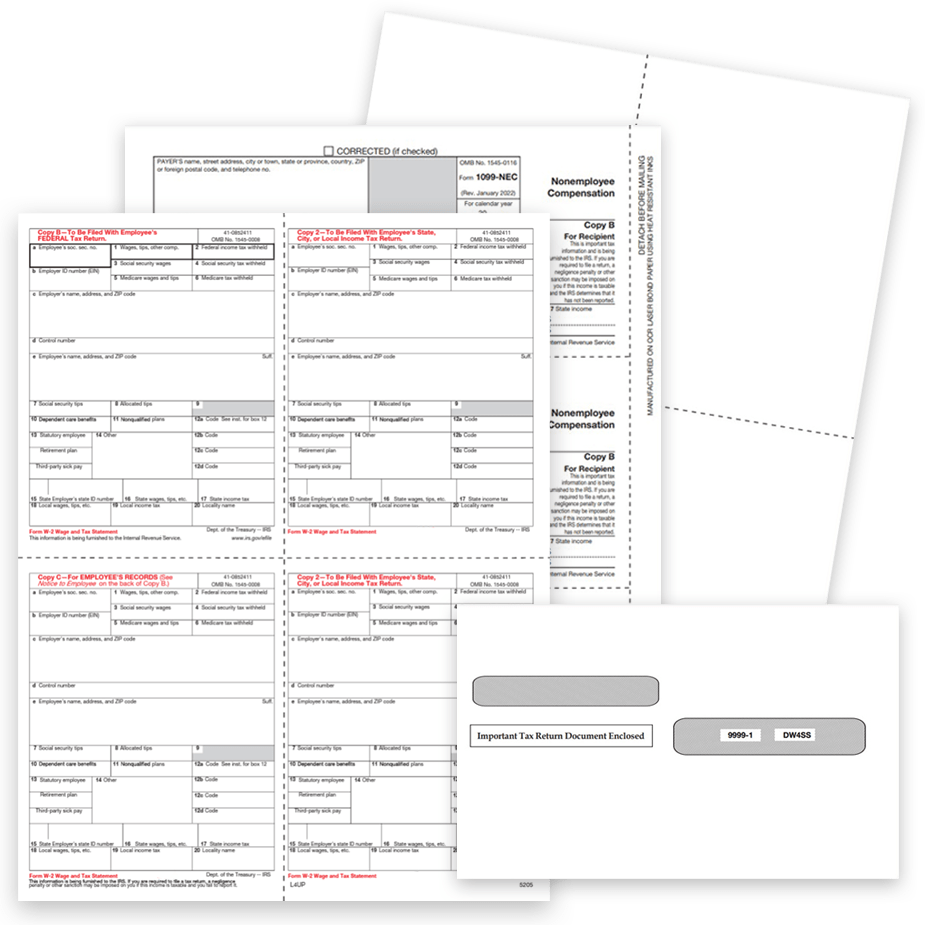

1099 & W2 Tax Forms for Accounting Software

100% Compatible 1099 & W2 forms for 2023 for popular accounting and tax software.

Guaranteed compatible tax forms that are more affordable, everyday!

Whether you use QuickBooks® or Peachtree® accounting software for your small business, or prepare taxes with UltraTax®, ATX® or others, ZBP Forms has you covered.

**NEW** E-filing requirements — E-file Copy A if you have 10+ W2 and 1099 forms combined in 2023

DiscountEfile.com makes it easy! Simply enter or upload data, and we e-file with the IRS and can even print and mail recipient copies in one easy step. Learn More >

Order software compatible 1099 & W2 tax forms and envelopes at everyday discounts.

Year-End is Easier with The Tax Form Gals!

Major E-File Requirement Changes for 1099 & W2 Filing

The new e-file threshold for the 2023 tax year is only 10 W2 and 1099 forms, combined, per EIN.

For example, if your business has to file 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2024.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes.

Penalties apply if you don't - $60 per form if you file on time and up to $310 per form if you file late.

NEW E-FILE RULES + ONLINE FILING = EASY 2023!

E-file, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

If you have 10 or more 1099 & W2 forms combined for a single EIN, you must e-file 1099 & W2 Copy A in 2023.

Use DiscountEfile.com to enter or upload data from QuickBooks® or other programs, and we'll e-file with the IRS or SSA for you and can even print and mail recipient copies!

Create a free account and get started today!

Deadlines for 2023 1099 & W-2 Filing

January 31, 2024

All 1099 Recipient Copies B / C / 2 mailed to recipient

W-2 Employee Copies B / C / 2 mailed to employees

1099NEC Copy A forms to IRS*

W2 Copy A to IRS*

>> *NEW E-FILE RULES FOR 2023 << Businesses with 10+ 1099 and W2 forms combined MUST e-file Copy A forms with the IRS or SSA. Make it easy with DiscountEfile.com...

