Blank 1099 Paper

Perforated blank paper for printing 1099 forms.

- Every day discounts on retail prices

- 2up, 3up and 4up blank perforated 1099 paper

- Optional instructions on back for 1099-NEC, MISC and more

- Laser paper and pressure seal paper

- Compatible with most accounting software

**NEW** 1099 E-filing requirements — E-file Copy A if you have 10+ W2 and 1099 forms combined in 2023

DiscountEfile.com makes it easy! Simply enter or upload data, and we e-file with the IRS and can even print and mail recipient copies in one easy step. Learn More >

Everyday discount prices on 1099 blank perforated paper in various formats.

Year-End is Easy with The Tax Form Gals!

Major E-File Requirement Changes for 1099 & W2 Filing

The new e-file threshold for the 2023 tax year is only 10 W2 and 1099 forms, combined, per EIN.

For example, if your business has to file 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2024.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes.

Penalties apply if you don't - $60 per form if you file on time and up to $310 per form if you file late.

NEW E-FILE RULES + ONLINE FILING = EASY 2023!

E-file, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

If you have 10 or more 1099 & W2 forms combined for a single EIN, you must e-file 1099 & W2 Copy A in 2023.

Use DiscountEfile.com to enter or upload data from QuickBooks® or other programs, and we'll e-file with the IRS or SSA for you and can even print and mail recipient copies!

Create a free account and get started today!

Order 1099 Blank Perforated Paper

-

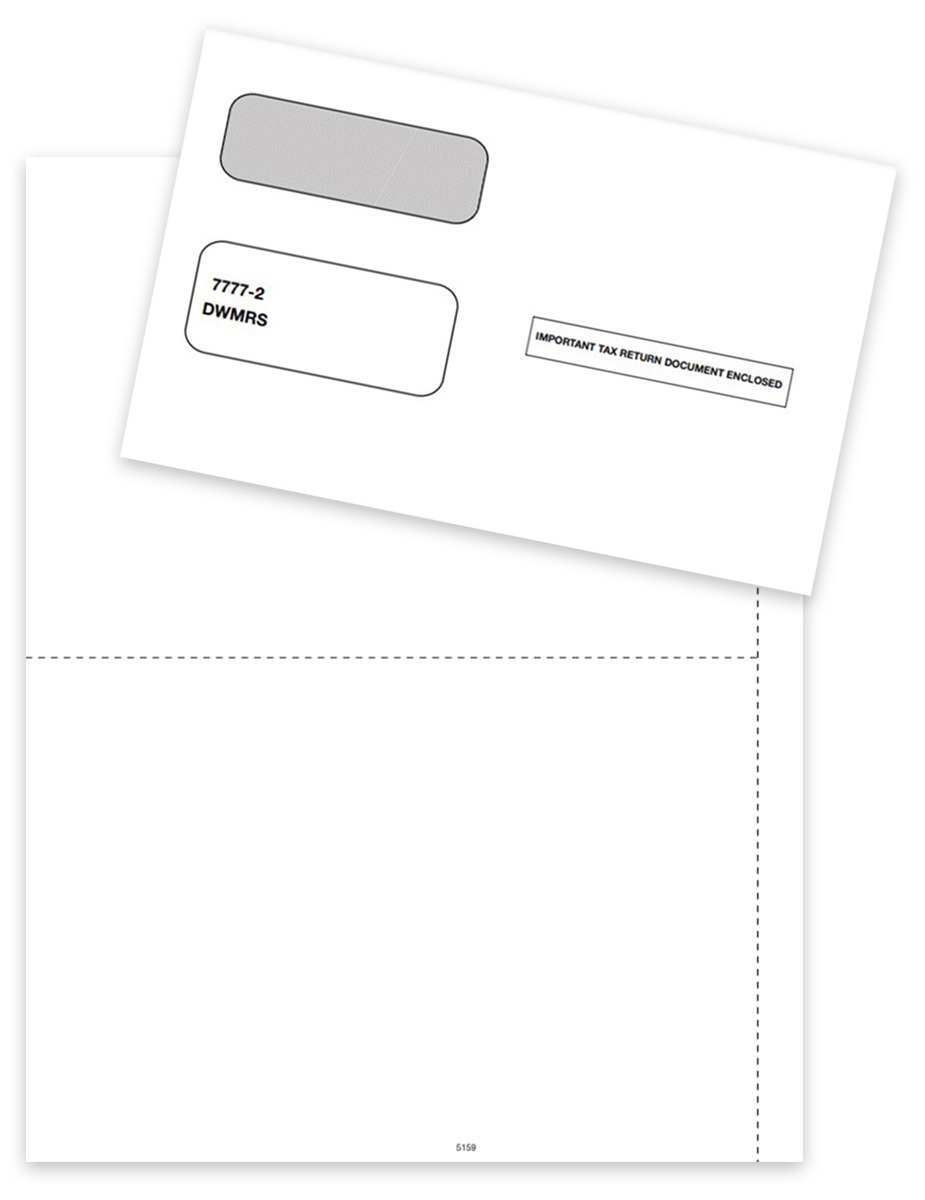

1099MISC Blank Paper & Envelope Set – 2up with Instructions

-

1099MISC Blank Paper – 2up with Instructions & Side Stub

-

1099NEC Blank Paper – 3up for 3 Recipients – With Recipient Instructions

-

1099NEC Blank Paper – 3up for 1 Recipient – With Recipient and Payer Instructions

-

1099-R Blank Paper 4up

-

1099 Blank Paper – 3up with Side Stub without Instructions

-

1099-MISC Blank Paper – 3up with Side Stub & Instructions

-

1099 or W2 Blank Paper – 2up without Instructions

-

1099 Blank Paper – 2up with 1099MISC Instructions

-

W2 & 1099 Universal Blank Perforated Paper

Pressure Seal Blank 1099 Forms