Easy 1099 Filing for 2023

Order 1099 forms, envelopes, software and e-filing.

- Low prices and small minimum quantities

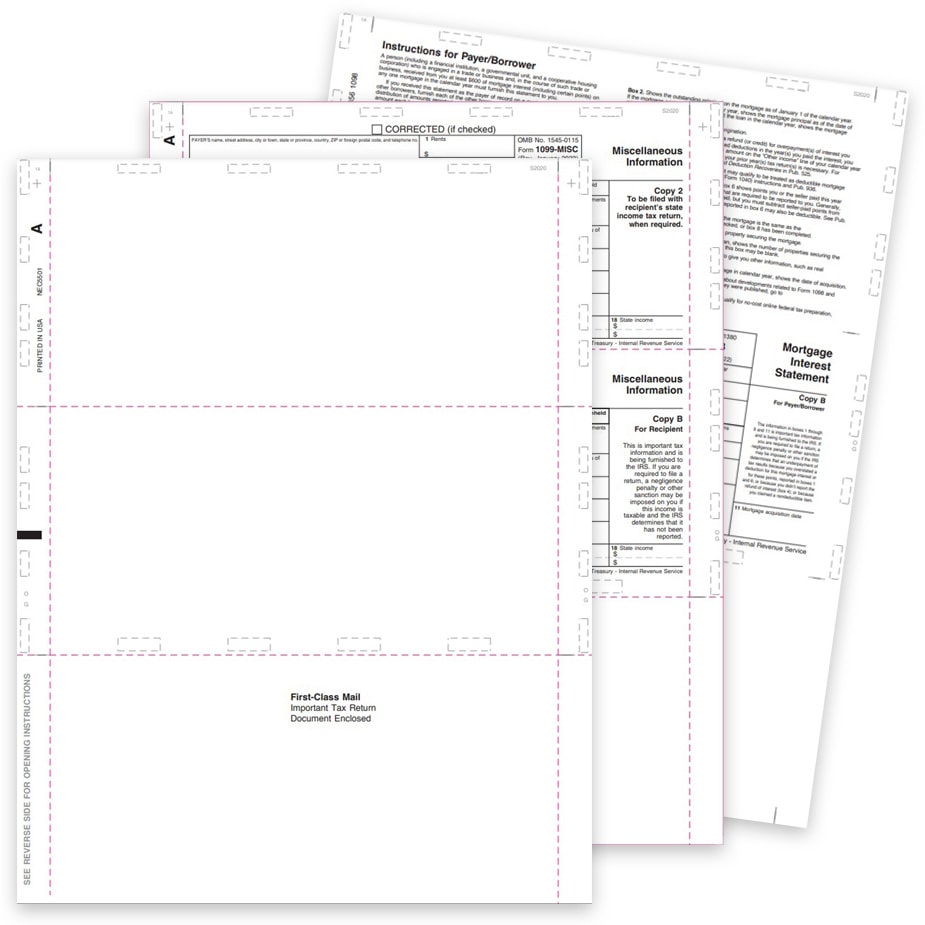

- Official 1099 forms, blank perforated paper, carbonless forms, pressure seal forms

- Compatible 1099 security window envelopes

- Software and online e-filing + print and mail service options

**NEW** 1099 E-filing requirements — E-file Copy A if you have 10+ W2 and 1099 forms combined in 2023

DiscountEfile.com makes it easy! Simply enter or upload data, and we e-file with the IRS and can even print and mail recipient copies in one easy step. Learn More >

EASY 1099 & W2 FILING ALL YEAR LONG!

ALL 2023 1099 & W2 FORMS ARE OUT OF STOCK

But we have a solution! You can easily print, mail and e-file all common 1099 & W2 forms on DiscountEfile.com.

1099 Filing for 2023 made easy! Order 1099 forms, envelopes, software and online e-filing from The Tax Form Gals.

Major E-File Requirement Changes for 1099 & W2 Filing

The new e-file threshold for the 2023 tax year is only 10 W2 and 1099 forms, combined, per EIN.

For example, if your business has to file 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2024.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes.

Penalties apply if you don't - $60 per form if you file on time and up to $310 per form if you file late.

NEW E-FILE RULES + ONLINE FILING = EASY 2023!

E-file, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

If you have 10 or more 1099 & W2 forms combined for a single EIN, you must e-file 1099 & W2 Copy A in 2023.

Use DiscountEfile.com to enter or upload data from QuickBooks® or other programs, and we'll e-file with the IRS or SSA for you and can even print and mail recipient copies!

Create a free account and get started today!

