Product Details

ATX Universal W2 & 1099 Envelopes

A universal W2 & 1099 envelope for use with Universal W-2/1099 blank perforated paper for easy printing and mailing from ATX software.

Rely on The Tax Form Gals for easy 1099 & W2 filing!

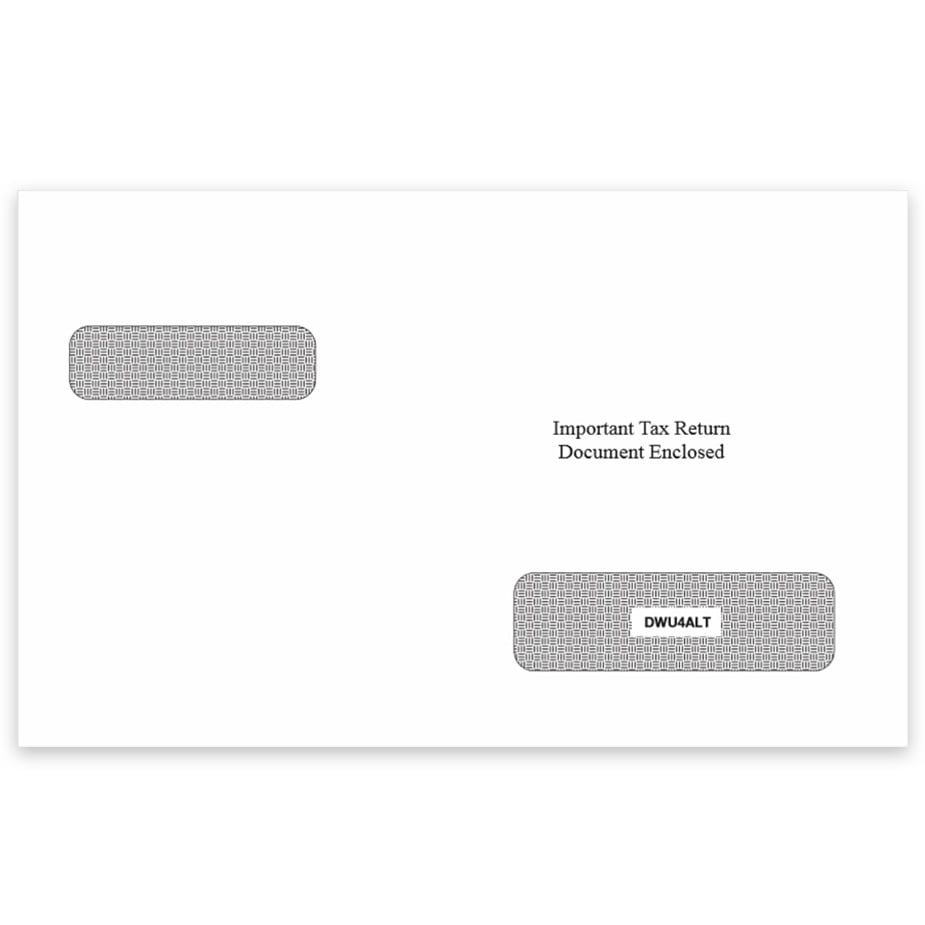

Tinted envelopes have 2 windows that match the address fields on ATX Universal 1099 & W2 form paper and ensure that no sensitive information is revealed. “Important Tax Return Document Enclosed” is printed on the front per IRS requirements.

Universal W2 & 1099 Envelope Info:

- 5-3/4″ x 8-3/4″

- Security tint and cellophane windows ensure the privacy of information

- 24# envelope stock

- “Important Tax Return Document Enclosed” is printed on the front

- Standard moisture seal flap

- Item# DWU4ALT

Compatible with universal perforated paper when used with ATX software.

How to Choose the Right W-2 Forms

POSSIBLE NEW E-FILING REQUIREMENTS

The IRS is considering changing the 1099 & W2 e-filing threshold requirement to 100 forms for a single payer in 2021. They will make this determination by November. Stay tuned to ZBP Forms for compliance information!

If you want to get a jump on the new requirements, we make it easy with DiscountEfile.com. Learn More.

OPTIONS FOR FILING W-2 FORMS

- Your Accounting Software: Print W-2 forms compatible with your software, such as QuickBooks®.

- Specialized W-2 Software: Print and e-file W-2 forms if your accounting software does not.

- Online W-2 Filing: Enter or import data and we print, mail and e-file for you!

TYPES OF W-2 FORMS

All government copies must be printed in a 2up format (2 forms per page)

Employee copies may be printed in a 2up, 3up or 4up format (2, 3 or 4 forms per page; also called ‘condensed forms). All of the copies for a single employee will print on one page. You simply fold and mail – no need to separate and collate forms! Your software may support these formats, be sure to check its functionality before ordering.

