W2C Correction Forms

Easily Correct W2 Errors with W2-C Forms or Online Filing.

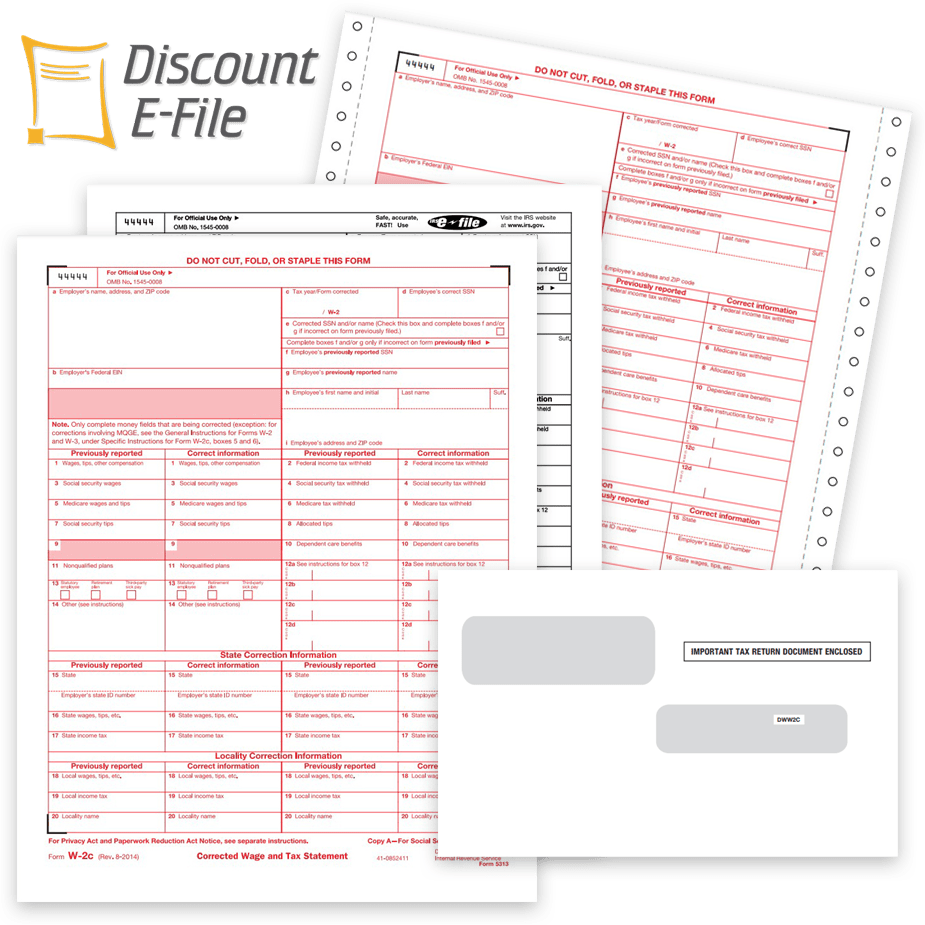

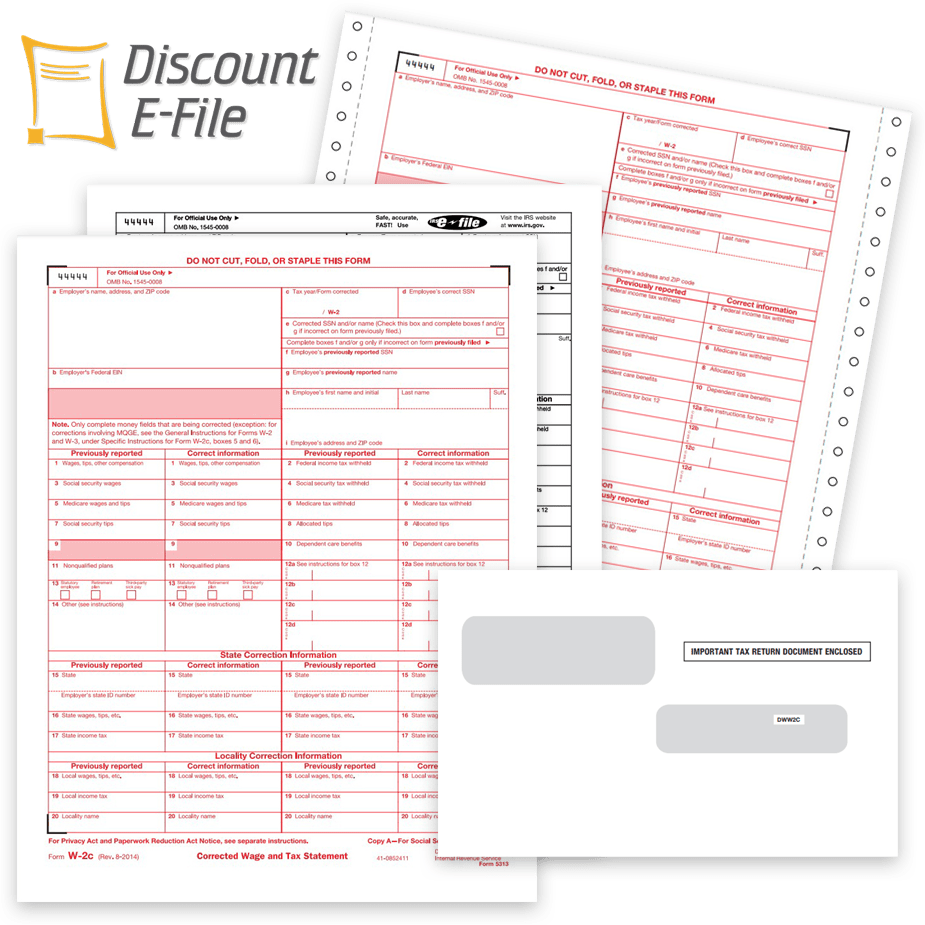

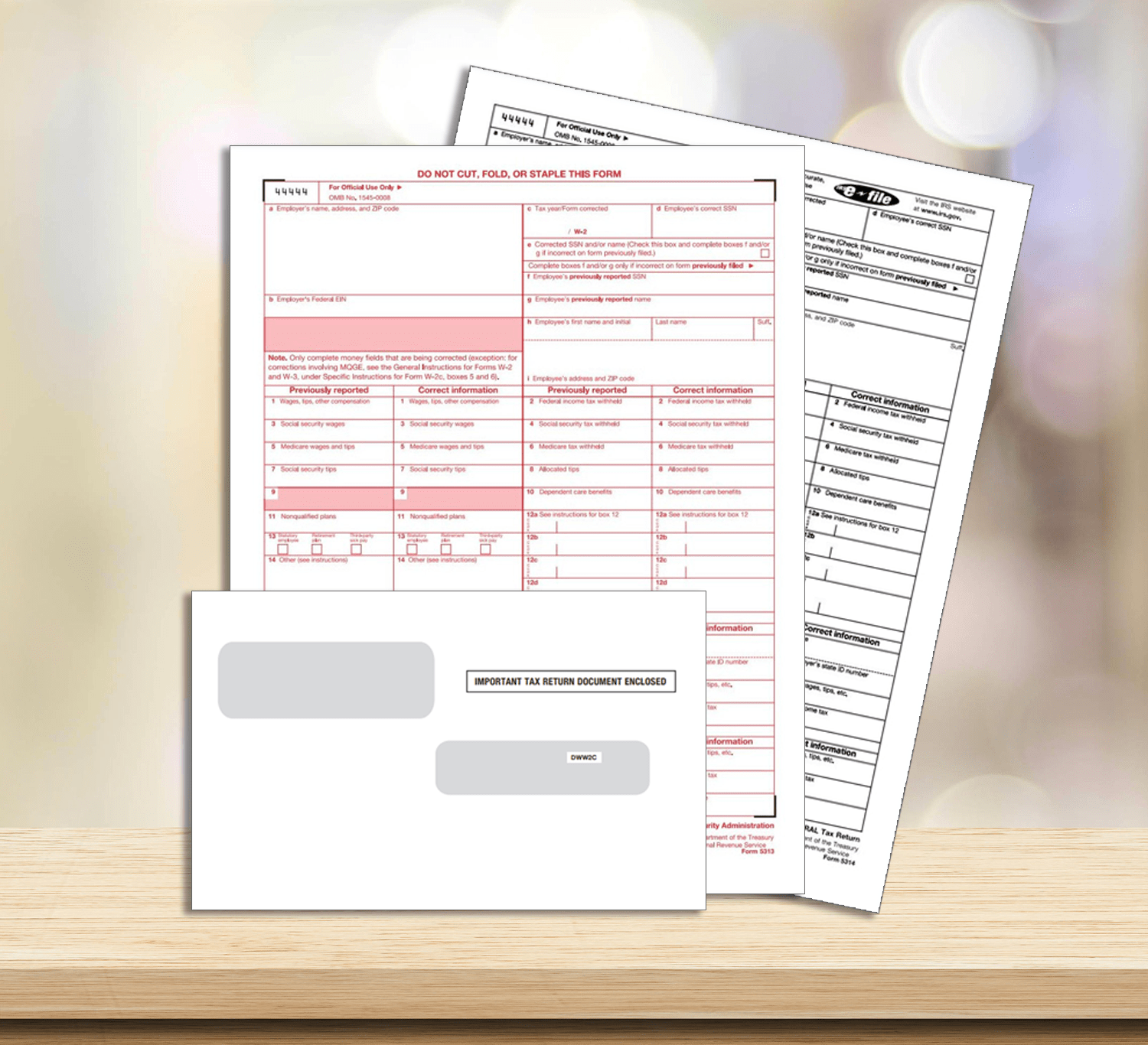

- Official W2C forms and envelopes

- W2C filing instructions

- Online filing options for W2C forms – no forms or software required!

NEW W2C FILING REQUIREMENTS FOR 2023

For tax year 2023, you MUST file W2C Copy A in the same manner as the original W2 was filed.

