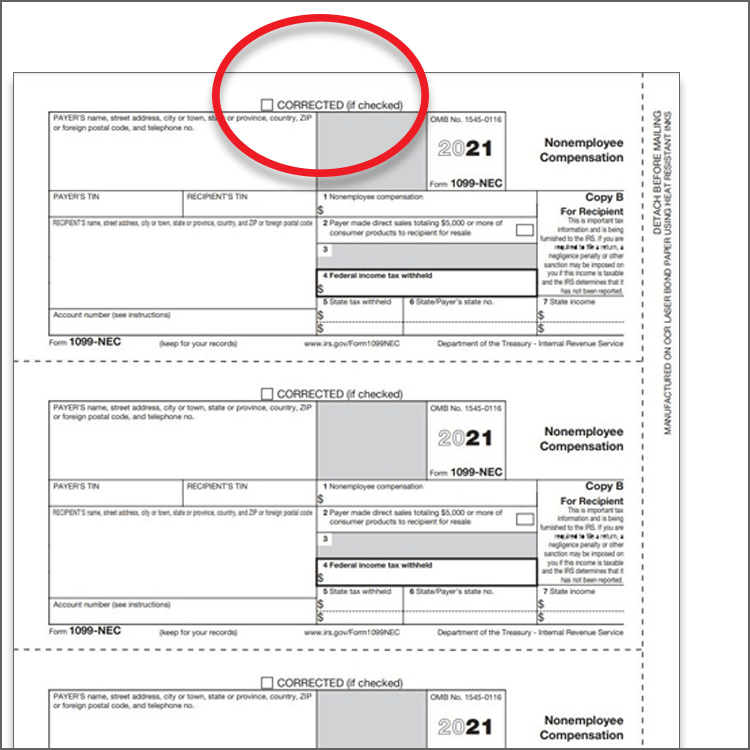

Need to file a 1099 correction?

It's simpler than you may think! All types of 1099 forms have a checkbox at the top to note that it is a Corrected form that has already been filed with the IRS.

You'll need to purchase new 1099 forms, or use any leftovers you have. Just be sure to use the exact same type of 1099 form that was originally filed. Enter the corrected information and check the Corrected box at the top. Then, mail a Copy A to the IRS, provide the recipient a copy and don't forget that the payer needs one too.

But there is an easier way... file them online! Our DiscountEfile.com system lets you correct 1099 forms, even if you didn't use it to file the originals. We'll efile a copy with the IRS, mail a recipient copy and provide one for the payer. Learn More About 1099 Corrections Online >

Online Filing Eliminates the Forms!