1099 & W2 E-File Requirement Changes

You must electronically file 1099 & W2 forms with the IRS if you have 10 or more in 2023.

The new threshold will affect most businesses!

If your business has 10 or more forms – 1099 and W2 forms combined – you must e-file Copy A forms for the 2023 tax year.

Learn about the new requirements and find easy solutions!

1099 & W2 E-filing compliance made easy in 2023.

Get the best solutions from The Tax Form Gals!

Major E-File Requirement Changes for 1099 & W2 Filing

The new e-file threshold for the 2023 tax year is only 10 W2 and 1099 forms, combined, per EIN.

For example, if your business has to file 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2024.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes.

Penalties apply if you don't - $60 per form if you file on time and up to $310 per form if you file late.

NEW E-FILE RULES + ONLINE FILING = EASY 2023!

E-file, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

If you have 10 or more 1099 & W2 forms combined for a single EIN, you must e-file 1099 & W2 Copy A in 2023.

Use DiscountEfile.com to enter or upload data from QuickBooks® or other programs, and we'll e-file with the IRS or SSA for you and can even print and mail recipient copies!

Create a free account and get started today!

Official IRS Statement Regarding 1099 & W2 Efiling Requirements for 2023

Regulations section 301.6011-2 was amended by Treasury Decision 9972, published February 23, 2023, which lowers the threshold to 10 for which employers must file certain information returns electronically, including Forms W-2, W-2AS, W-2GU, W-2VI, and Form 499R-2/W-2PR (collectively Forms W-2), but not Form W-2CM.

To determine whether they must file information returns electronically, employers must add together the number of information returns (see the list below) and the number of Forms W-2 they must file in a calendar year. If the total is at least 10 returns, they must file them all electronically.

The new threshold is effective for information returns required to be filed in calendar years beginning with 2024. The new rules apply to tax year 2023 Forms W-2 because they are required to be filed by January 31, 2024.

The following information return forms must be added together for this purpose: Form 1042-S, the Form 1094 series, Form 1095-B, Form 1095-C, Form 1097-BTC, Form 1098, Form 1098-C, Form 1098-E, Form 1098-Q, Form 1098-T, the Form 1099 series, Form 3921, Form 3922, the Form 5498 series, Form 8027, and Form W-2G.

Order 1099 & W2 Form Sets for Efilers

Sets of Forms for Recipient and Payer State Filing Only – Copy A Forms are NOT included

