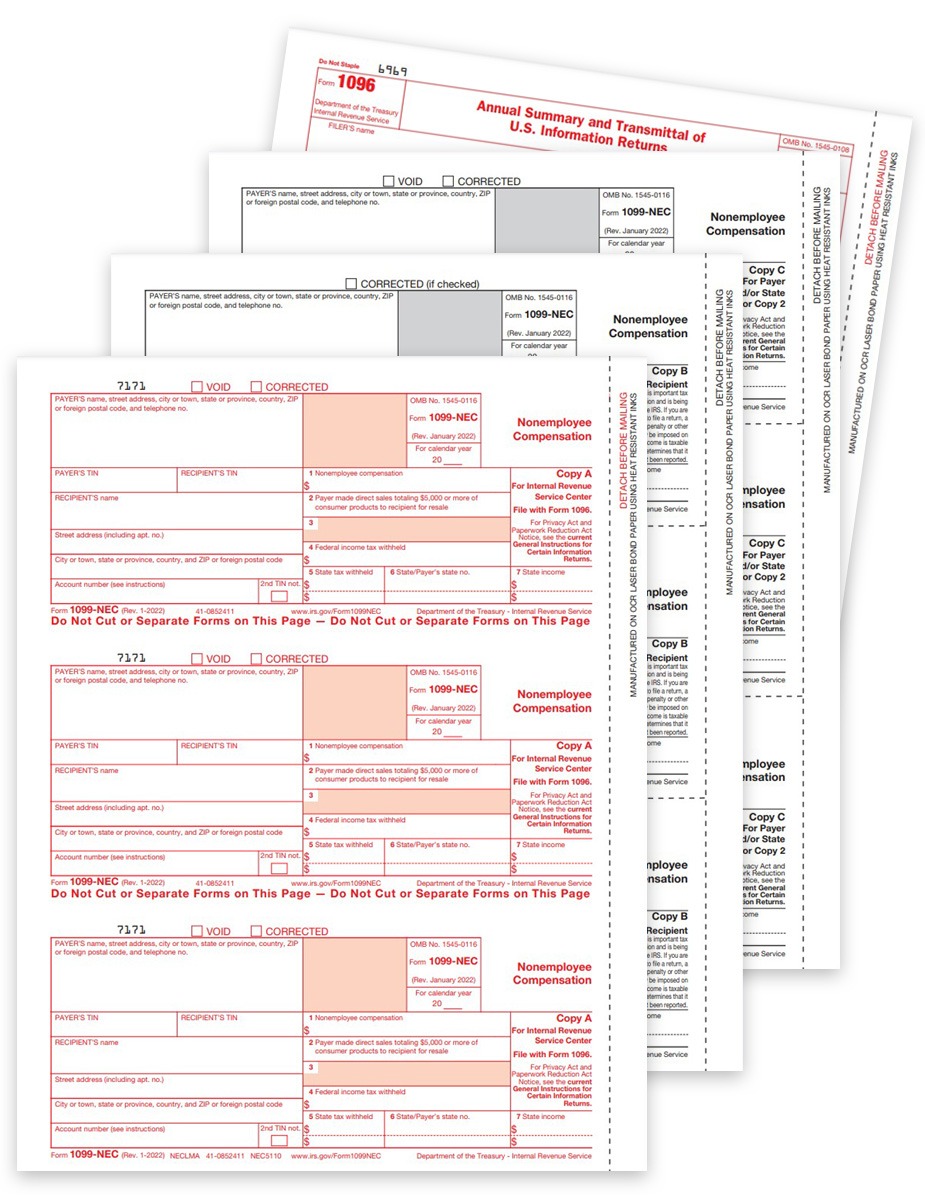

1099-NEC Tax Forms Sets for 2023 Non-Employee Compensation Reporting

1099NEC Forms kit with everything you need to print recipient and payer copies to report non-employee compensation during tax year 2023.