February 28, 2024 - Paper 1099 Copy A forms to IRS

1099 Form Copy A, along with 1096 Transmittals, mailed to the IRS for all 1099 forms except 1099-NEC with non-employee compensation, which are due January 31.

April 1, 2024 - E-file 1099 forms with IRS

1099 Forms E-filed to the IRS, except 1099-NEC with non-employee compensation, which are due January 31.

Instantly print, mail and e-file your 1099 and W-2 forms.

Simply enter or import your data, even from QuickBooks®, click a few buttons and you're done.

We print and mail recipient copies, plus e-file with the government, starting at about $4 per form and going down based on your overall quantity.

Guide to Filing 1099 & W-2 Forms

Whether you need to file W2s for employees, or 1099-MISC for contractors, we can help!

Use this guide to understand how to file, when to file and the best forms, software and solutions for you.

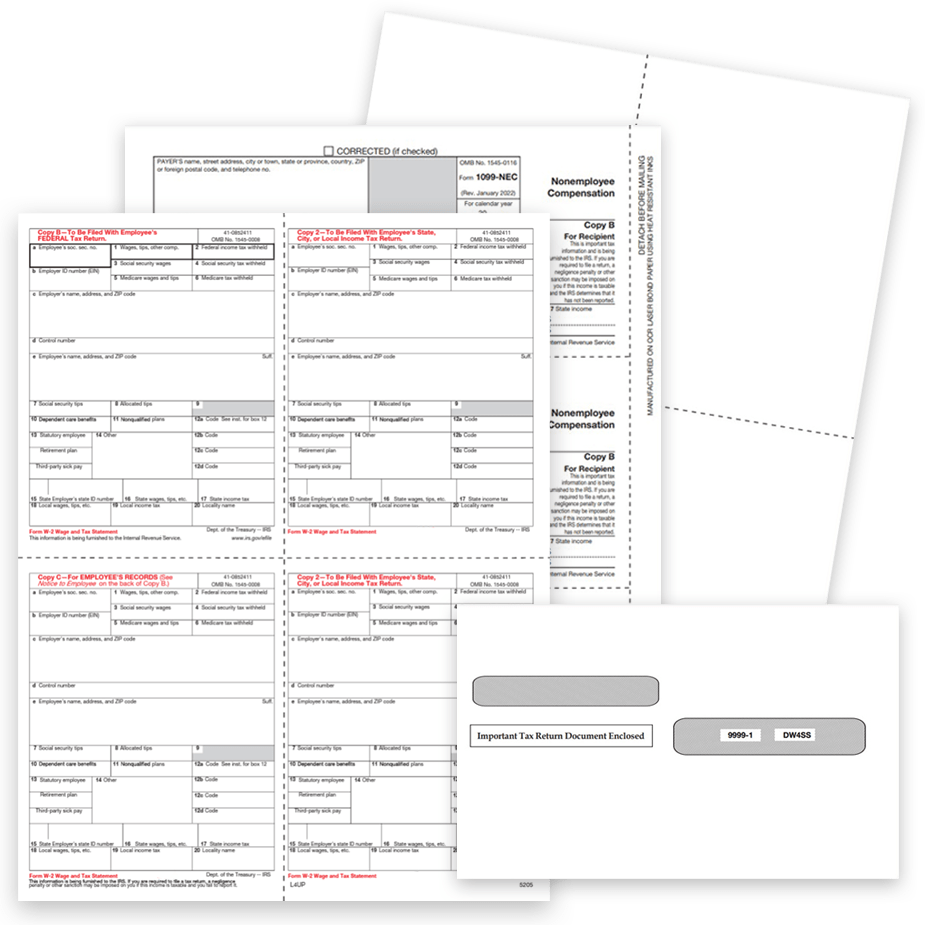

Decoding W-2 Formats

2up Forms

2 forms per sheet, all blank paper can include employee instructions on the back.

Use them for Official W2 forms (2 of the same copies) or condensed 2up employee Copies B/C for federal filing.

3up Forms

3 forms on a sheet, typically with a vertical size strip to remove before mailing.

Use for condensed 3up W2 forms for employees, Copies B/C/2 for federal and state filing.

4up Forms

4 forms on a single sheet, perforated into quadrants or horizontal sections depending on your software.

Use for 8pt W2 printing of employee Copies B/C/2/2 for federal, state and local filing.

Tips for Faster & Easier W2 Filing

Be sure that you use W2 forms compatible with your software! Check your software for supported formats:

- Preprinted forms (prints data on a pre-made form) or

- Blank paper (prints data and boxes on a perforated sheet)

- 2up, 3up or 4up forms

- Be sure your envelope windows match!

W3 Transmittal forms must be mailed with Red Copy A forms. We include a couple FREE W3 forms with each W2 order.

Online filing is an option! DiscountEfile.com lets you enter or import data, and then takes care of the rest. Your forms are e-filed with the IRS/SSA and mailed to employees automatically. With a few clicks, you're done! Learn more.