TaxWise™ Software Compatible Tax Forms

Easily order compatible 1099 & W2 tax forms for TaxWise software.

Tax forms and business checks are guaranteed compatible and more affordable – no coupon code required!

Printing tax forms is faster and easier when forms align perfectly with the data format. We’ve done the research for you.

Looking for an easier way to get 1099 & W2 forms done? We can take care of everything for you! Learn more >

*Brand names are property of their respective owners

1099 & W-2 Forms for TaxWise™ Software

Major E-File Requirement Changes for 1099 & W2 Filing

The new e-file threshold for the 2023 tax year is only 10 W2 and 1099 forms, combined, per EIN.

For example, if your business has to file 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2024.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes.

Penalties apply if you don't - $60 per form if you file on time and up to $310 per form if you file late.

NEW E-FILE RULES + ONLINE FILING = EASY 2023!

E-file, print and mail 1099 & W2 forms online.

No paper, no software, no mailing, no hassles!

If you have 10 or more 1099 & W2 forms combined for a single EIN, you must e-file 1099 & W2 Copy A in 2023.

Use DiscountEfile.com to enter or upload data from QuickBooks® or other programs, and we'll e-file with the IRS or SSA for you and can even print and mail recipient copies!

Create a free account and get started today!

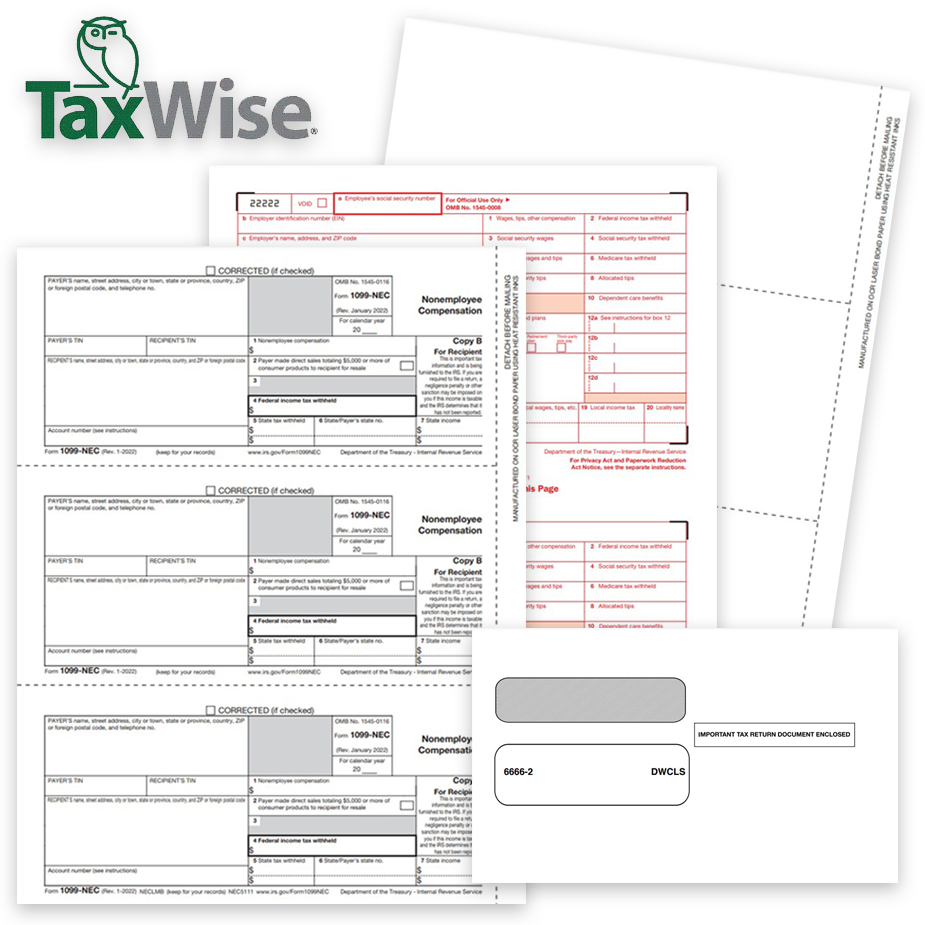

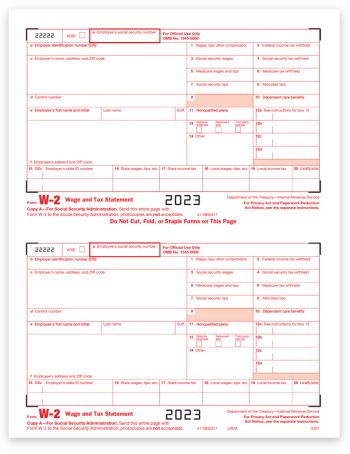

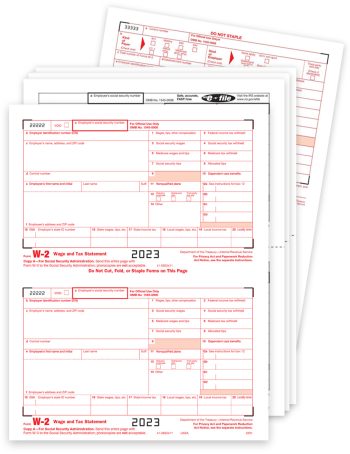

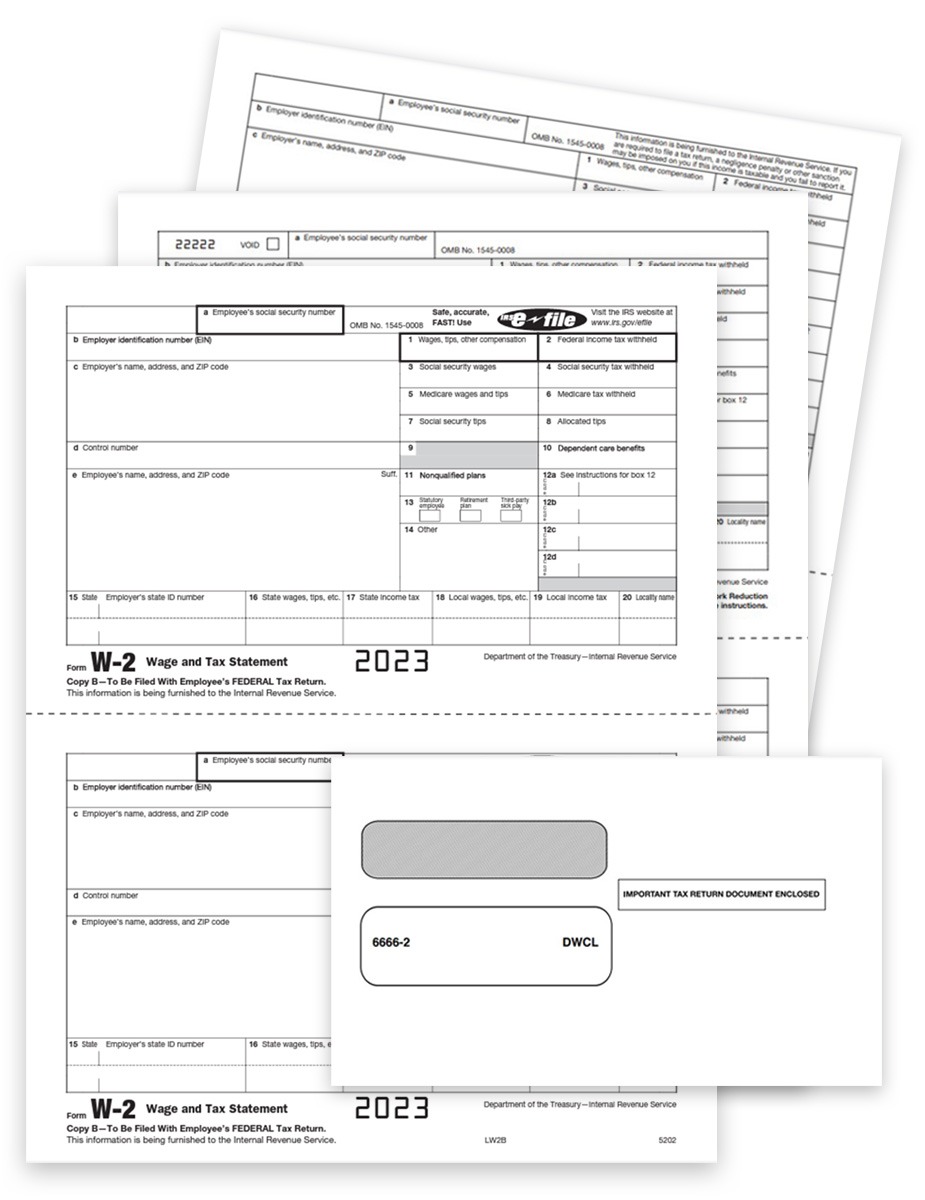

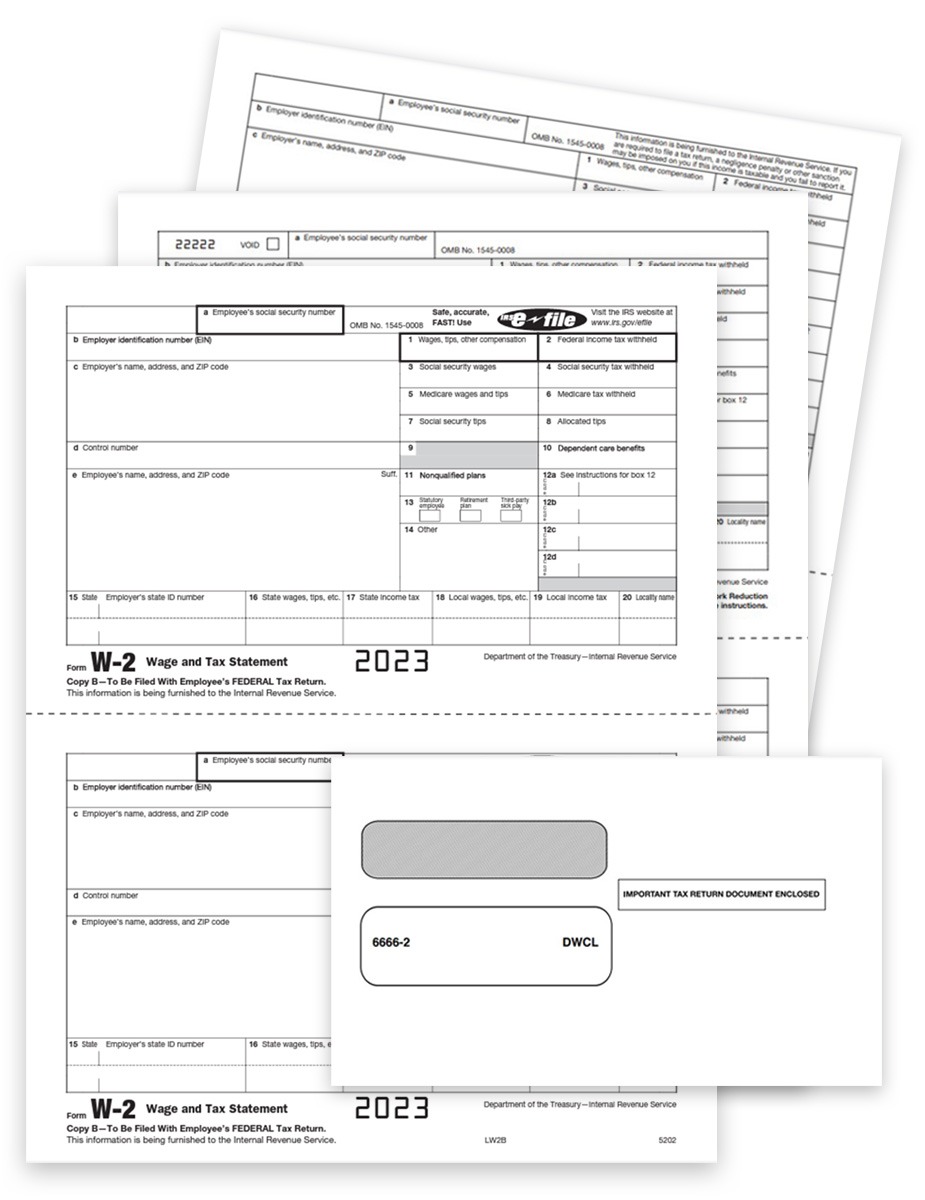

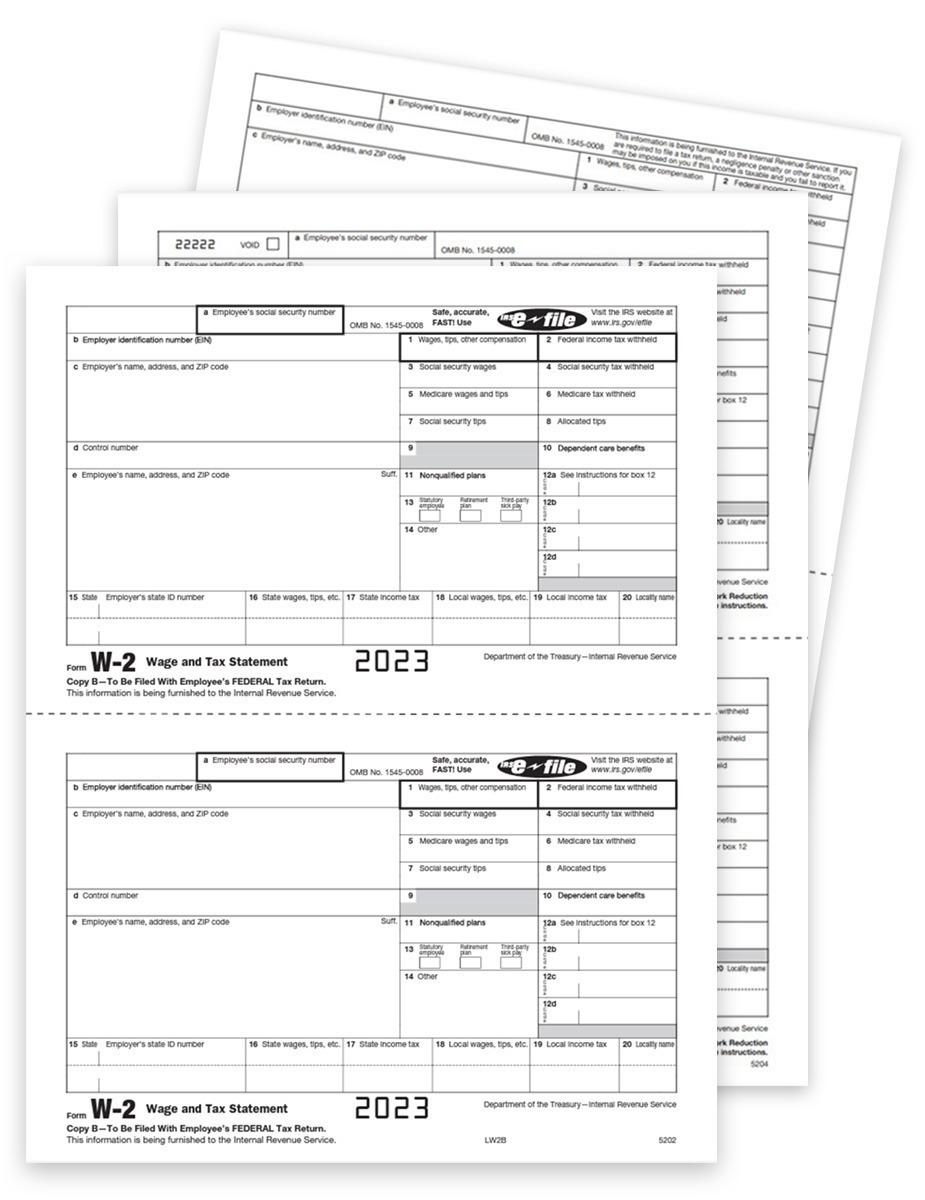