1099-NEC Filing is easy with The Tax Form Gals!

Use 1099-NEC Forms to report annual income of $600+ for contractors, freelancers and more.

Choose the number of parts based on your filing requirements: 3-part Federal Only, 4-part Federal & State, 5-part Federal, State & Local

New E-filing Requirements for 10+ Recipients

If you have 10+ recipients for 1099 & W2 forms, combined per EIN, you must efile Copy A forms with the IRS in 2023.

We make it easy with DiscountEfile.com… we’ll efile with the IRS or SSA and can even print and mail recipient copies for you in one easy step – no forms, envelopes or postage required!

More on Efile Changes + Easy Solutions

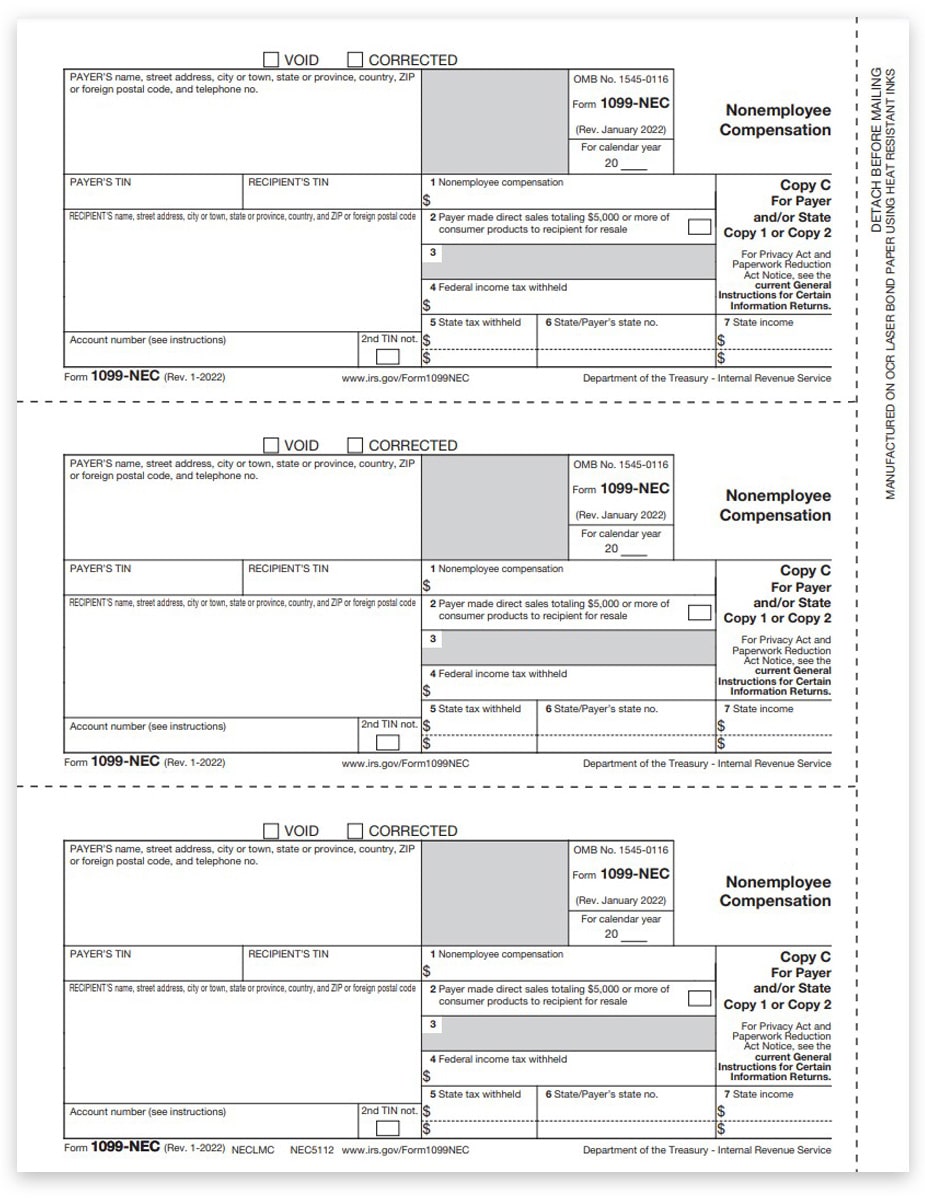

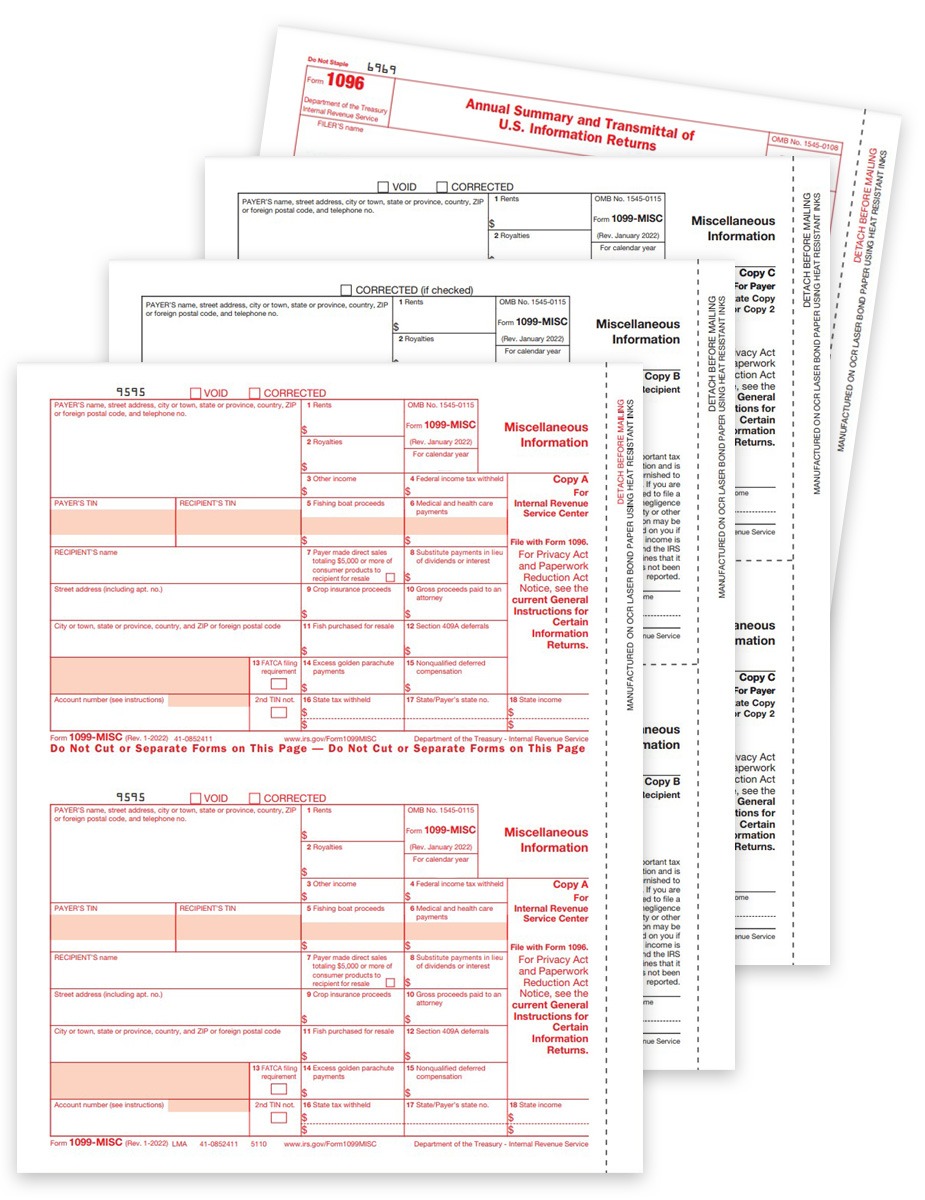

1099-NEC Form Sets with Envelopes Include:

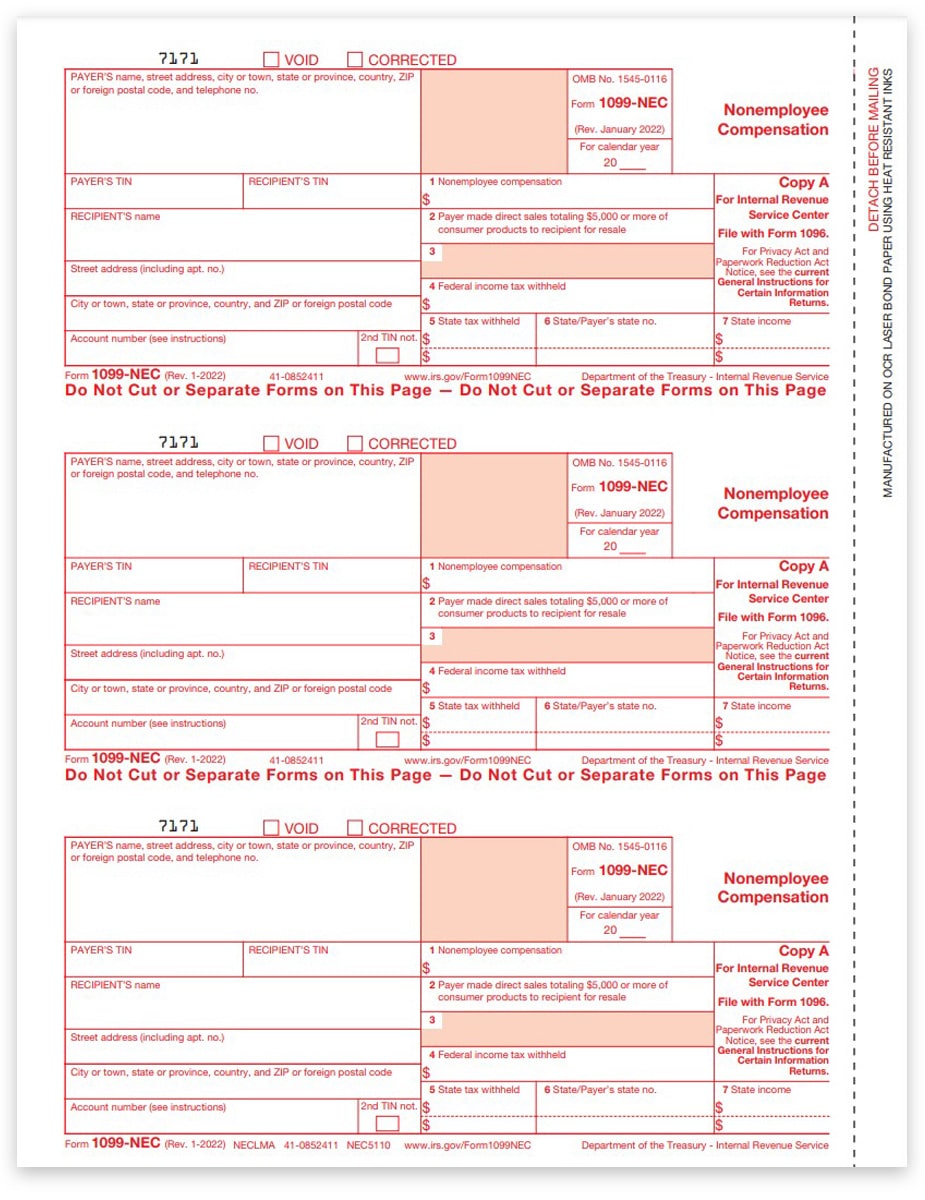

- Copy A (Federal, red scannable)