Order 1099 Forms, Envelopes, Software and Online E-filing

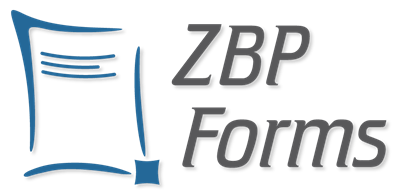

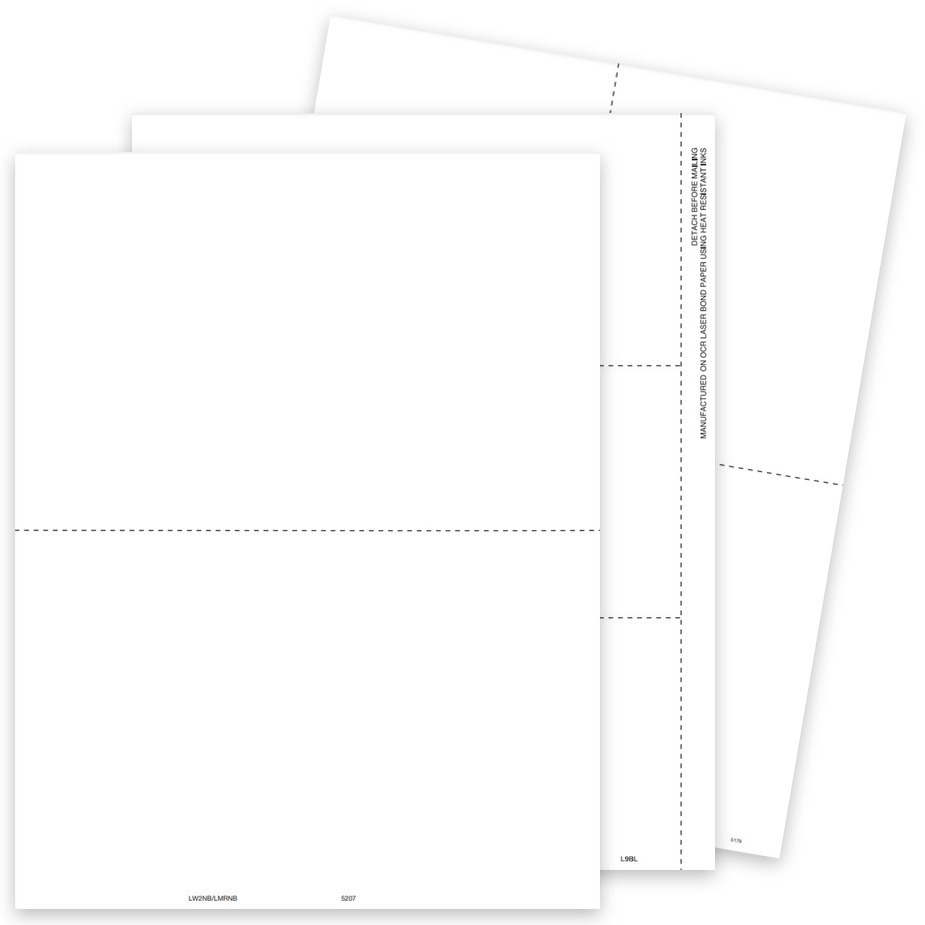

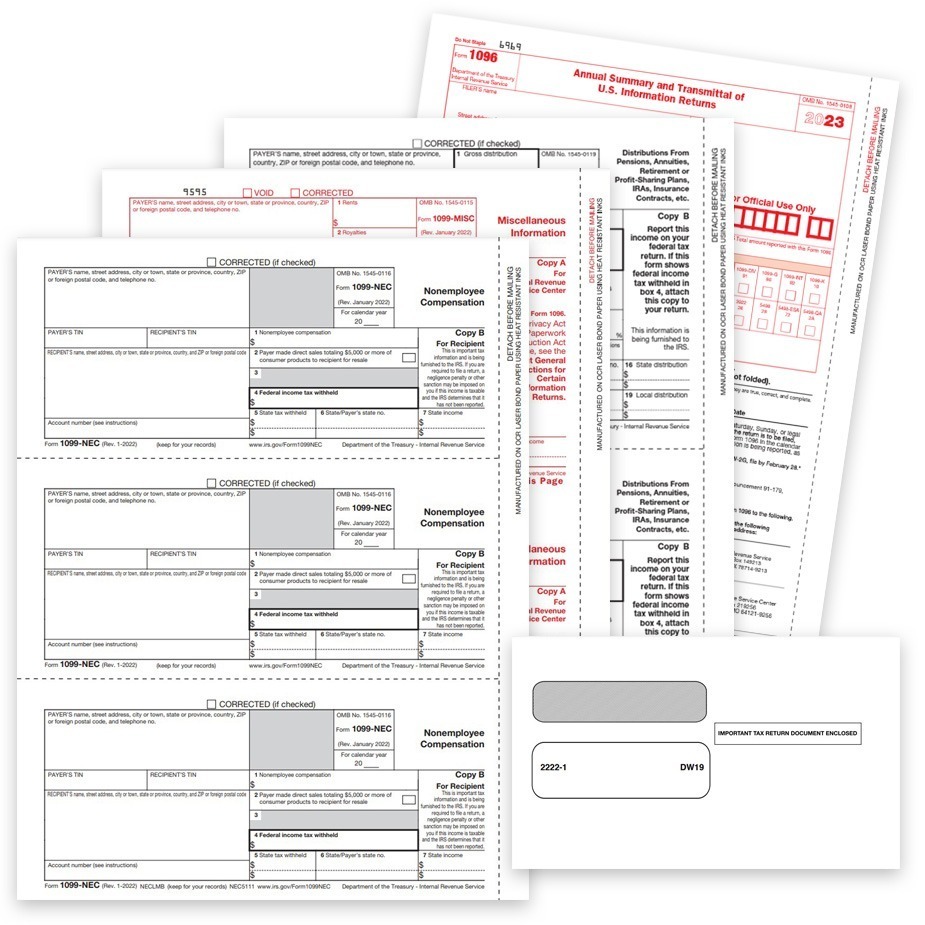

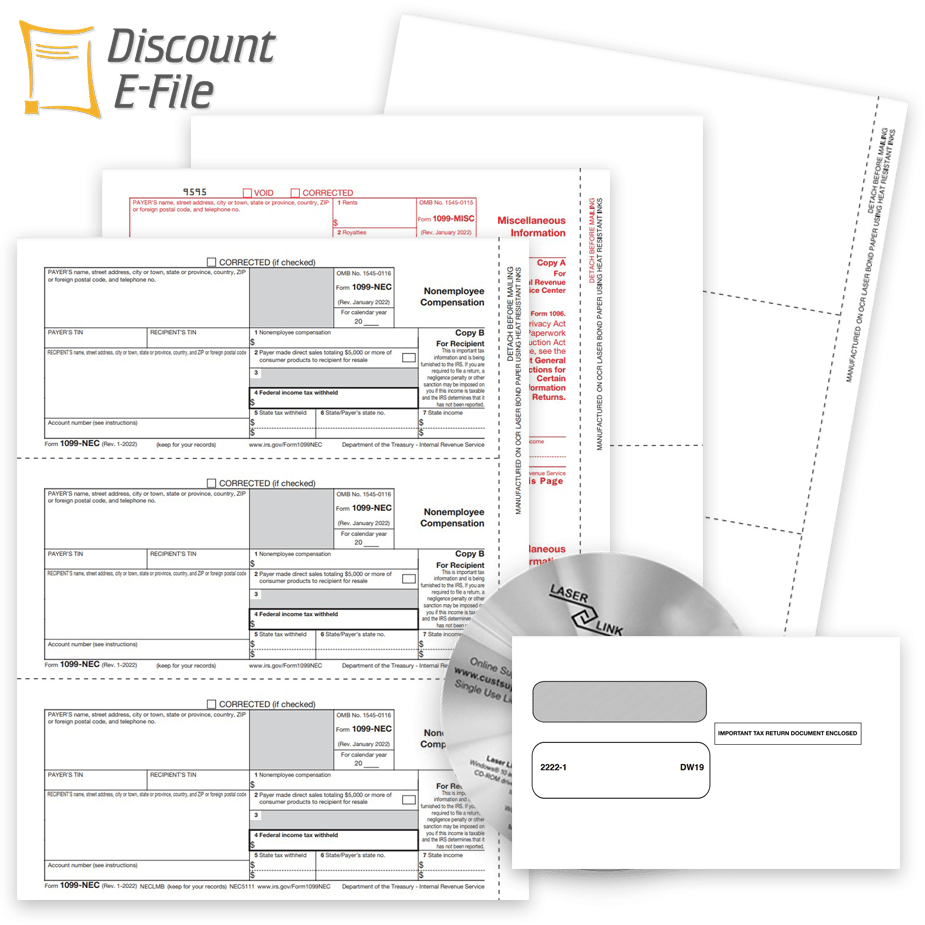

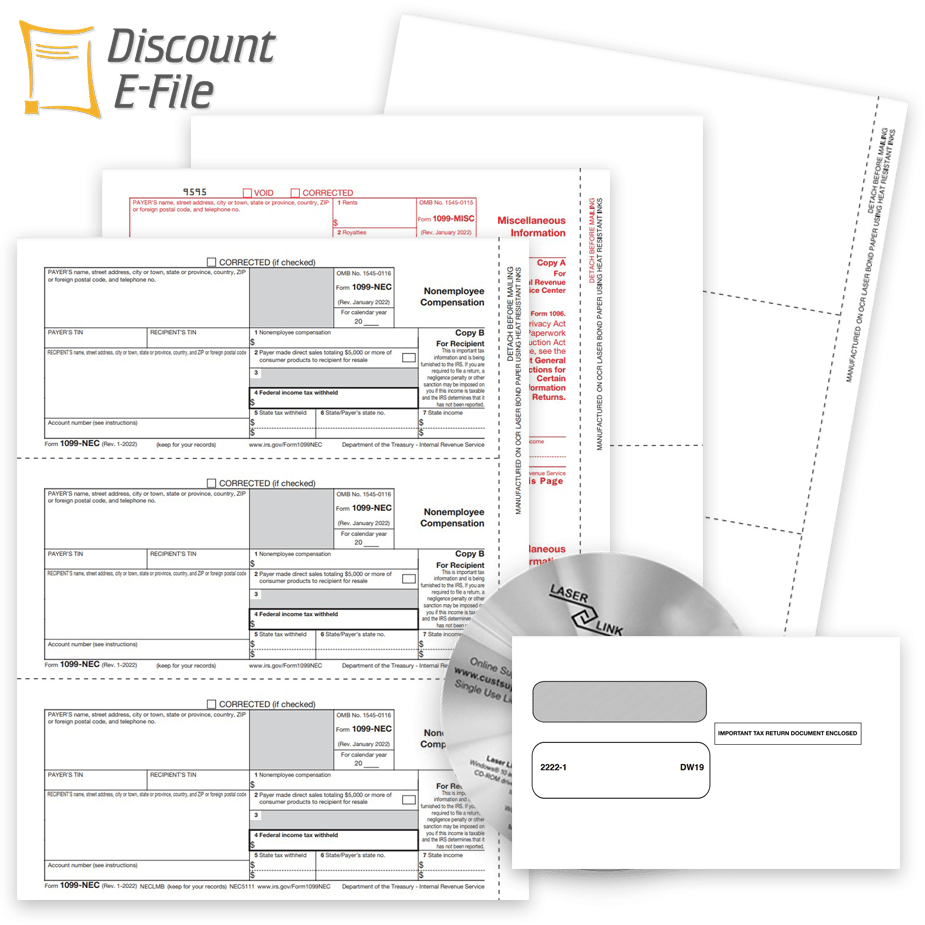

1099-NEC Forms

Report non-employee compensation.

Blank 1099 Paper

Easy printing from your software.

1099 Sets

Sets of forms and envelopes.

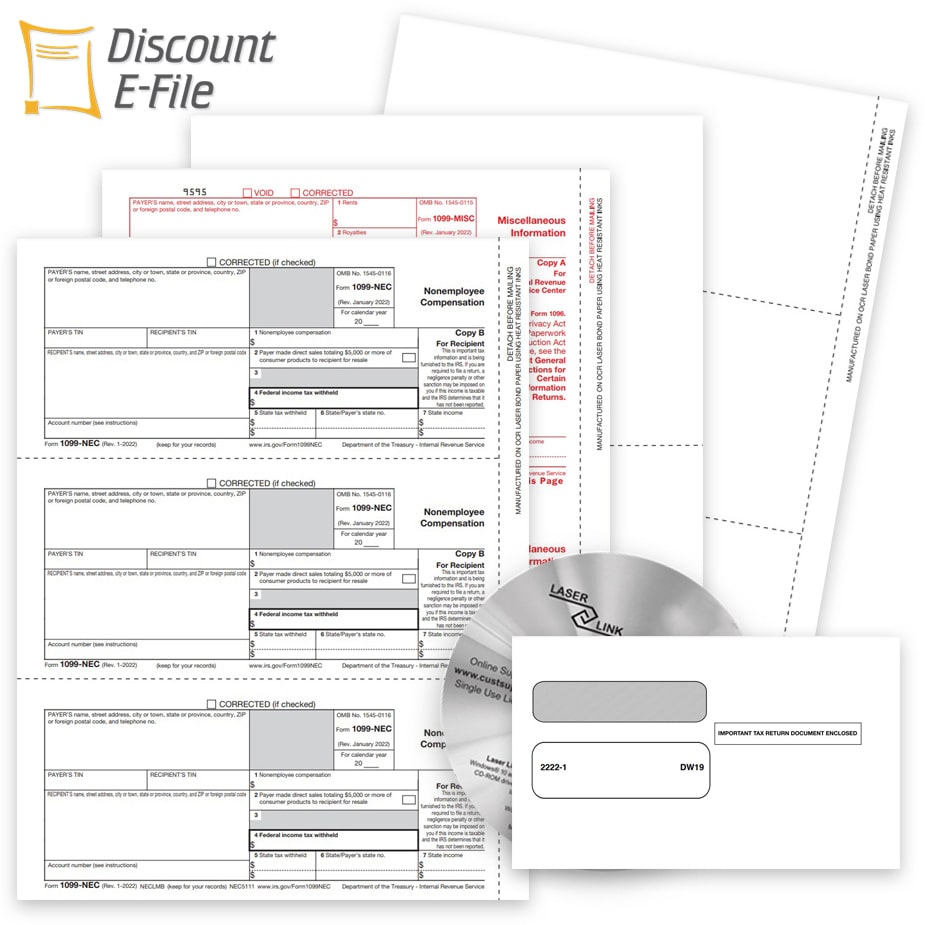

Online 1099 Filing

E-file and mail 1099 forms instantly.