W2 Forms for TaxWise

-

W2 Envelope – 4up V1

-

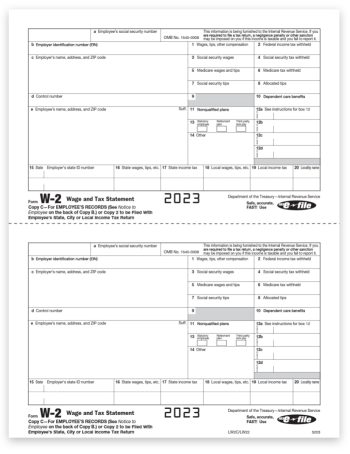

Blank Perforated W2 Form Paper – 4up V1

-

W2 & 1099 Universal Blank Perforated Paper

-

Envelope for Universal 1099 & W2 Forms

-

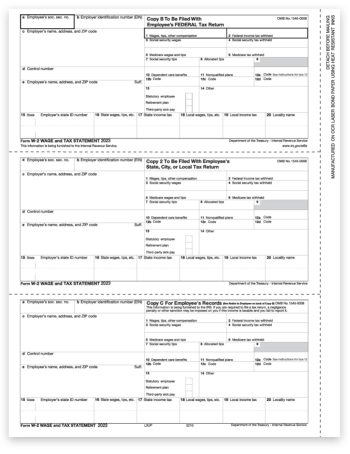

W2 Forms – Copy A, Employer Federal

-

W2 Envelope – 2up

-

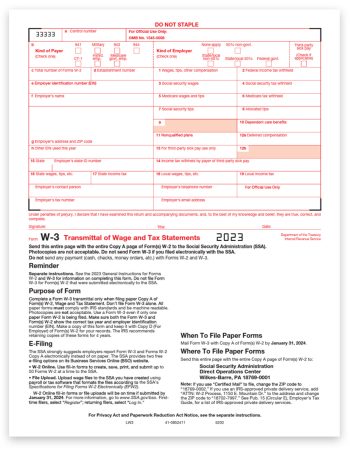

W3 Transmittal Forms

-

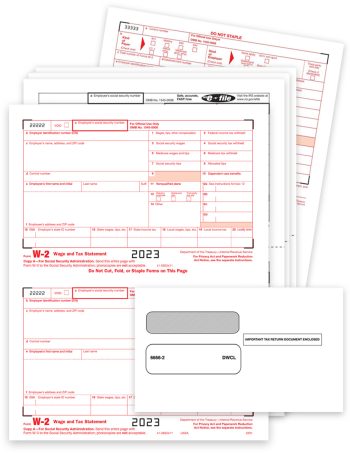

W2 Forms Set – Preprinted Forms & Envelopes

-

W2 Forms – 3up Copies B-2-C, Employee Federal-State-File