-

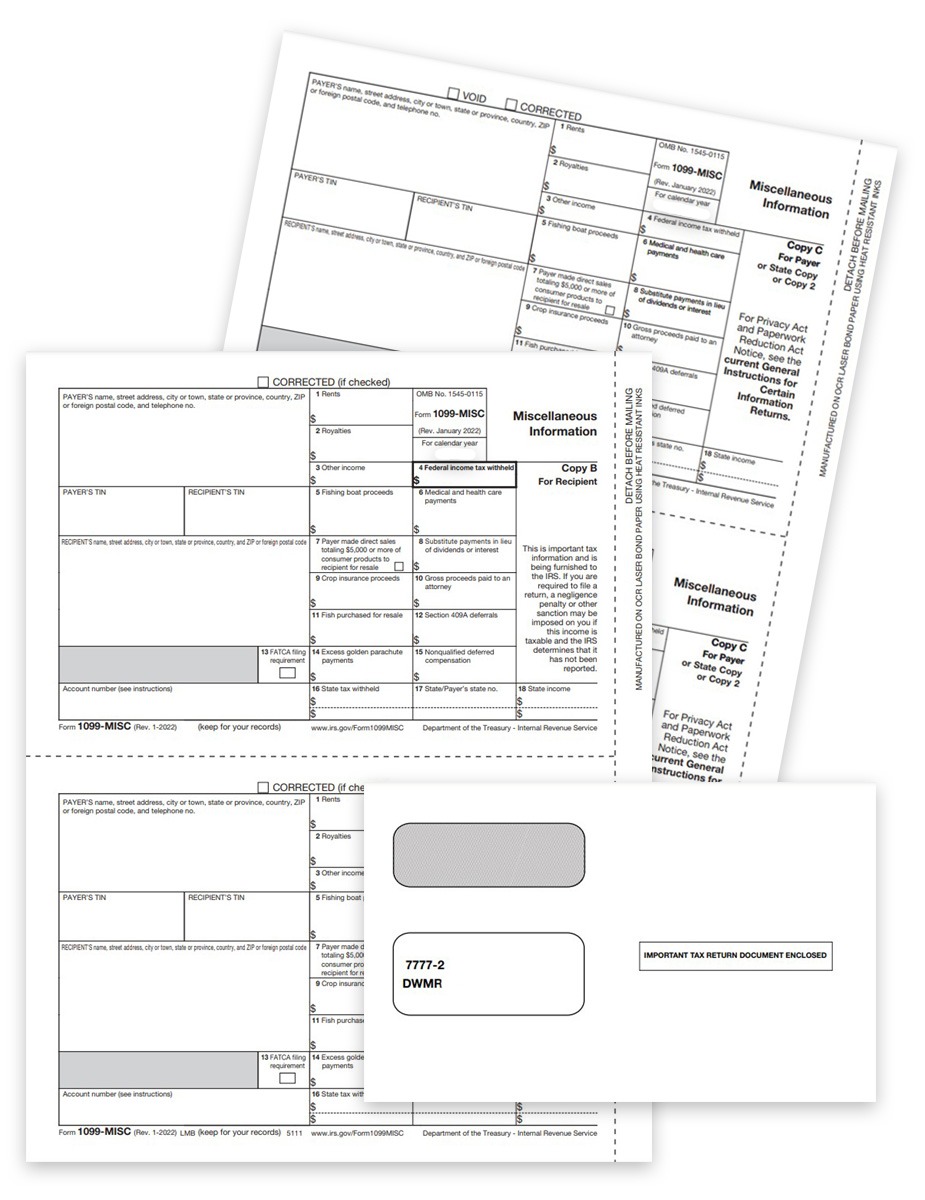

1099MISC Blank Paper & Envelope Set – 2up with Instructions

-

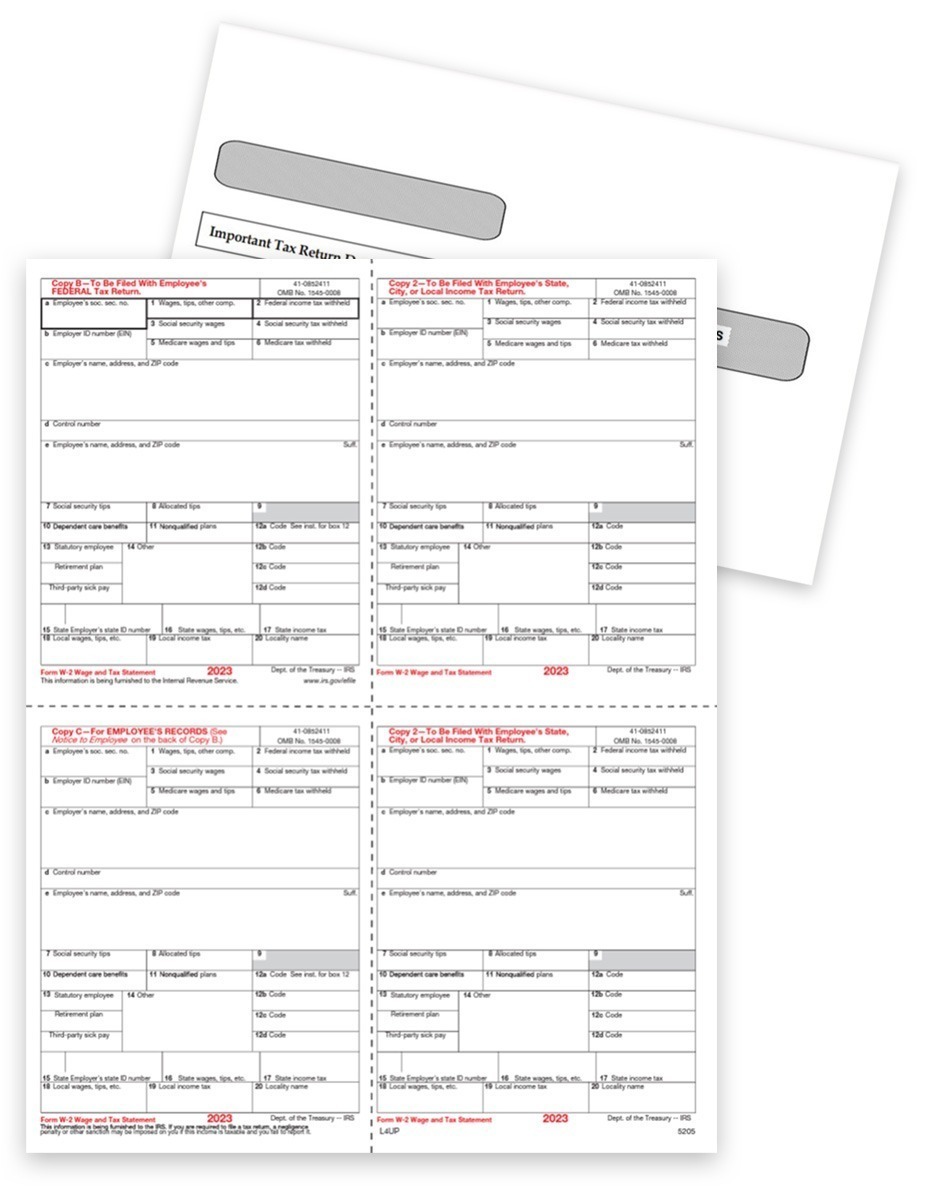