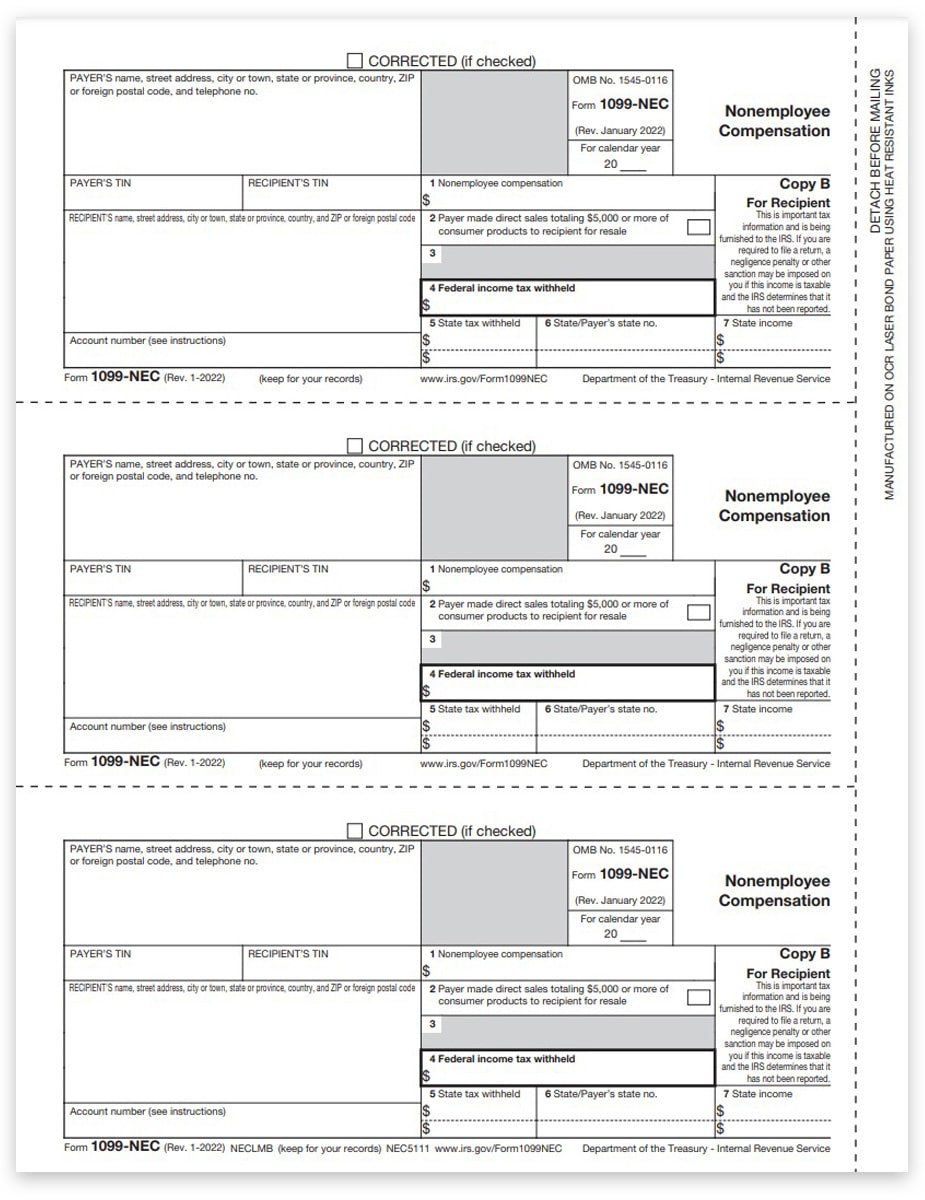

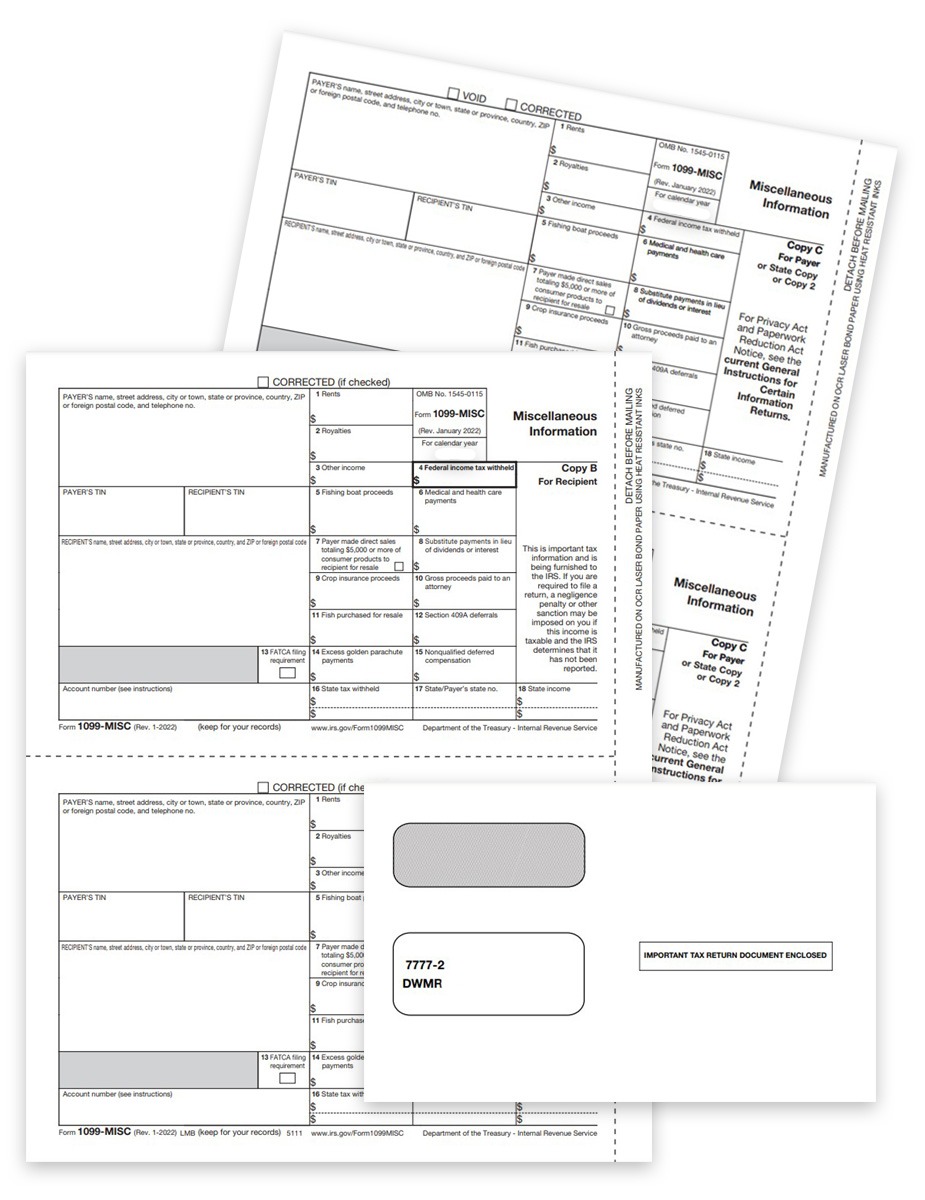

- Federal Copy B (Recipient)

- Copy C / 2 (Payer or State) – (5pt includes 2 copies of C/2)