-

W2 Forms Set – Preprinted Forms

-

W2 Blank Paper & Envelope Set – 4up V1 with Instructions

-

W2 Forms – Copy B, Employee Federal

-

W2 Forms – Copy D-1, Employer State-File

-

W2 Forms – Copy C-2, Employee State-File

-

W2 Tax Forms Sets with Envelopes for Efilers – 3-part

-

W2 Tax Forms Sets with Envelopes for Efilers – 5-part

-

W2 Tax Forms Sets for Efilers – 5-part

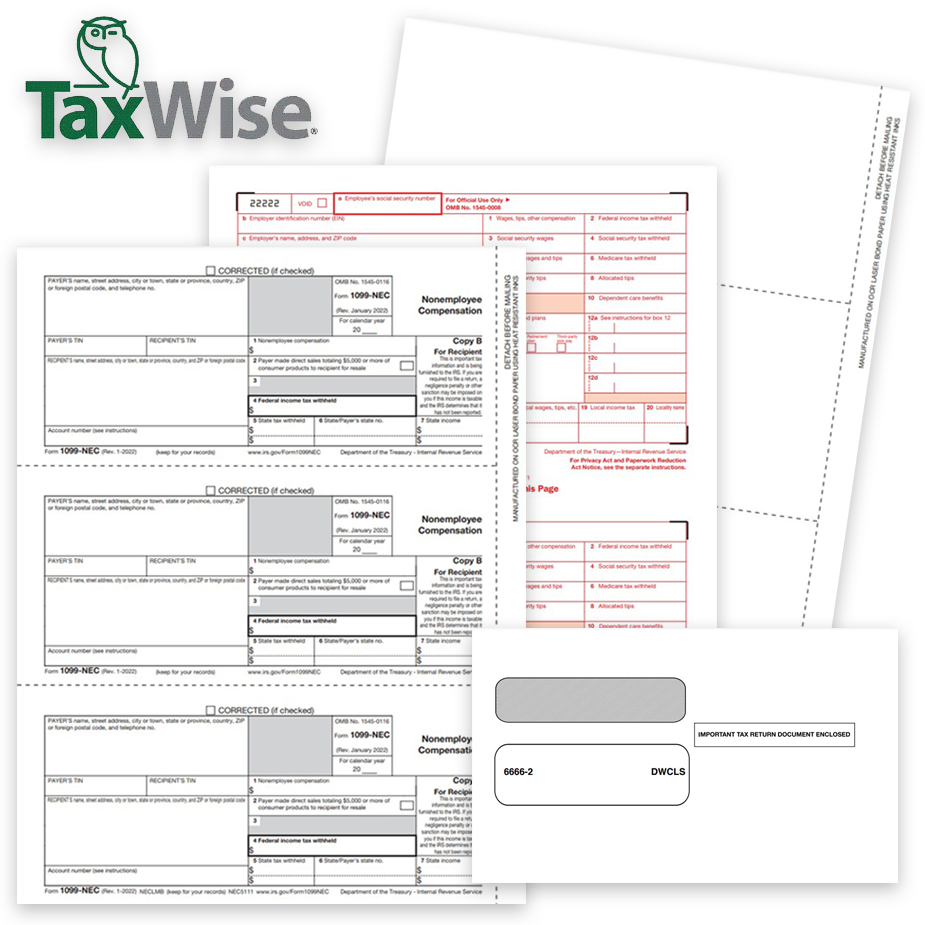

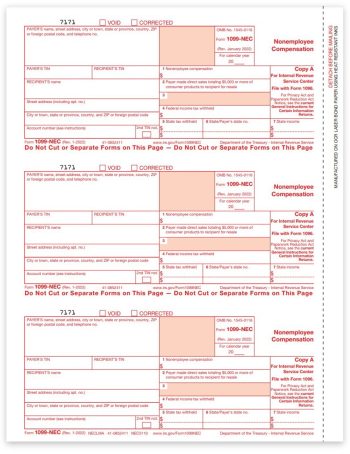

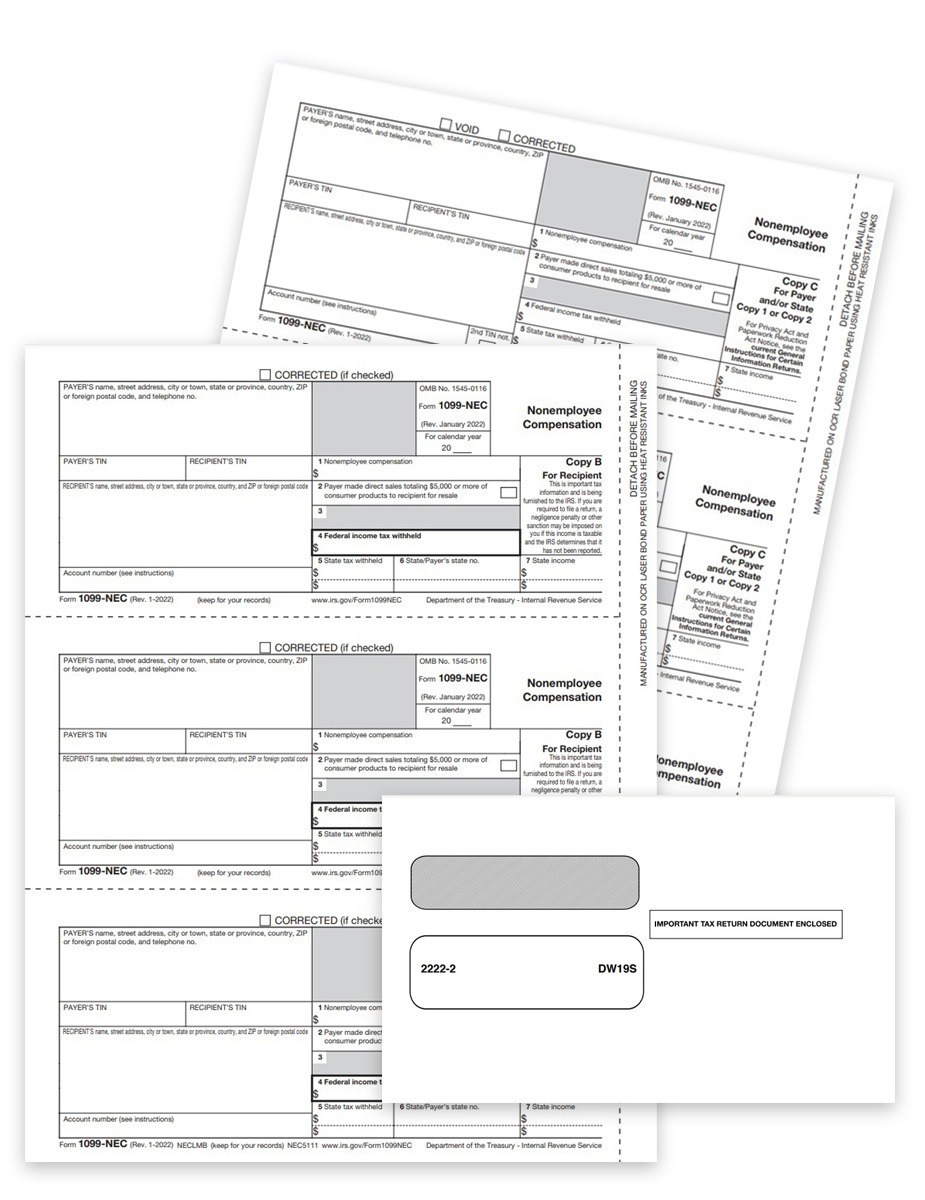

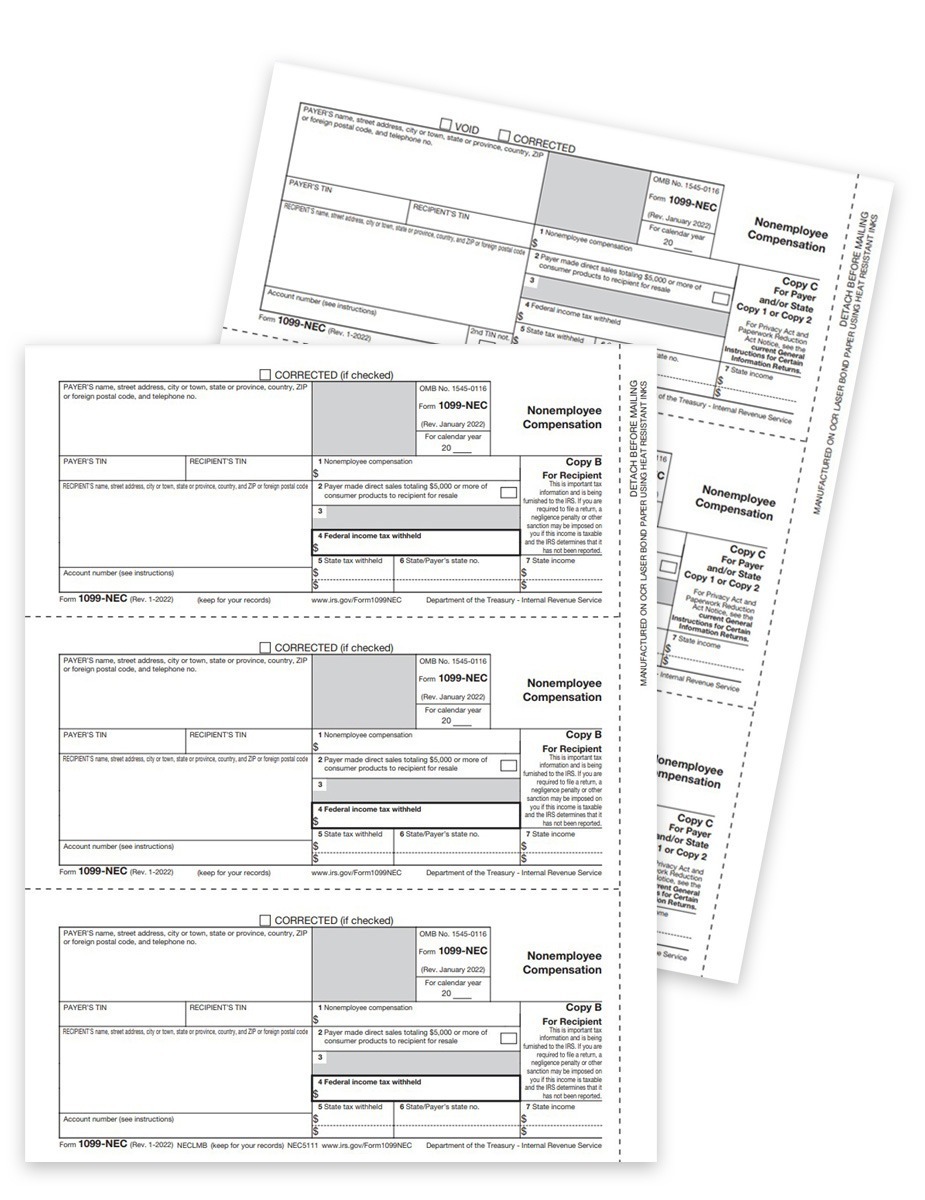