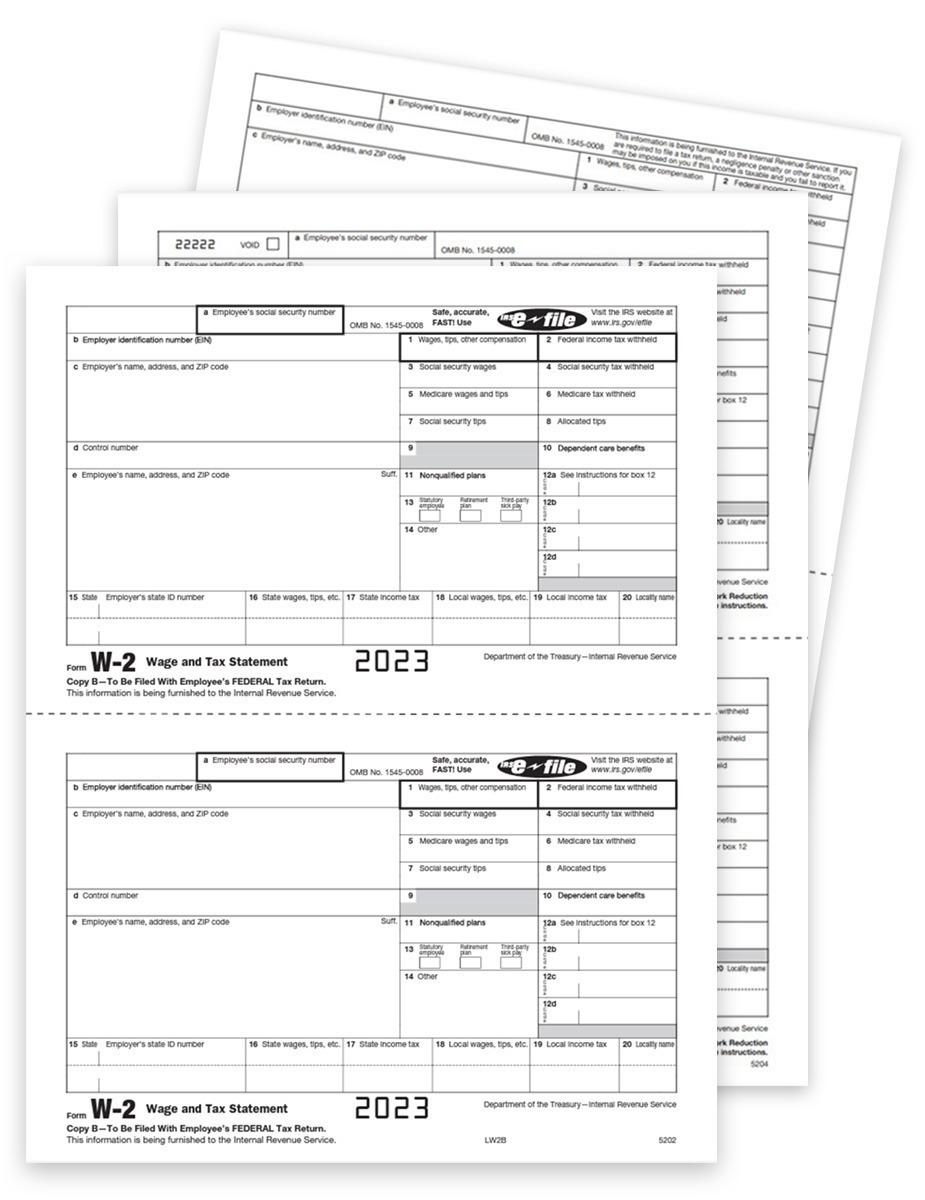

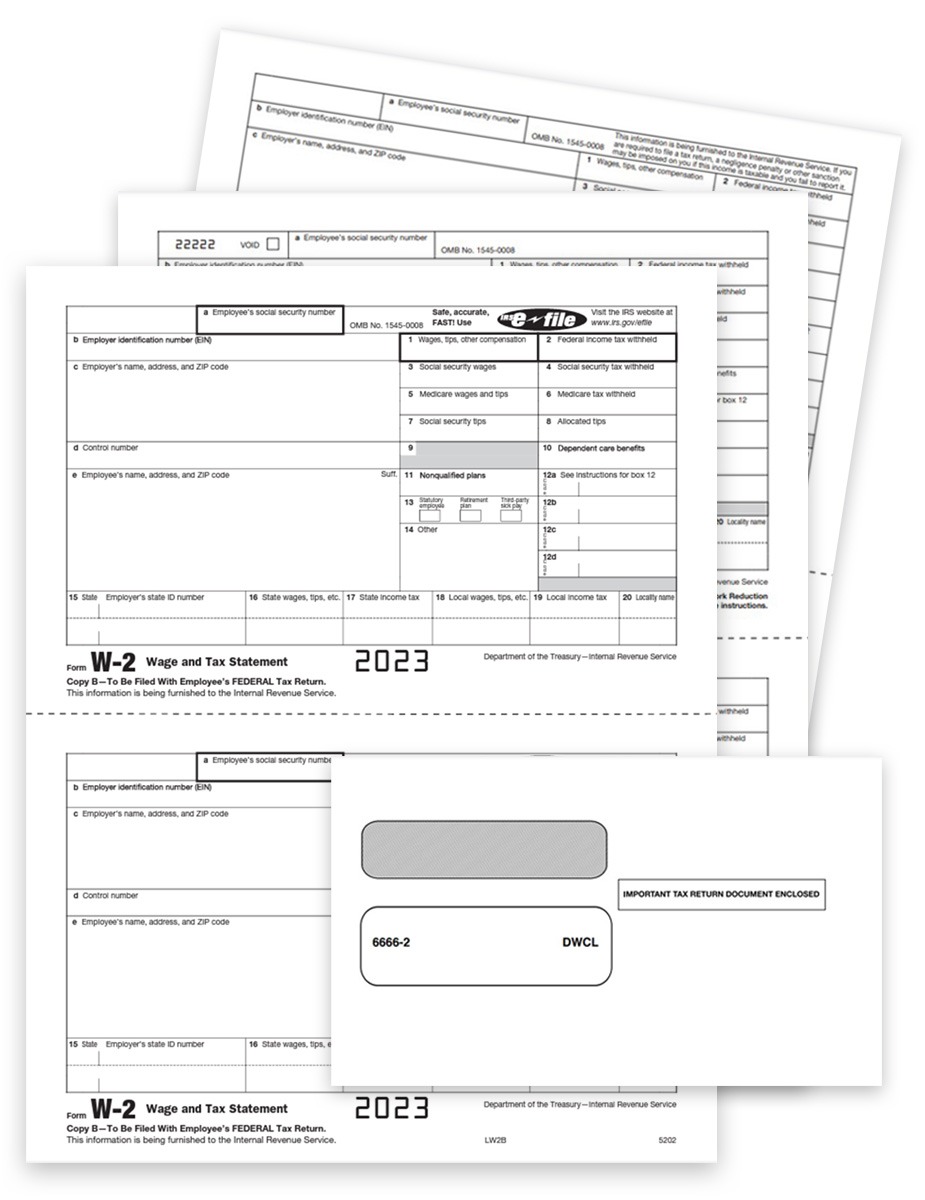

W2 Blank Paper & Envelope Set – 2up

-

W2 Blank Paper & Envelope Set – 4up V1 with Instructions