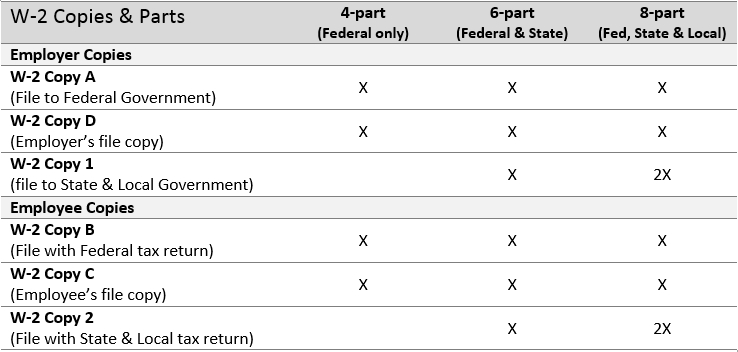

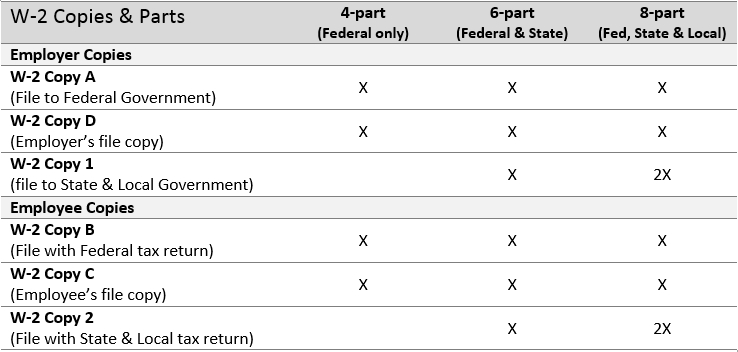

NUMBER OF PARTS

The number of parts you need is determined by which government agencies you are reporting to.

- Federal Only – 4 parts

- Federal and State – 6 parts

- Federal, State and City – 8 parts

When using condensed 2up, 3up or 4up forms, you can print all employee copies on a single sheet to save time.

- For a 4-part form, use 2up paper.

- For a 6-part form, use 3up paper.

- For an 8-part form, use 4up paper.

4-Part States: AK, FL, NV, NH, SD, TN, TX, WA, WY

6-Part States: AL, AZ, AK, CA, CO, CT, DC, DE, GA, HI, ID, IA, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, MT, NC, NE, ND, NJ, NM, NY, OH, OK, OR, PA, RI, SC, UT, VA, VT, WI, WV (add extra parts for city withholding taxes)

8-Part States: AL, DE, KY, MD, MI, MO, NY, OH, PA

Read More: Decoding W2 Copy Requirements >

EASY ONLINE FILING W2 FORMS

For EASY FILING OF A FEW W2 FORMS, an online system is a better option than printing forms.

Enter data online and we do the work for you for about $4 per form. Visit DiscountEfile.com for more information.

W3 TRANSMITTAL FORMS

Transmittal W-3 Forms are required only if you are printing and mailing W2 Copy A to the Federal Government.

One W3 is required to summarize all W2s for one employer. Order W-3 Forms.

W2 ENVELOPES

Order compatible W-2 Envelopes to ensure mailing information aligns correctly in the windows. Order W-2 Envelopes

W-2 FILING DEADLINES

- January 31 – Recipient copies postmarked, Copy A mailed or efiled with IRS

These are federal deadlines. Most states follow the same dates.

W2C CORRECTION FORMS

Need to correct a W2 form? Use W2C forms or file them online and let us do the work for you!

More on W2 Corrections

How to Choose the Right 1099 Forms

OPTIONS FOR 1099 FILING

NEW 1099-NEC Forms for nonemployee compensation reporting.

Form 1099-NEC is used for payments of $600+ or more to non-employees, such as contractors, freelancers, some attorney payments and more. It replaced the 1099MISC in 2020.

1099NEC Forms changed to a 3up format for 2021 (instead of last year’s 2up format). You will need new forms and compatible 1099 envelopes. Learn about new 1099-NEC Forms.

POSSIBLE NEW E-FILING REQUIREMENTS

The IRS is considering changing the 1099 & W2 e-filing threshold requirement to 100 forms for a single payer in 2021. They will make this determination by November. Stay tuned to ZBP Forms for compliance information!

If you want to get a jump on the new requirements, we make it easy with DiscountEfile.com. Learn More.

TYPE OF FORMS

NUMBER OF PARTS

The number of 1099 parts needed is based on government filing requirements.

- Copy A: Federal Copy for the IRS

- Copy B: Recipient Copy

- Copy C/2: Payer or State Copy

Read more: Small business guide to filing 1099s

3-PART STATES: AK, CA, FL, GA, IL, IN, IA, KY, LA, MD, MI, MO, NV, NH, NM, NY, OR, SD, TN, TX, VT, WA, WY

4-PART STATES: AL, AR, AZ, CA, CO, CT, DE, DC, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MO, MS, MT, NE, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, UT, VT, VA, WV, WI

5-PART STATES: AL, AZ, CO, CT, DE, HI, ID, ME, MA, MN, MS, MT, NE, NC, ND, OH, OK, PA, SC, UT, WI

1096 FORMS

Transmittal 1096 forms are required only if you are printing and mailing 1099-MISC Copy A to the Federal Government. One 1096 is required to summarize all 1099s for a single payer.

1099 ENVELOPES

Order compatible 1099 envelopes to ensure mailing information aligns correctly in the windows.

1099 FILING DEADLINES

- January 31* – All 1099 Recipient Postmarked; 1099-NEC Federal Copy A Postmarked or e-filed with IRS

- February 28 – Paper Copy A filed with the IRS for all 1099s except MISC

- March 31 – E-filed copies to the IRS for all 1099s except MISC

These are Federal filing deadlines. Most states follow the same dates.

HOW TO CORRECT A 1099 FORM

If you need to correct a 1099 form because the original has errors, you will need to re-file the same 1099 form.

The only difference is a simple “Corrected” checkbox at the very top of the 1099.

Checking this box signifies to the IRS and recipient that there is different information than on the original 1099.

This is the approach for correcting any type of 1099 form, from the popular 1099NEC and 1099MISC to obscure types of 1099 forms too.

You can print and mail the corrected 1099 forms yourself, or file them all online to save time!

More on 1099 Corrections

Reviews

There are no reviews yet.