1099NEC Forms for TaxWise

-

1099 Envelope – 3up

-

1099-NEC Form – Copy A – IRS Federal

-

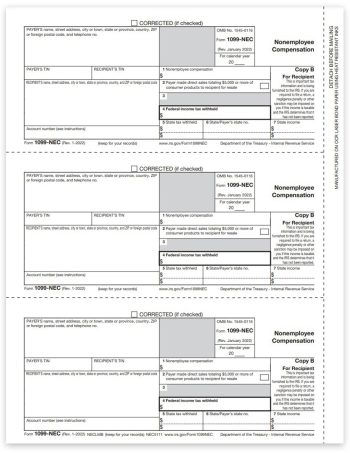

1099-NEC Form – Copy B Recipient

-

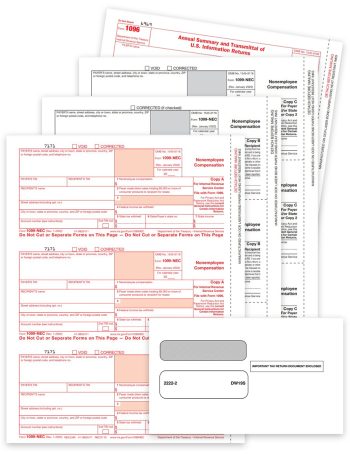

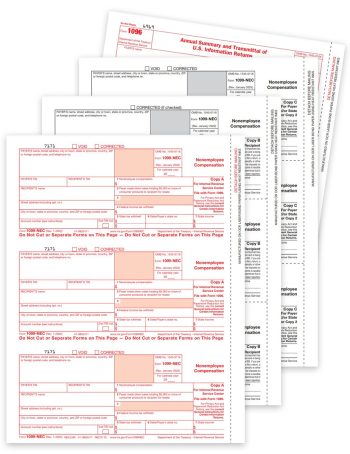

1099-NEC Forms Set with Envelopes

-

1099NEC Blank Paper – 3up for 3 Recipients – With Recipient Instructions

-

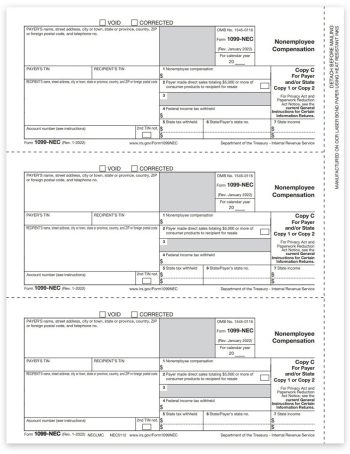

1099-NEC Form – Copy C-2-1 Payer State

-

1099NEC Blank Paper – 3up for 1 Recipient – With Recipient and Payer Instructions