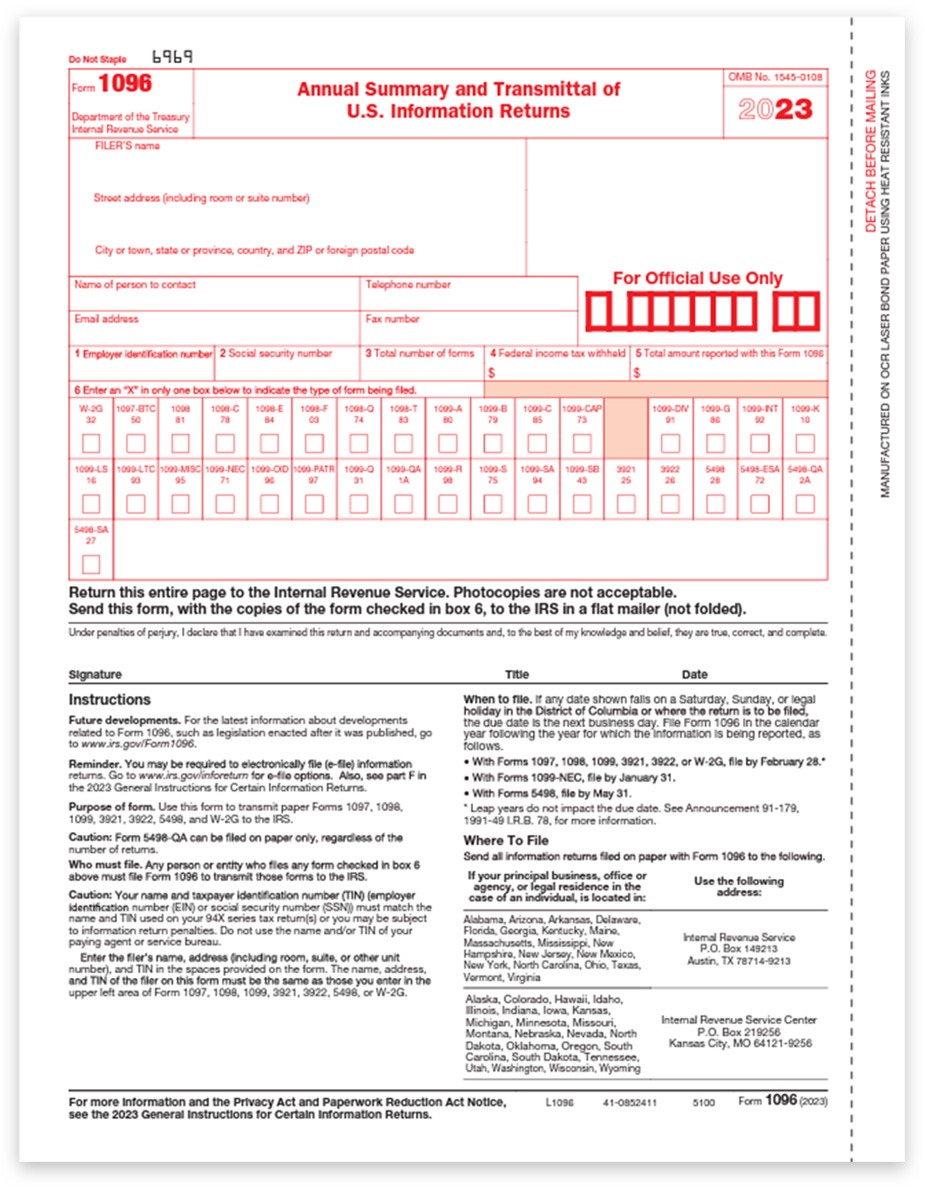

- 1096 Transmittal Forms (3 forms)

Order a quantity equal to the number of recipients you have.

- 2-up format

- 8.5″x 11″

- Copy A has a 1/2″ side perforation

- Printed on 20# laser paper

Print each copy as a batch and separate along the perforations (except Copy A)

Mail Copy A to the IRS in a batch with a 1096 Transmittal Form.

Mail Copy C to a state tax agency if required.

Mail Copy B to the recipient in compatible 1099 security envelopes.

Reviews

There are no reviews yet.