- If you e-filed the original W2 with the SSA, you must file the correction electronically.

- If you mailed a paper W2 to the SSA, you must print and mail W2C.

W2c Correction forms for correcting a W2 that was already filed. Forms, envelopes and easy online filing.

W2s are Easy with The Tax Form Gals!

-

Instant W2 Correction Filing

-

W2C Correction Forms – Copy 1-D, Employer State, City

-

W2C Correction Forms – Copy A, Employer Federal

-

W2C Correction Forms – Copy B, Employee Federal

-

W2C Correction Forms – Copy C-2 Employee State-File

-

W2C Envelopes

-

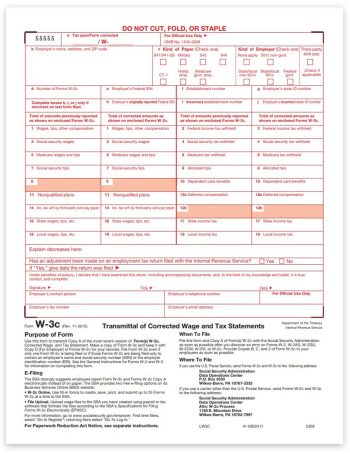

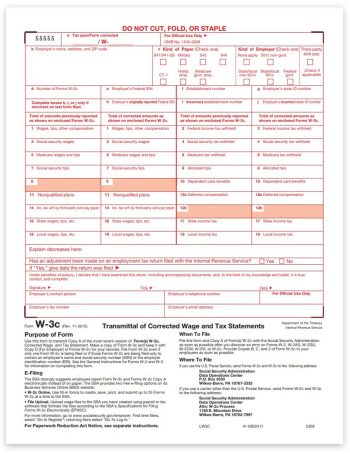

W3C Correction Transmittal Forms

-

W3C Correction Transmittal Forms – Carbonless

W2C Correction Filing Instructions

Correcting a W2 Form

How to correct an error on a W2 using W2C forms.