-

W2 Employee Tax Forms with Envelopes – 4up V1

-

W2 Tax Forms Sets for Efilers – 5-part

-

W2 Tax Forms Sets with Envelopes for Efilers – 3-part

-

W2 Tax Forms Sets with Envelopes for Efilers – 5-part

-

1099-MISC Forms Sets with Envelopes for E-filers – 3-part

-

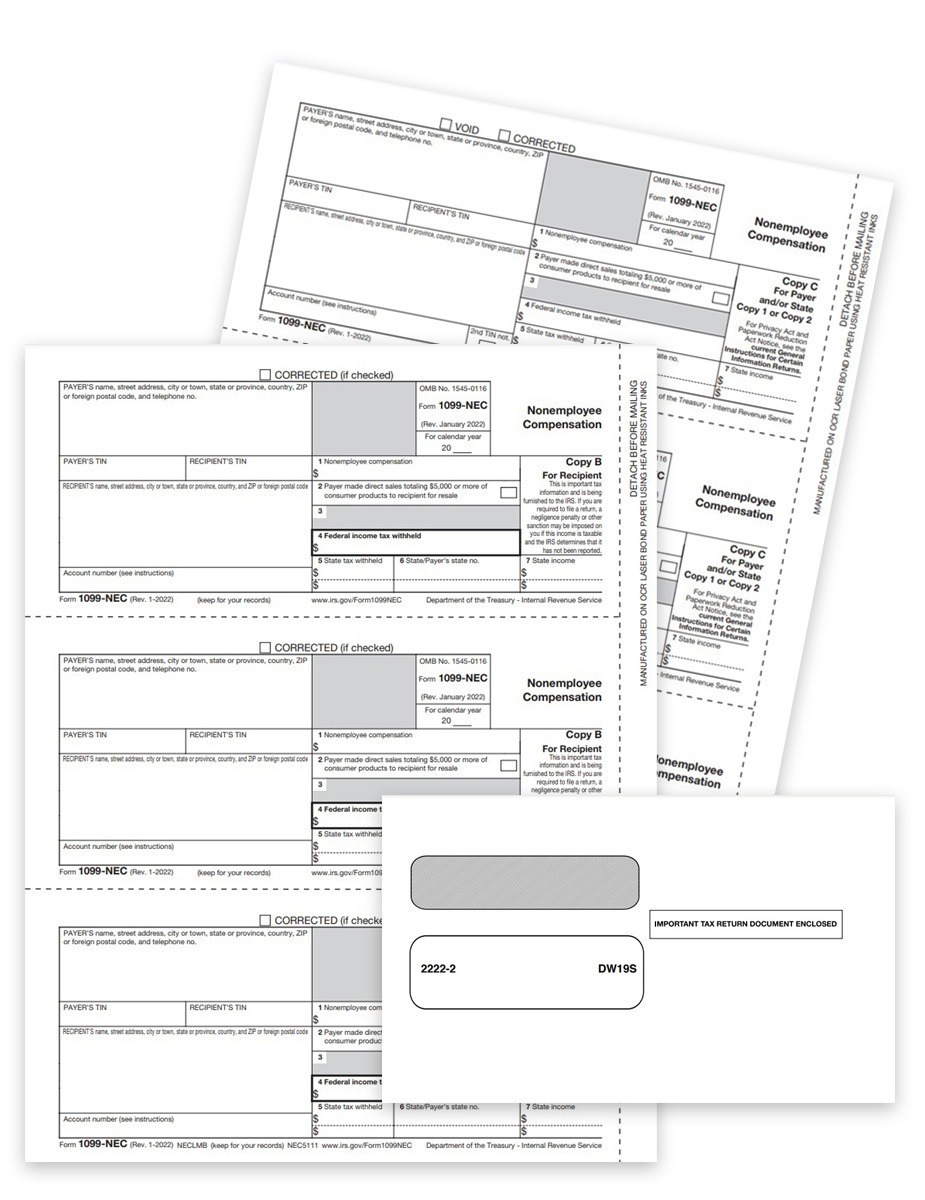