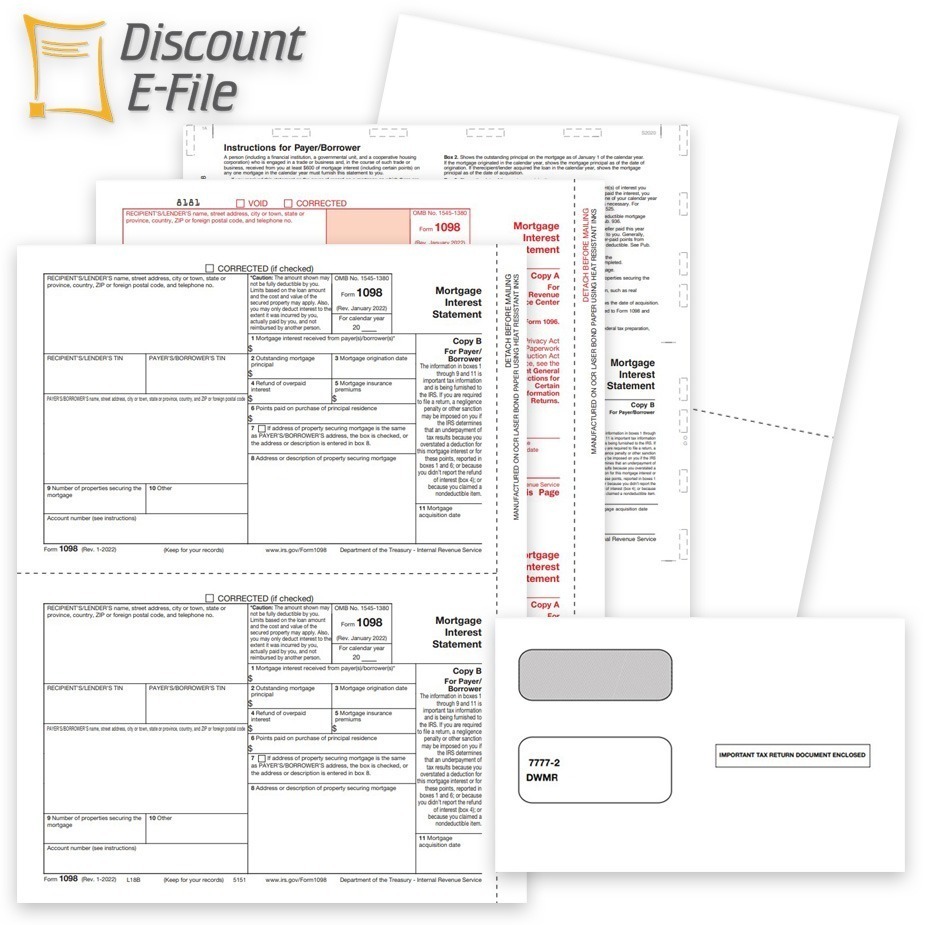

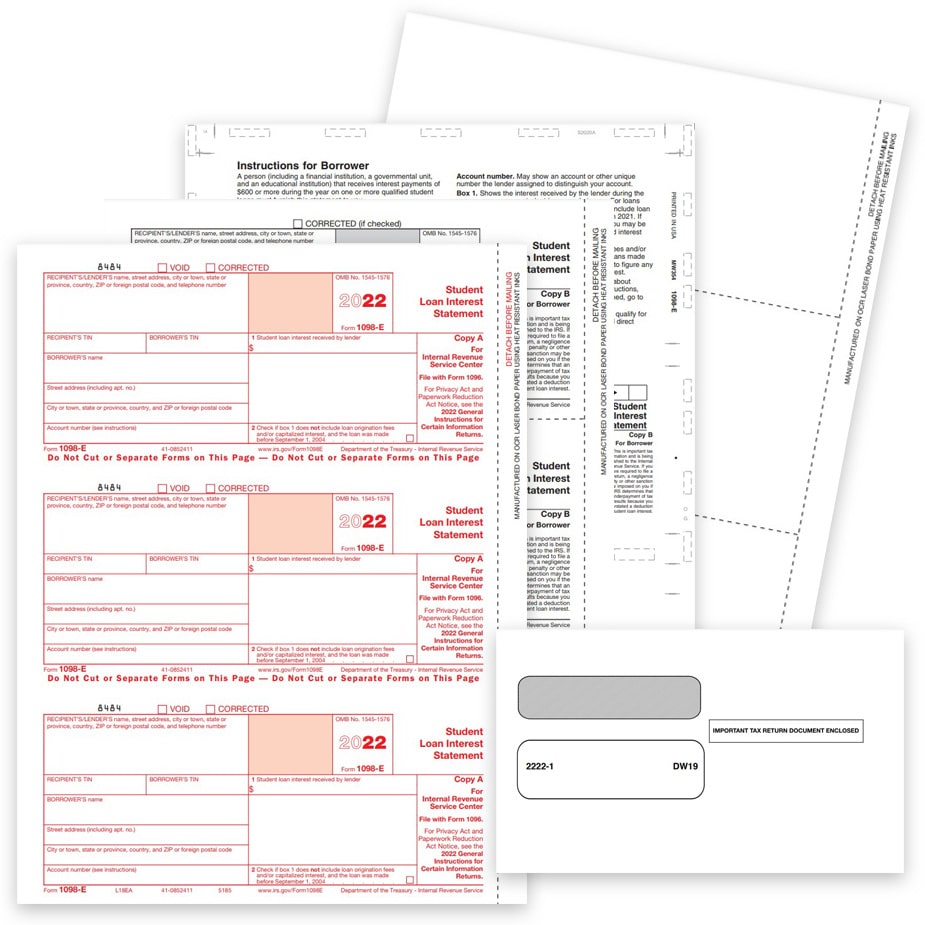

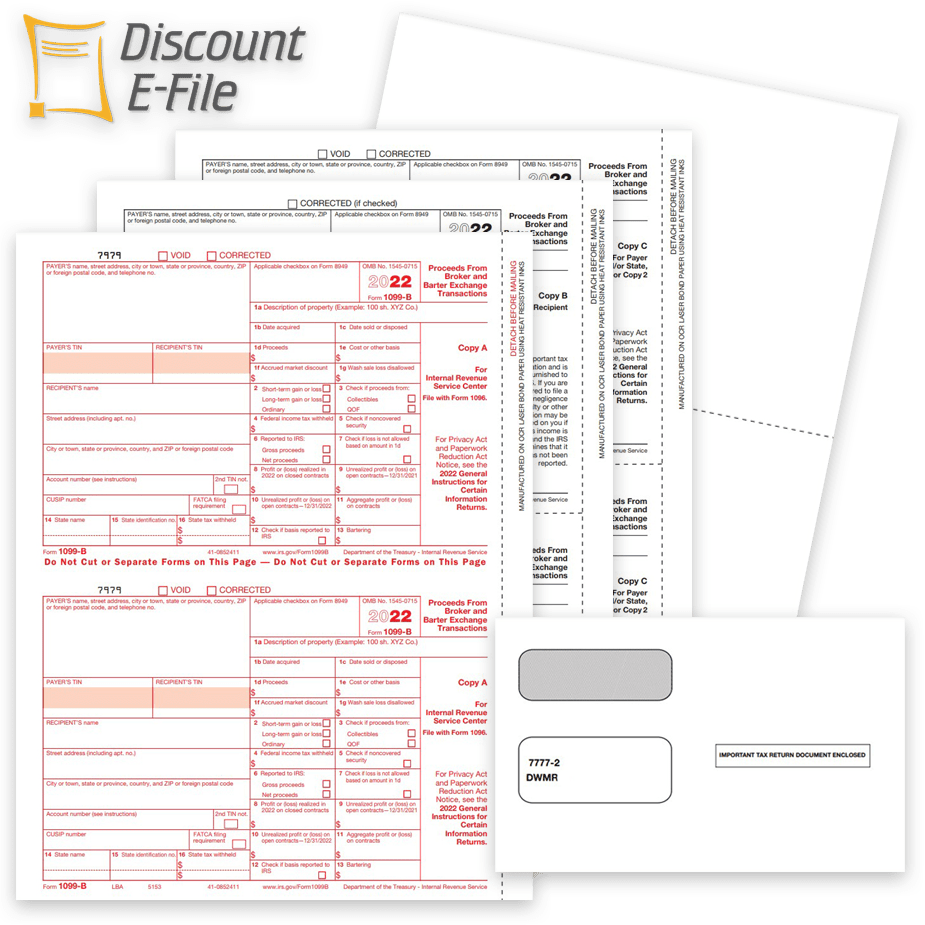

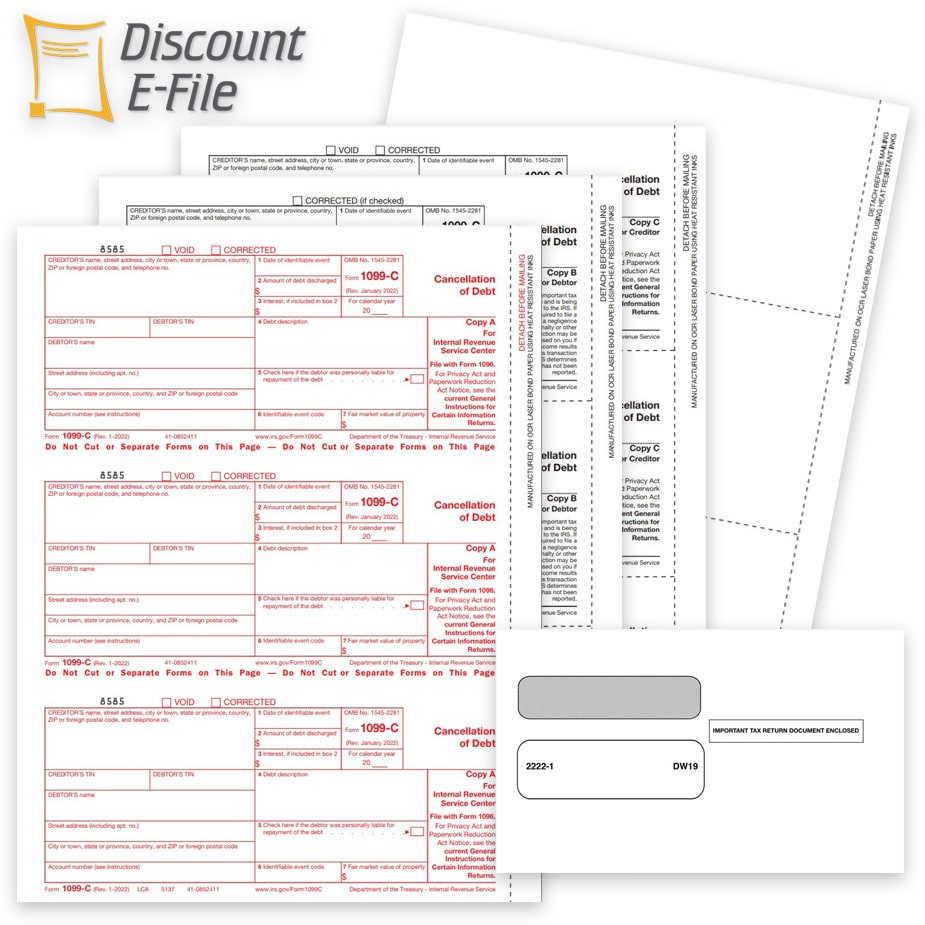