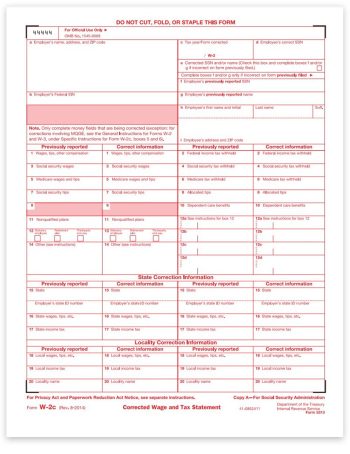

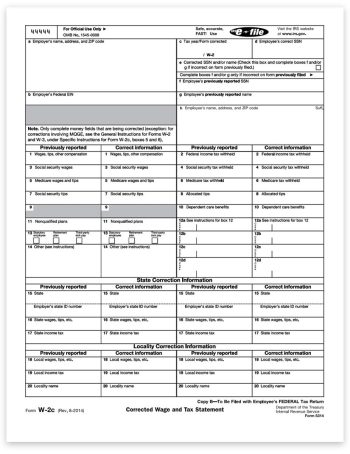

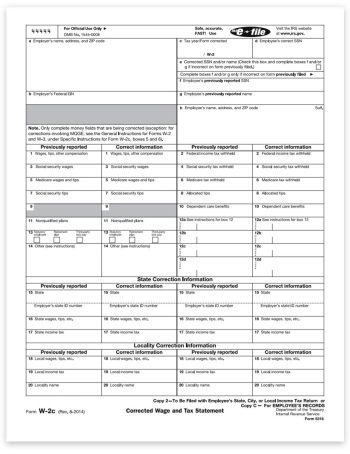

To correct a W2 form because the original has data errors, file a W2C form (W-2 Correction Form) with the SSA and employee.

Form W2C is different than a standard W2 form, and requires that you fill in all of the fields on the form, including the information originally filed, as well as the correct information.

But first, answer this question: Have you already filed W2 Copy A with the SSA?

Filing W2c forms when the original has already been filed with the SSA

Use Form W2C ONLY if you have already mailed the original W2 Copy A to the SSA, or e-filed is using any W2 e-filing system. You will need to complete and file W2C forms with the SSA, mail one to the employee and provide a file copy for the employer.

Use Form W-2C to:

- Correct errors on Form W-2 or W-2 C filed with the Social Security Administration (SSA).

- Provide a corrected Form W-2 to employees.

NEW for 2023! You must file W2C with the SSA in the same manner as the original W2 Copy A.

- If you e-filed with the SSA, you MUST efile W2C Copy A

- If you printed and mailed to the SSA, you MUST mail W2C Copy A

Correcting a W2 form that has NOT yet been filed with the SSA

If you discover a mistake on an employee’s W2 form, but have NOT mailed Copy A to the SSA or efiled it, you DO NOT need a W2C form! Only use W2C if the SSA copy has already been filed.

To correct a W2 form in this instance, simply reprint the W2 with the corrected information and provide that to the employee and when filing it with the SSA.

BUT WAIT!!! There is an easier way to file W2C Correction forms.

Instead of ordering W2C forms, printing and mailing them, you can do it all online! Our DiscountEfile.com system allows you to file W2C forms easily!

Simply enter data for the employer (payer) and the employee (recipient) information, the original and corrected data, then we’ll do the rest!

Discount Efile will automatically and securely e-file with the SSA if you e-filed the original W2 Copy A. (If not, you must print and mail a W2C Copy A to the SSA).

We’ll also print and mail recipient copies to each employee! Use the print and mail service option even if you can’t e-file with the SSA.

Set up a free account today, try it out and only pay for the forms you actually submit online.

Online W2C filing is available all year long!