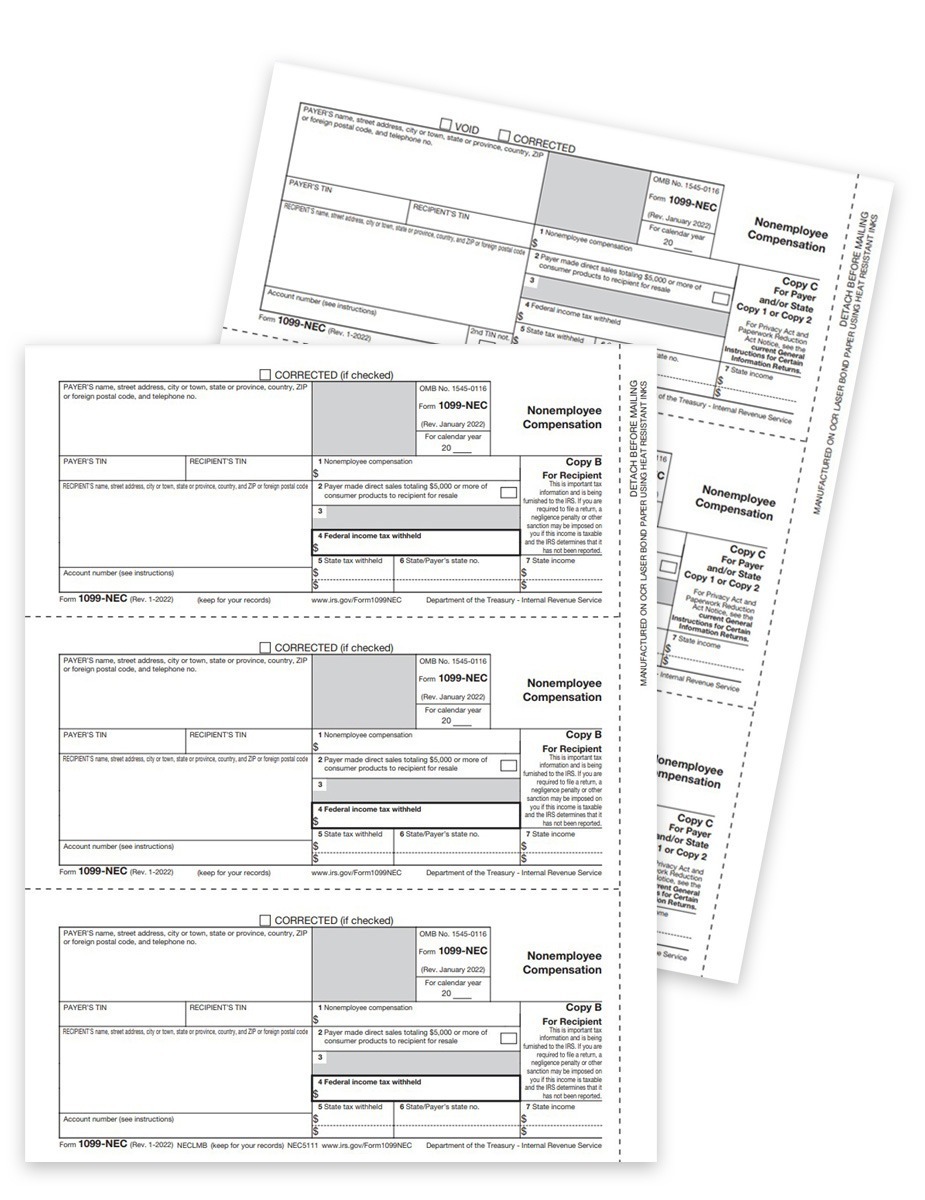

1099-NEC Forms Sets with Envelopes for E-filers – 3-part

-

1099-NEC Forms Sets for E-filers – 3-part