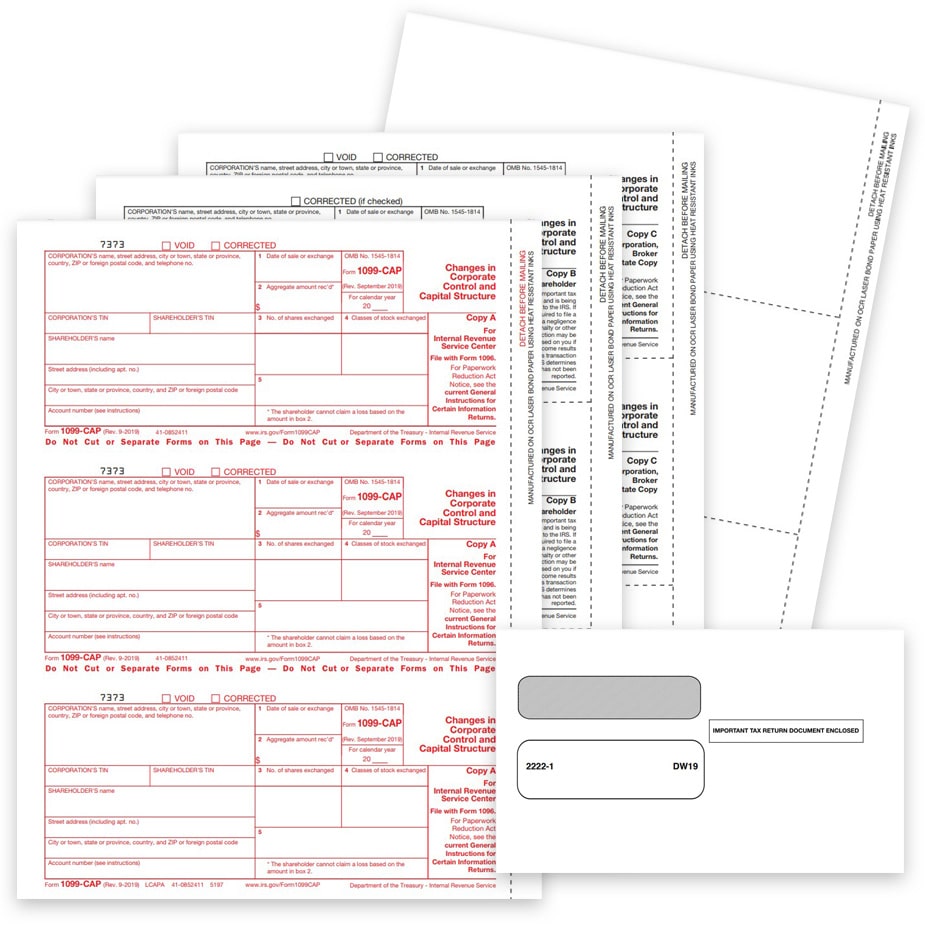

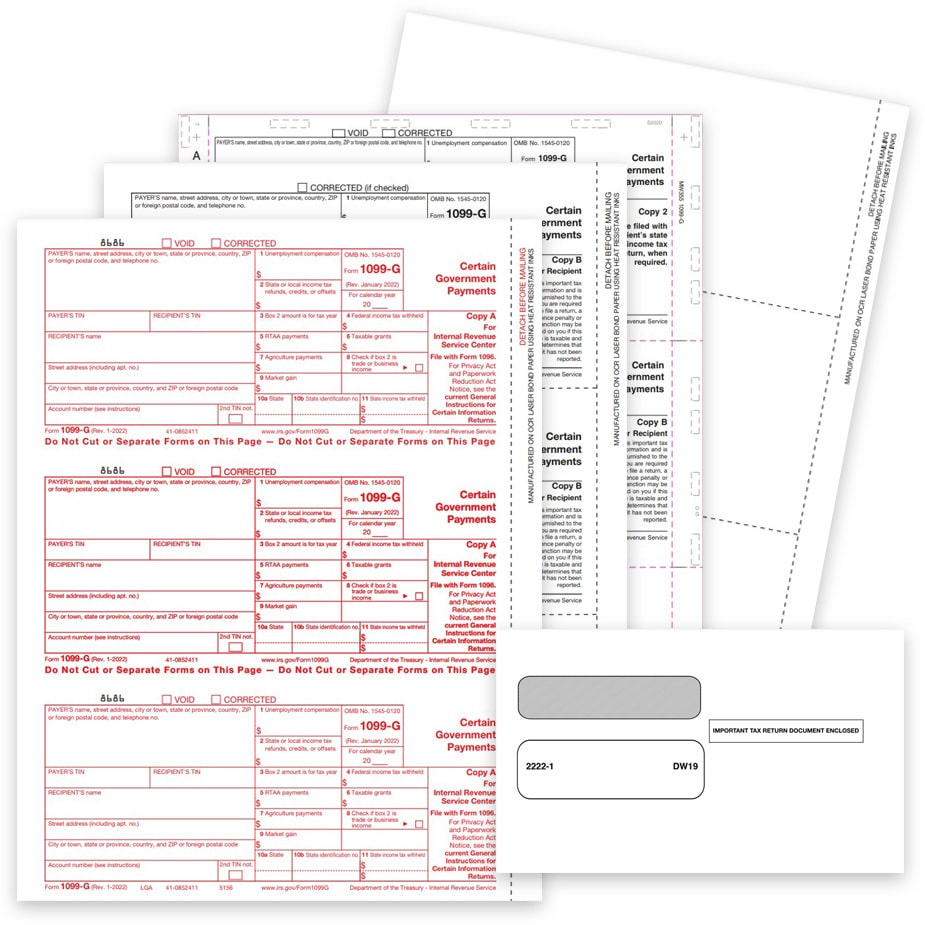

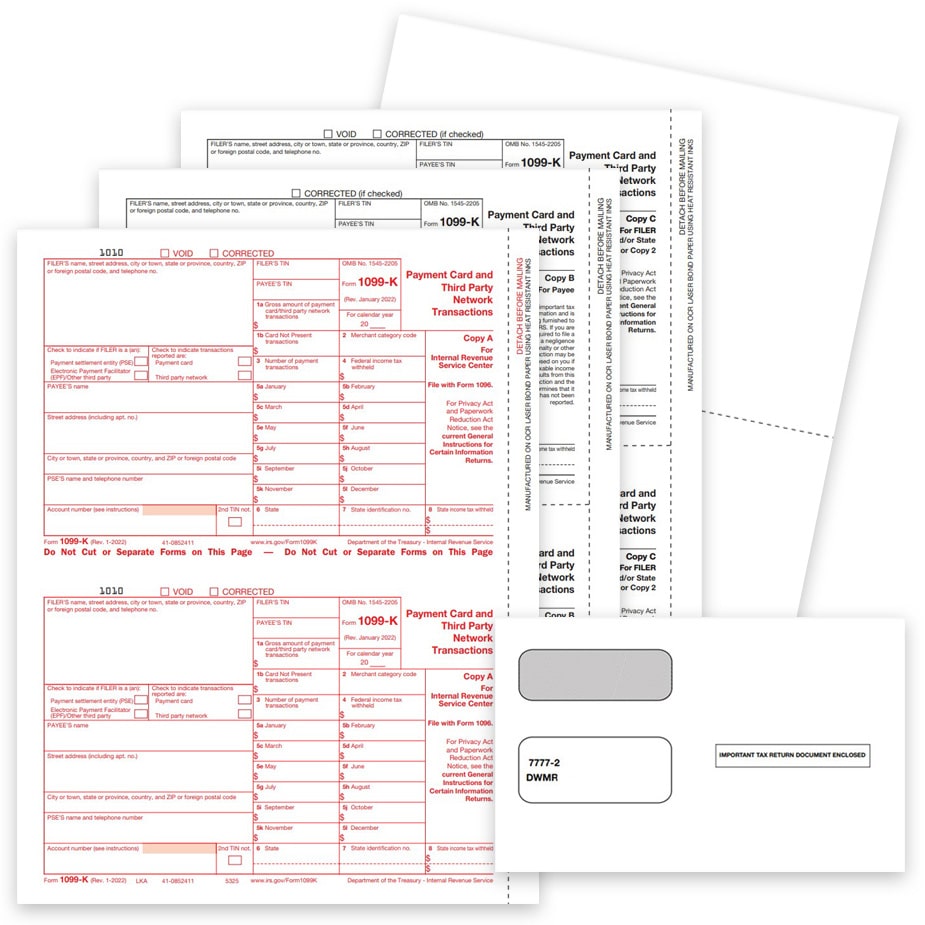

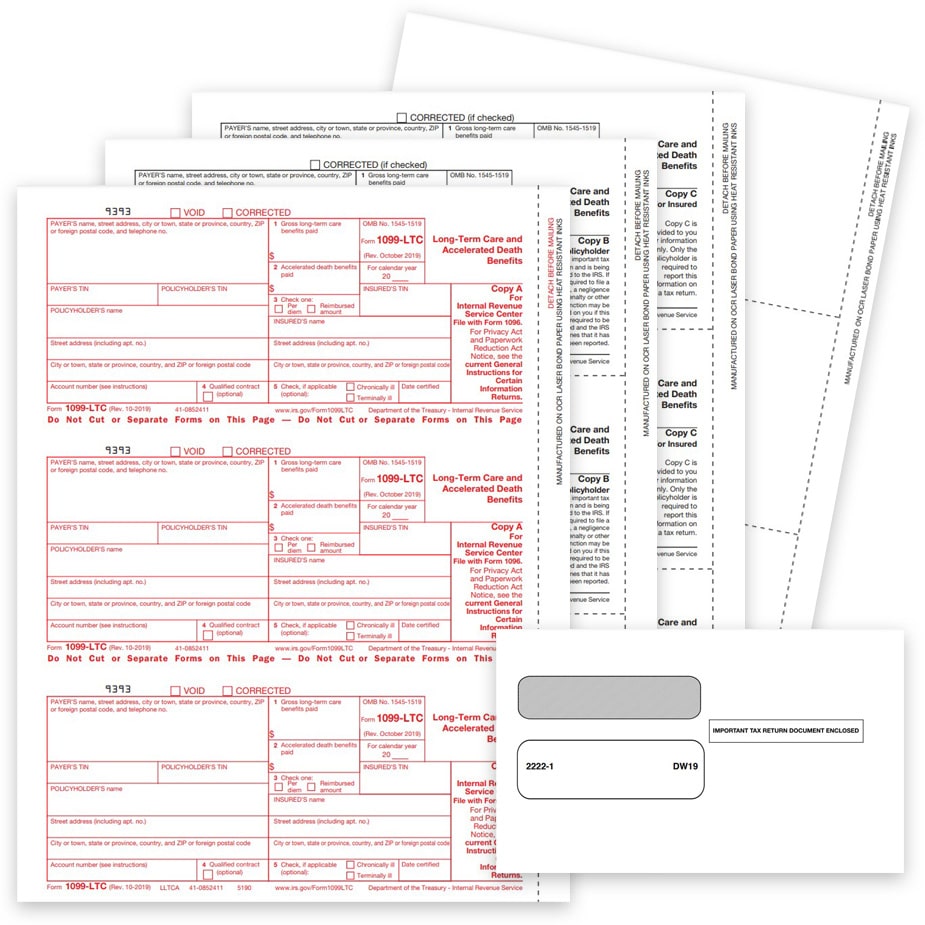

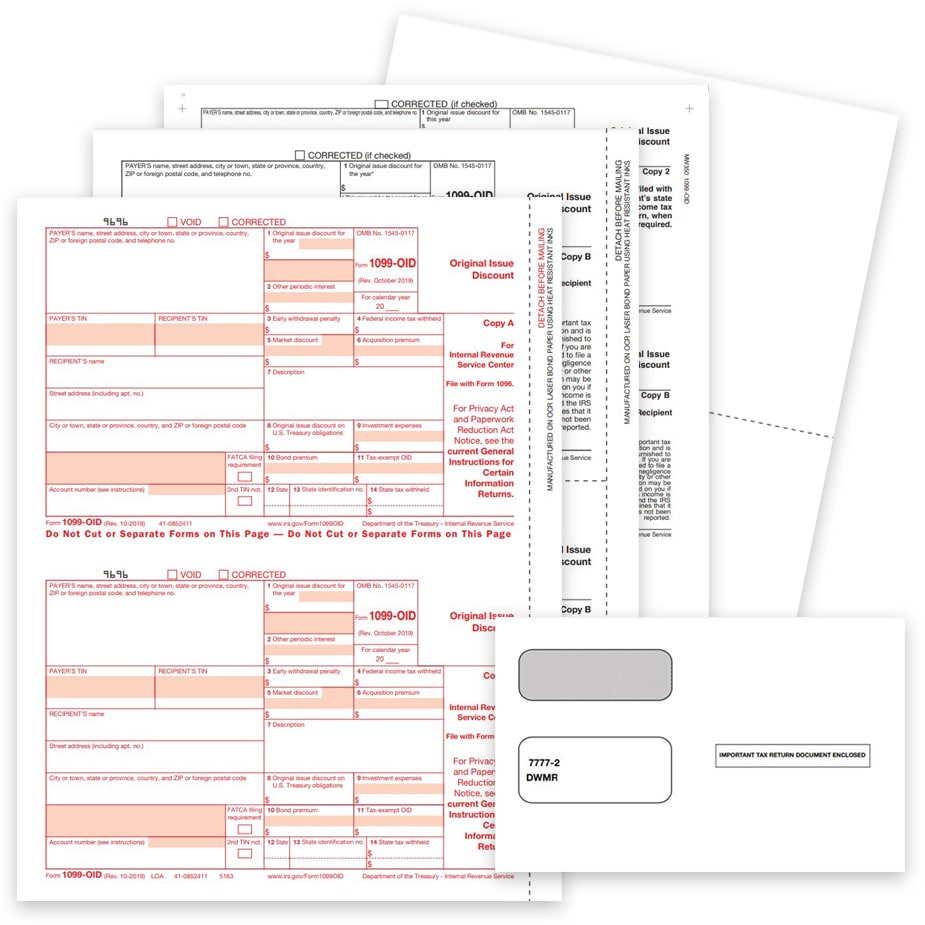

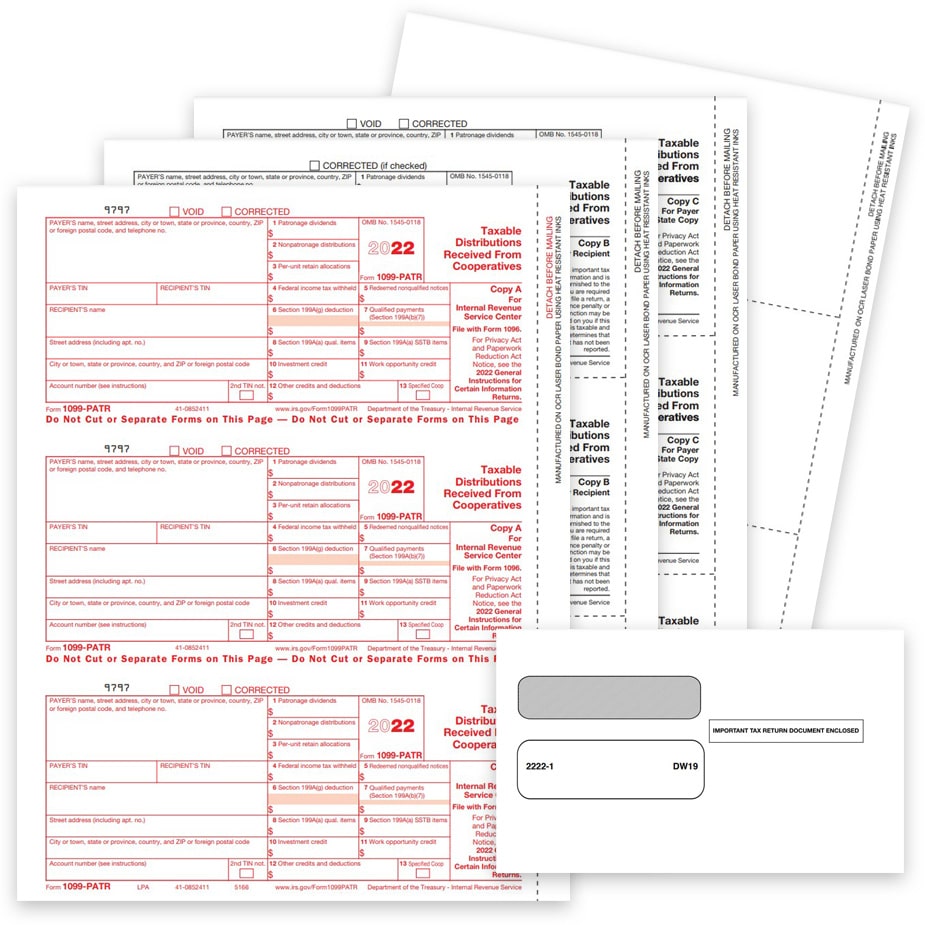

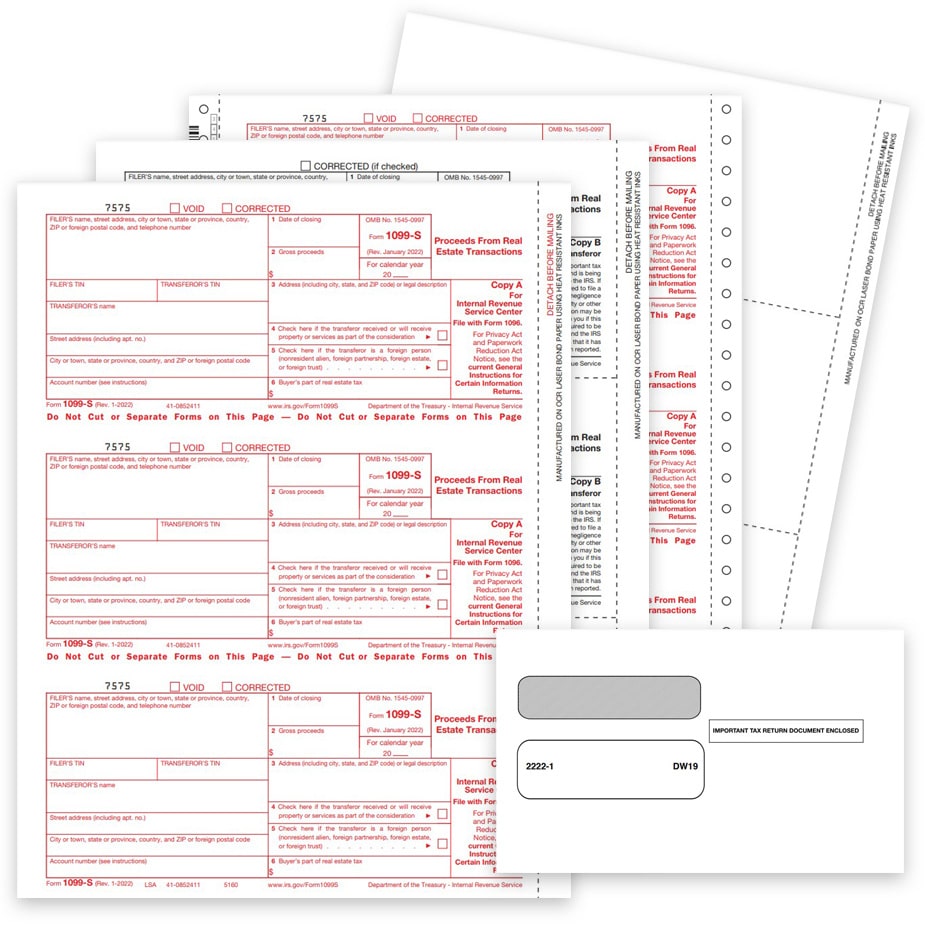

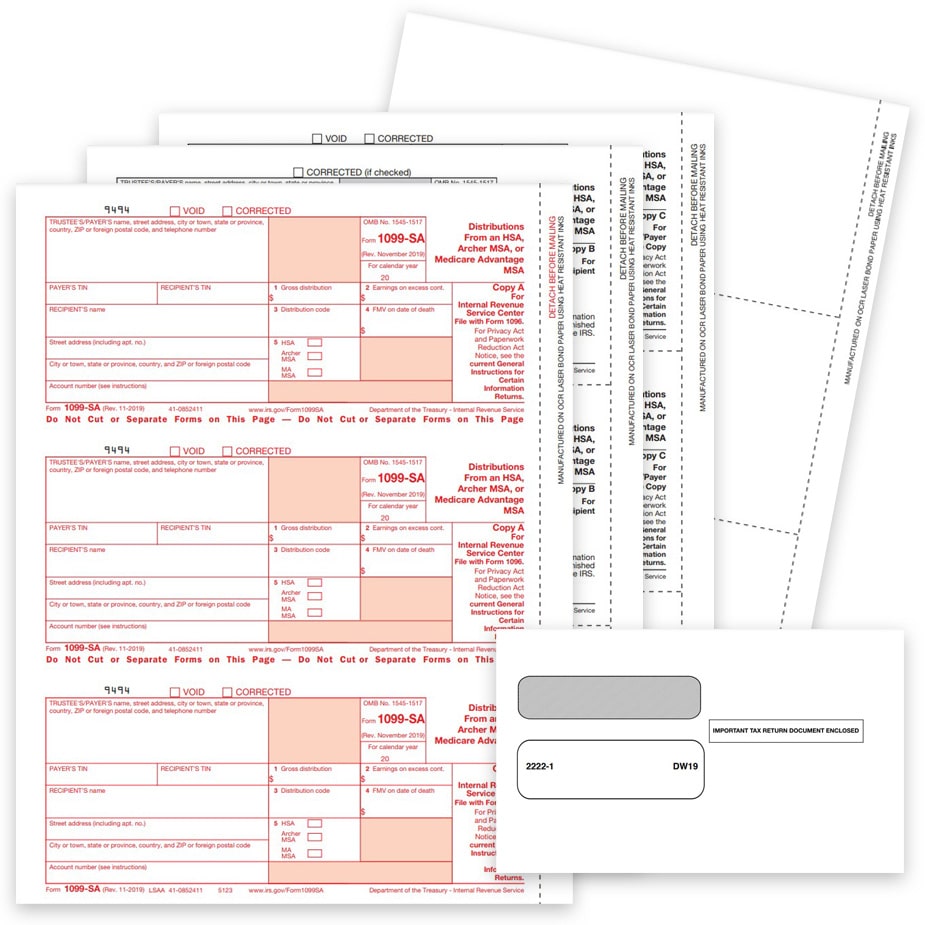

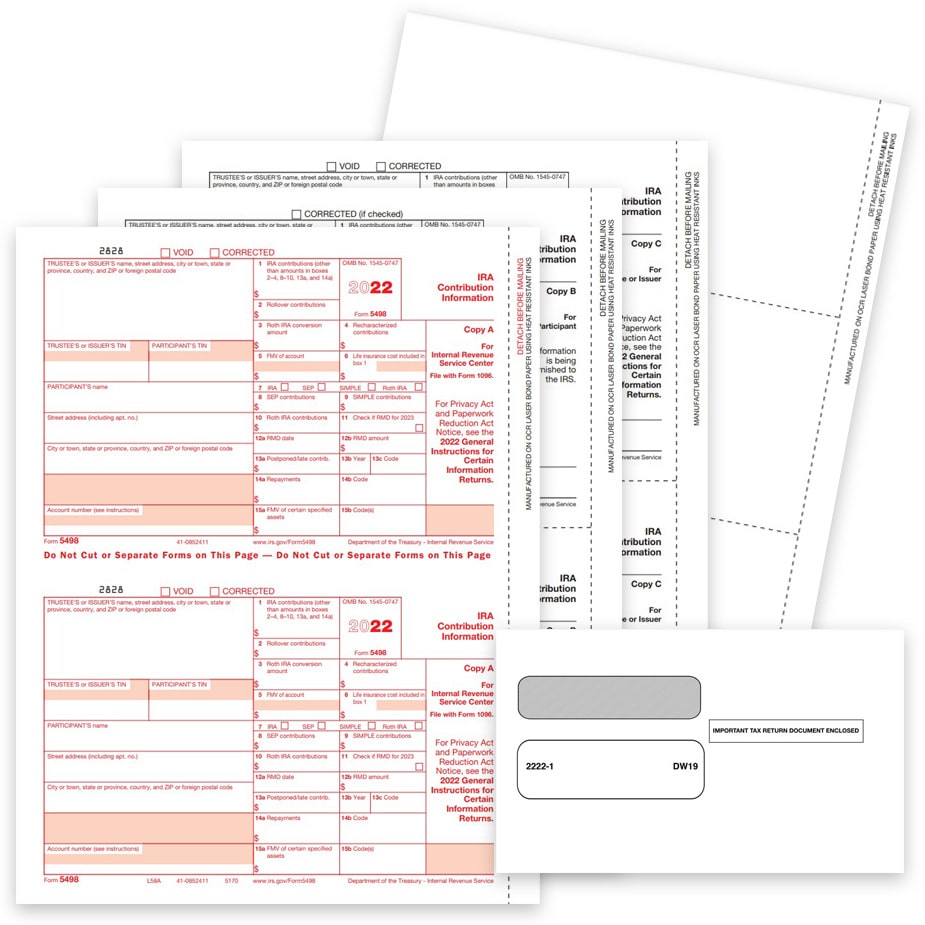

Preprinted 1099 Forms

Red Copy A 1099s and more.

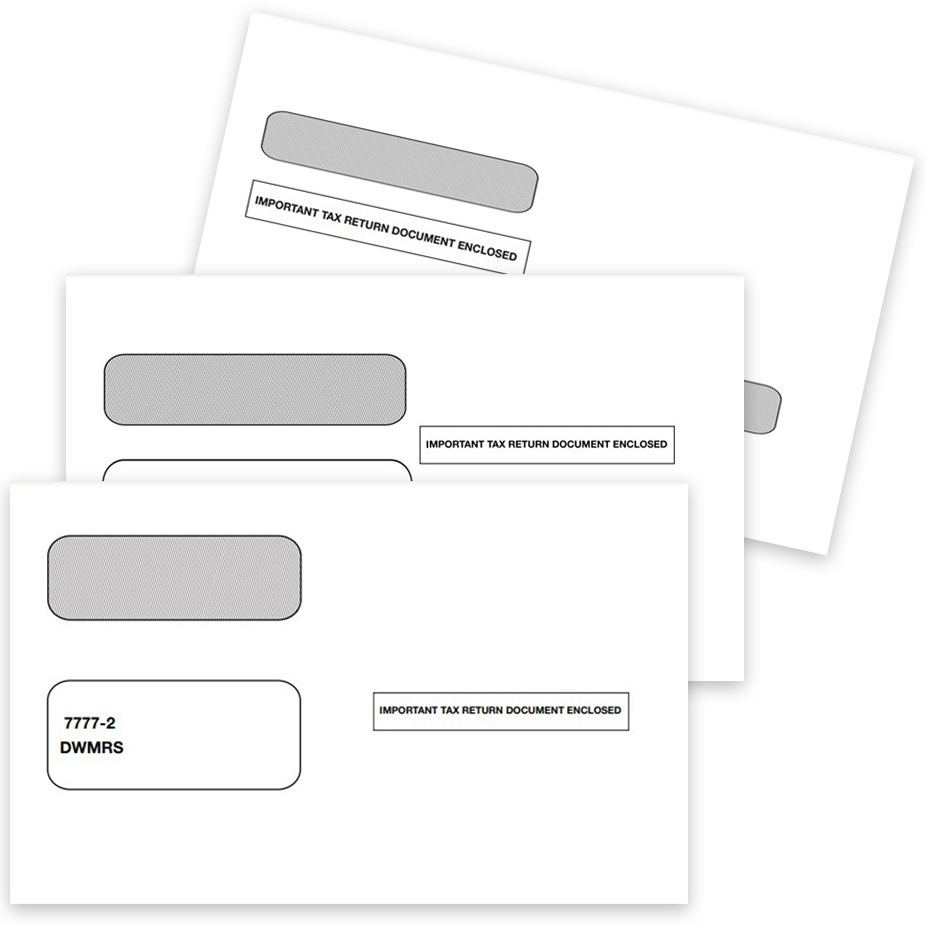

1099 Envelopes

Security-tint, window envelopes.

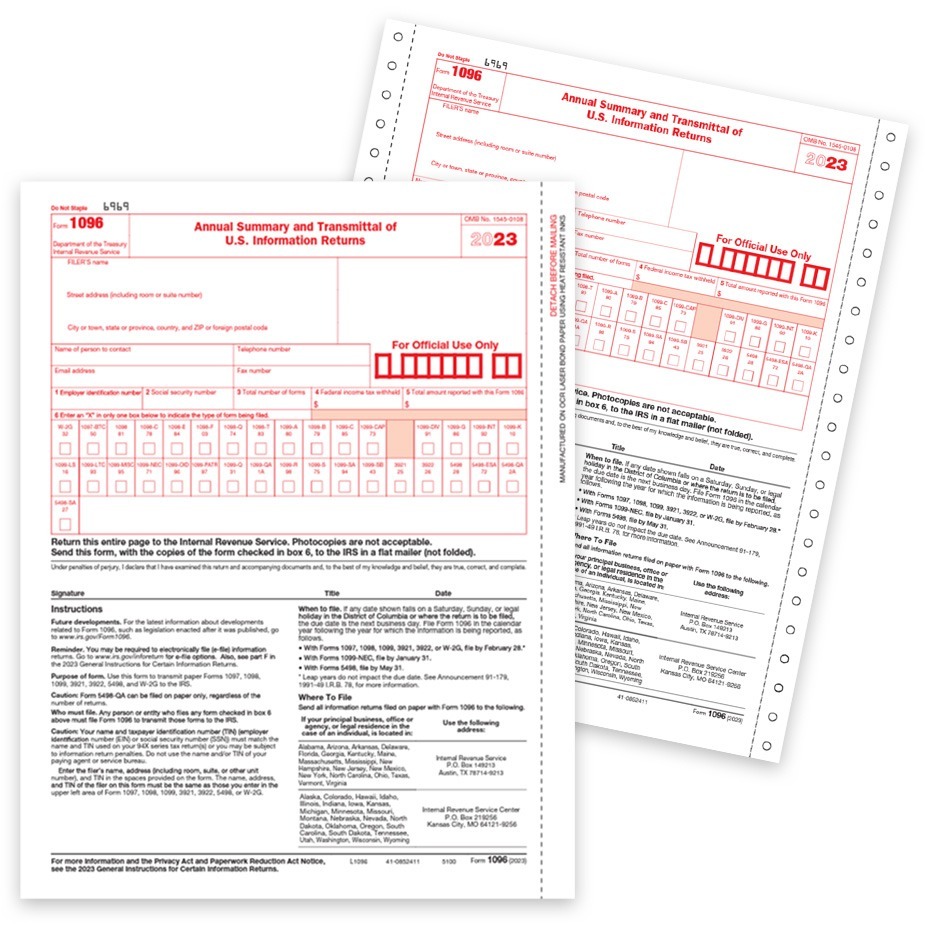

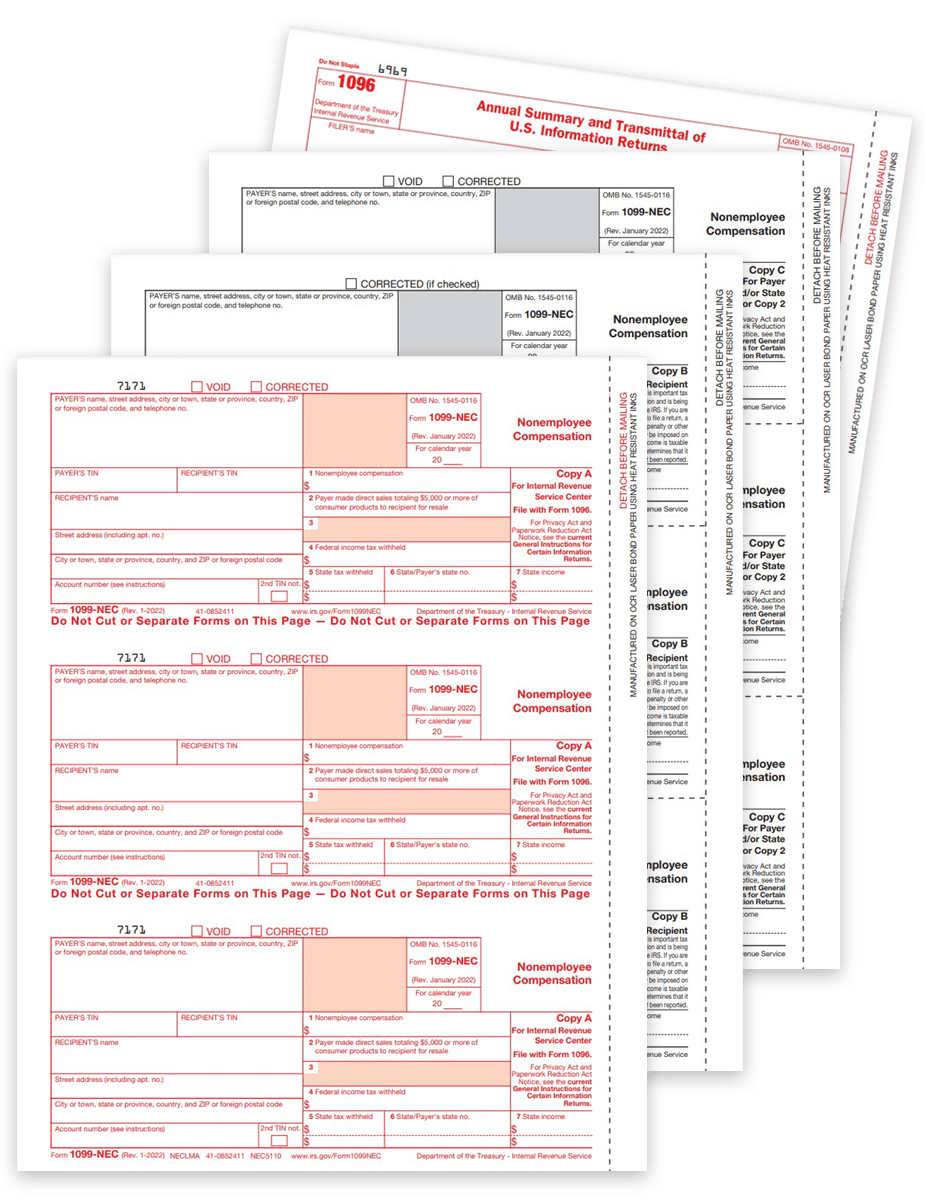

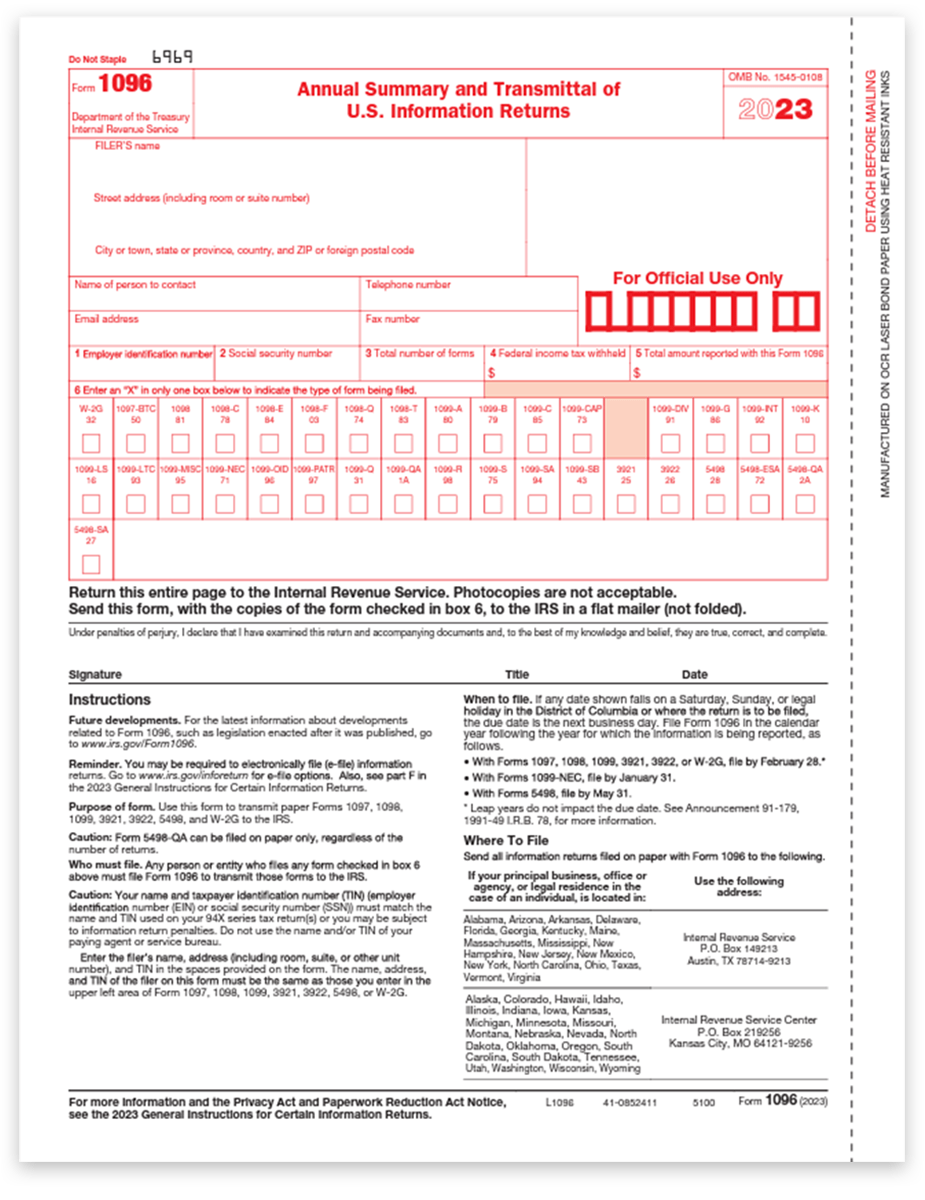

1096 Transmittals

For IRS Filing with Copy A

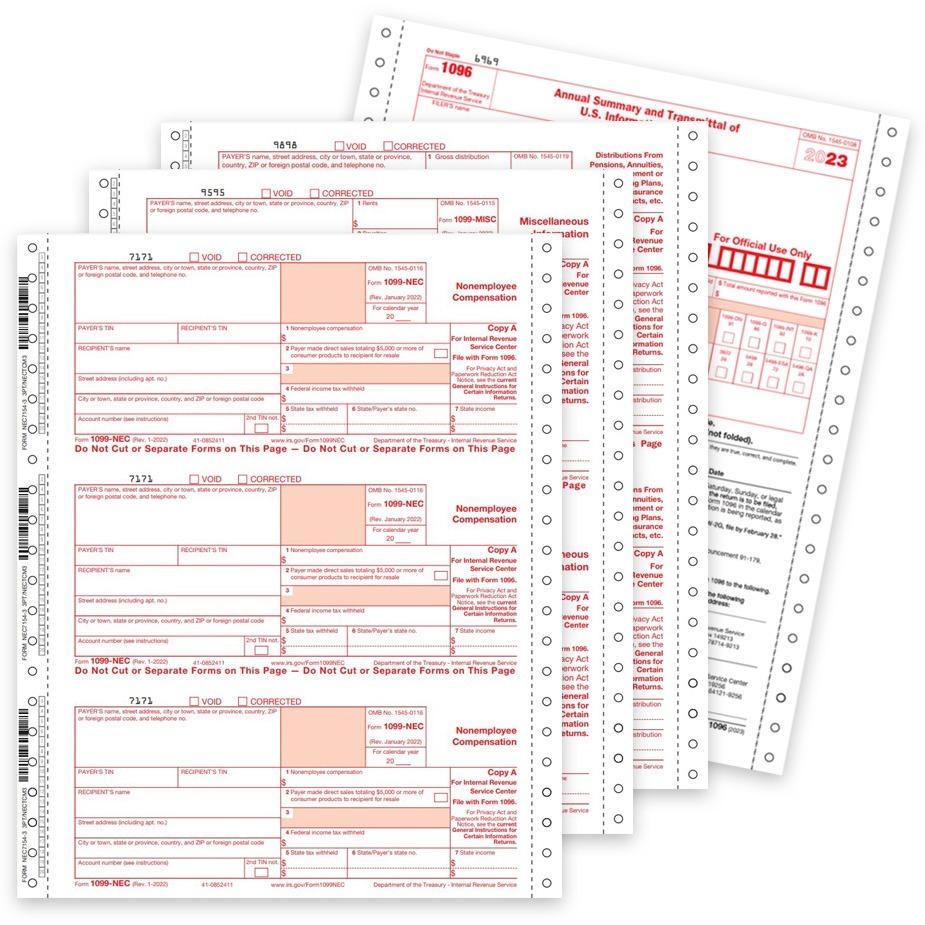

Continuous 1099 Forms

For pin-fed printers & typewriters.

Pressure Seal 1099

Forms for pressure seal systems.

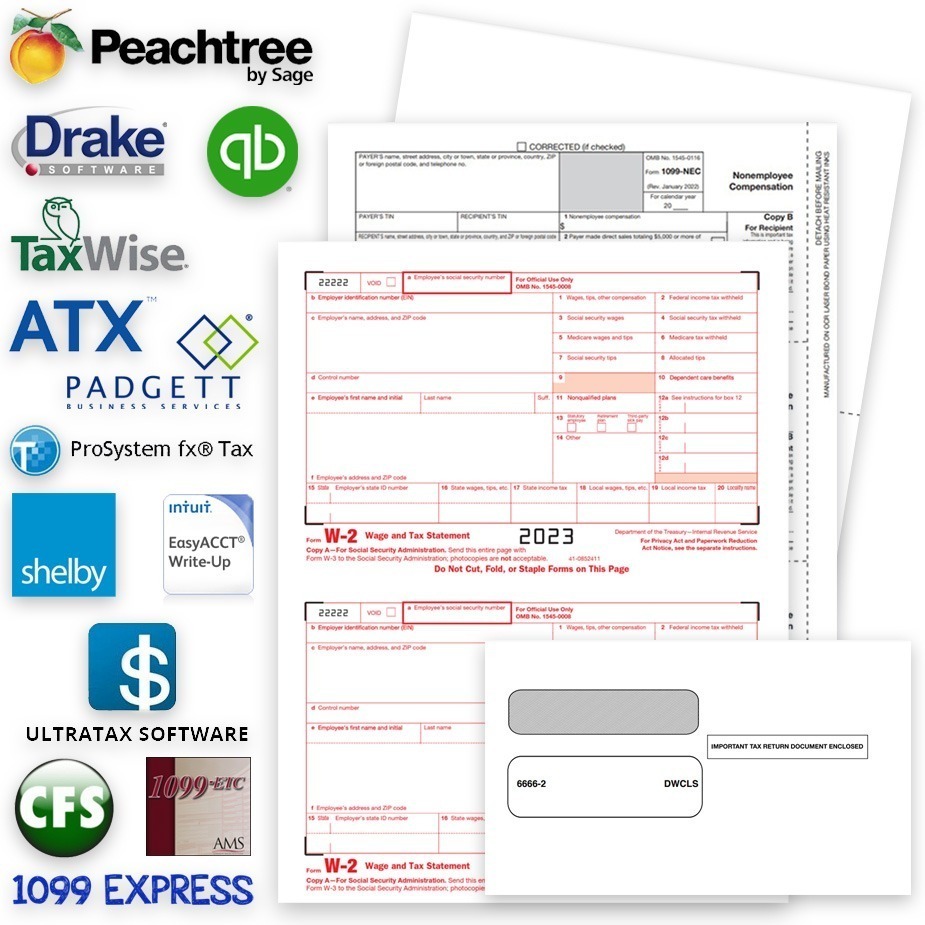

Software Compatible Forms

1099 forms for accounting software.

1099 Software

Stand-alone software for 1099 filing.

All 1099 Forms

Report nonemployee compensation for contractors, freelancers and more who you have paid over $600 using 1099NEC forms.

We offer discounted forms, software and online e-filing and mailing services.

File payment information for miscellaneous income over $600 using 1099MISC forms. No longer used for non-employee compensation.

We offer discounted forms, software and online e-filing and mailing services.

The transmittal form for 1099s, 1096 Forms are used to summarize payer information for a batch of 1099 forms sent to the IRS.

Use one 1096 for each payer, for each type of 1099, 1098, 5498 or W2G filed.

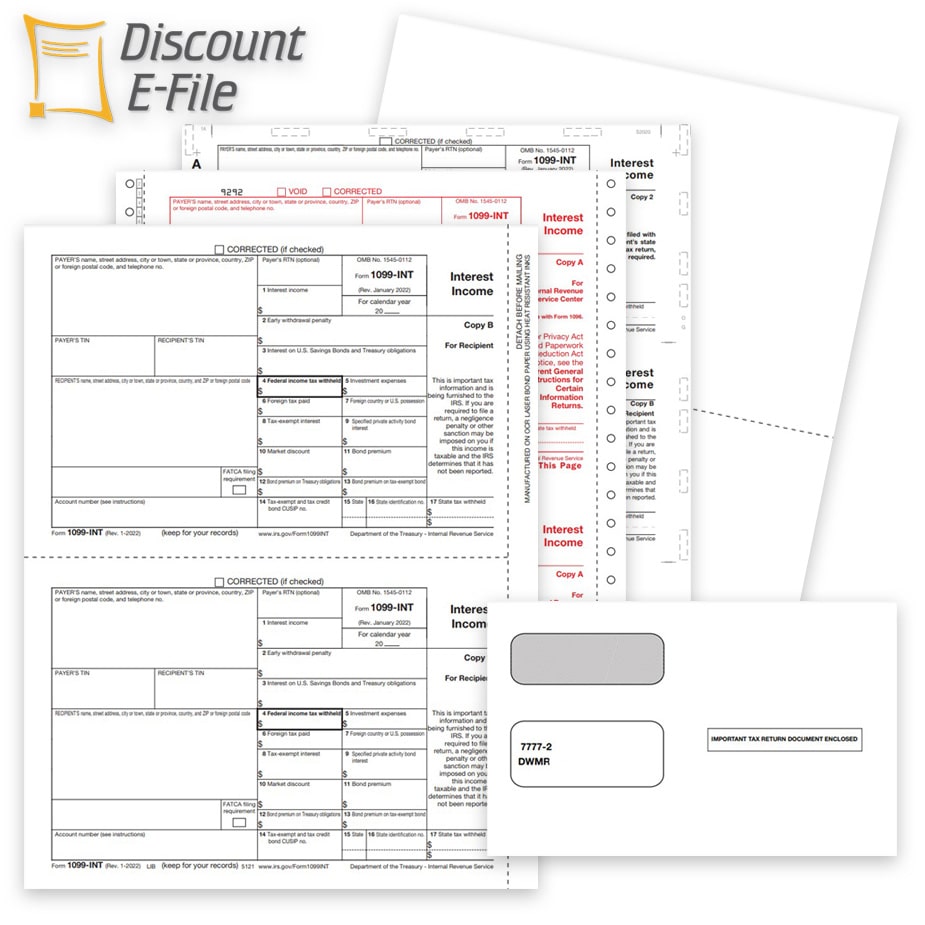

1099-INT Forms

For reporting interest income.

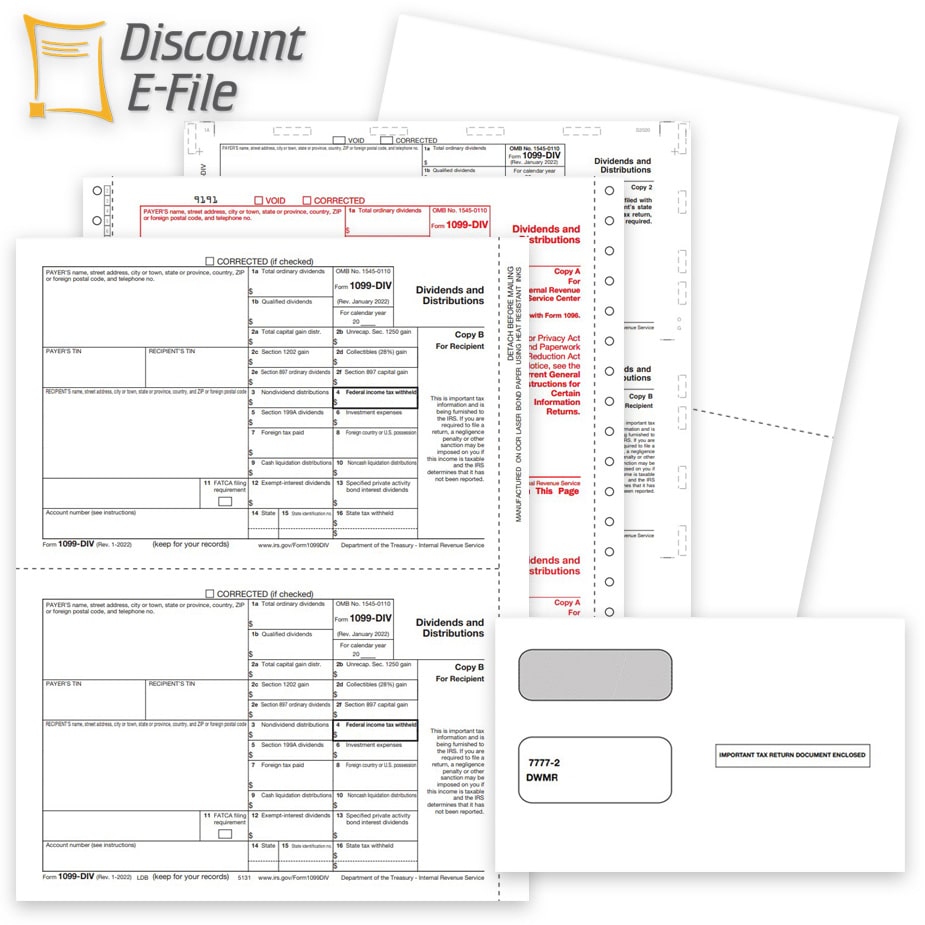

1099-DIV Forms

Use to report earnings from dividends.

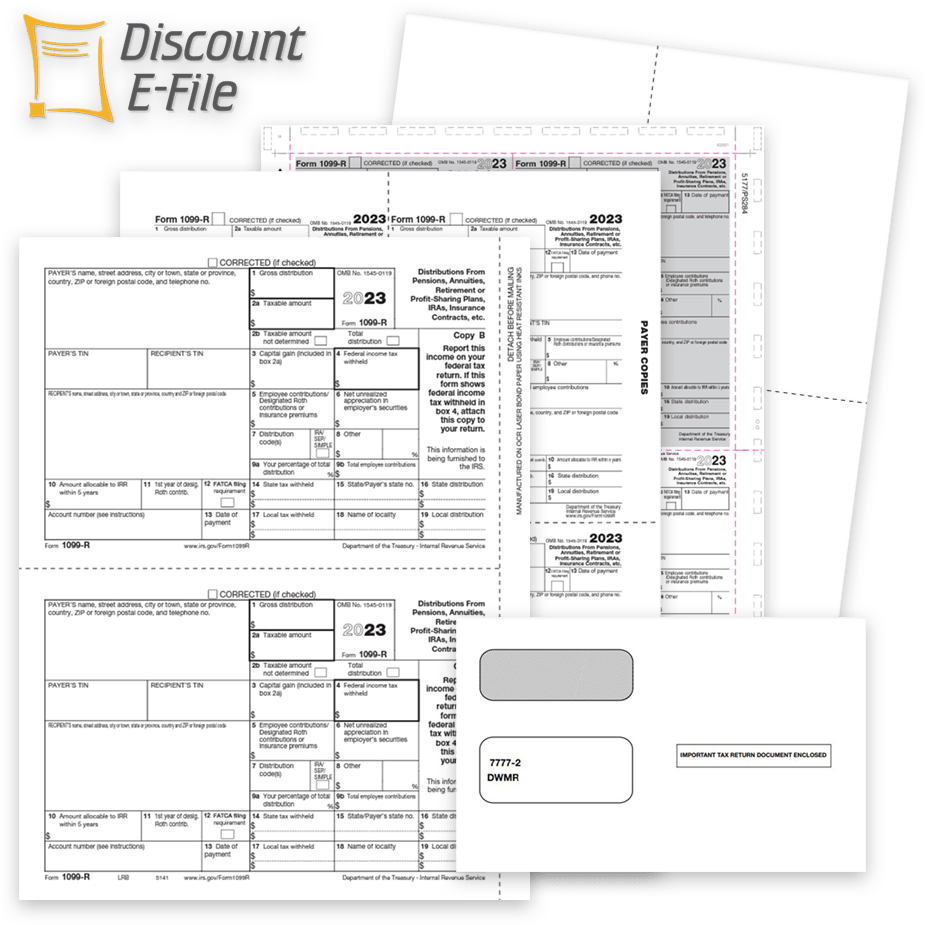

1099-R Forms

For real estate proceeds.