-

1099-NEC Forms Set

-

1099-NEC Forms Sets with Envelopes for E-filers – 3-part

-

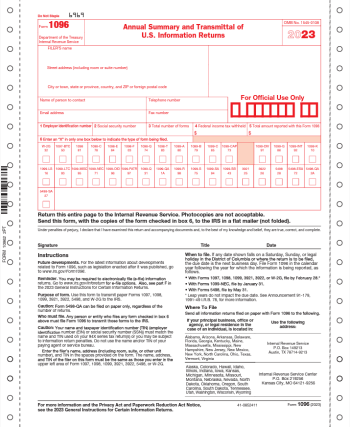

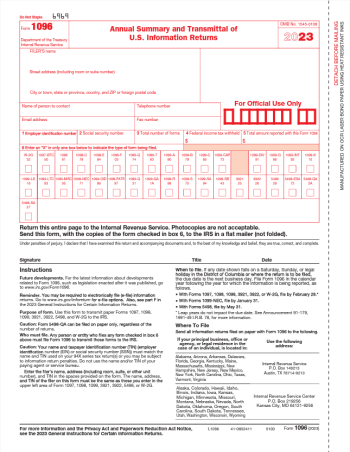

1096 Transmittal Forms – Carbonless Continuous

-

1099-NEC Forms Sets for E-filers – 3-part

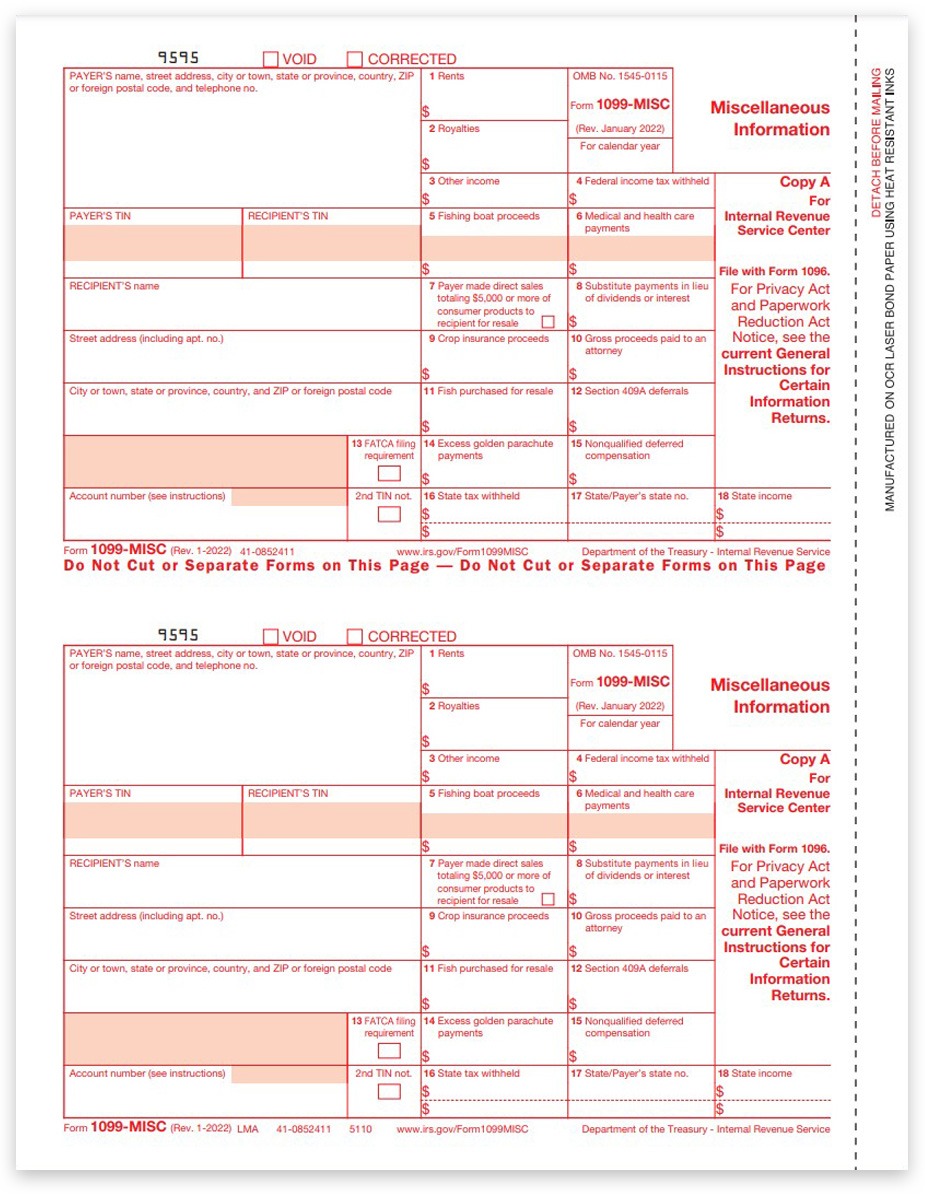

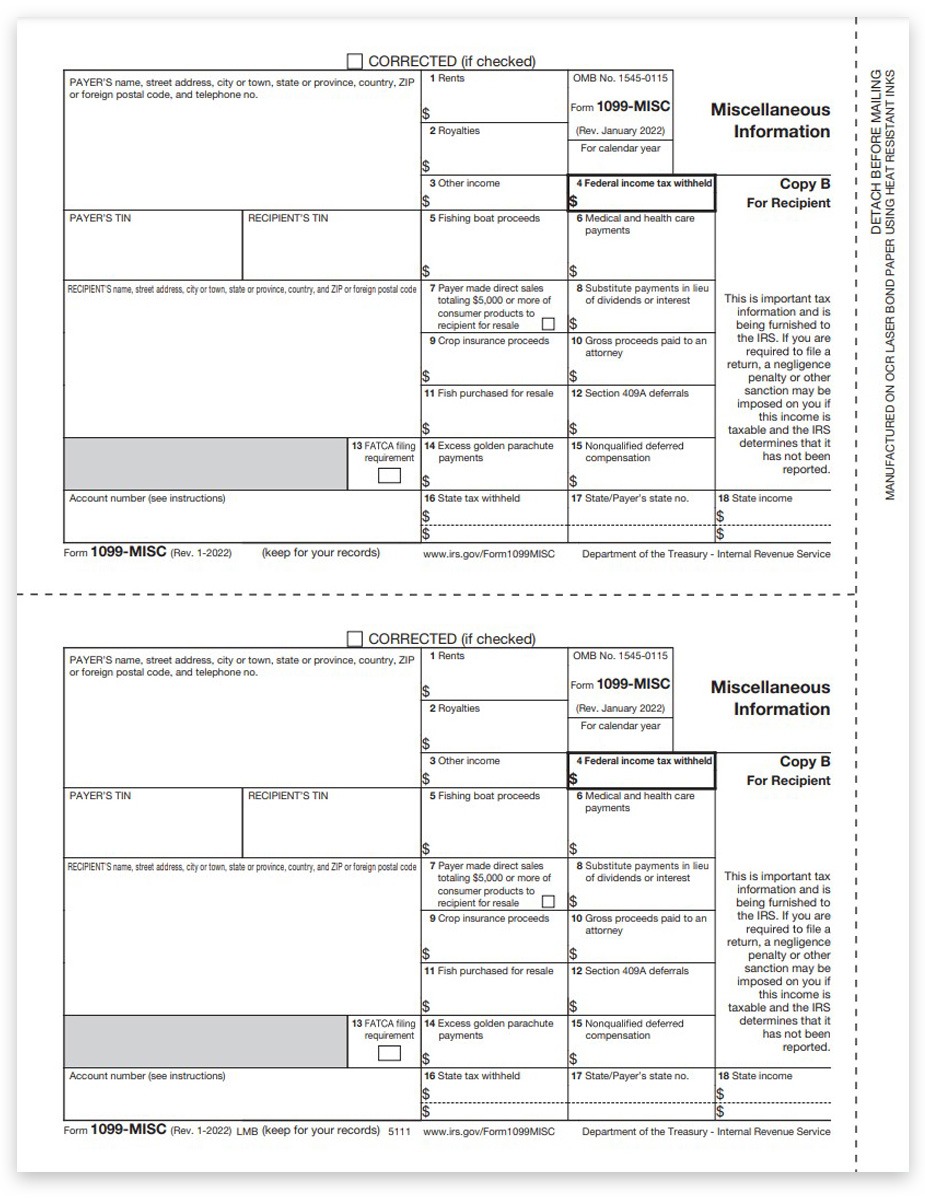

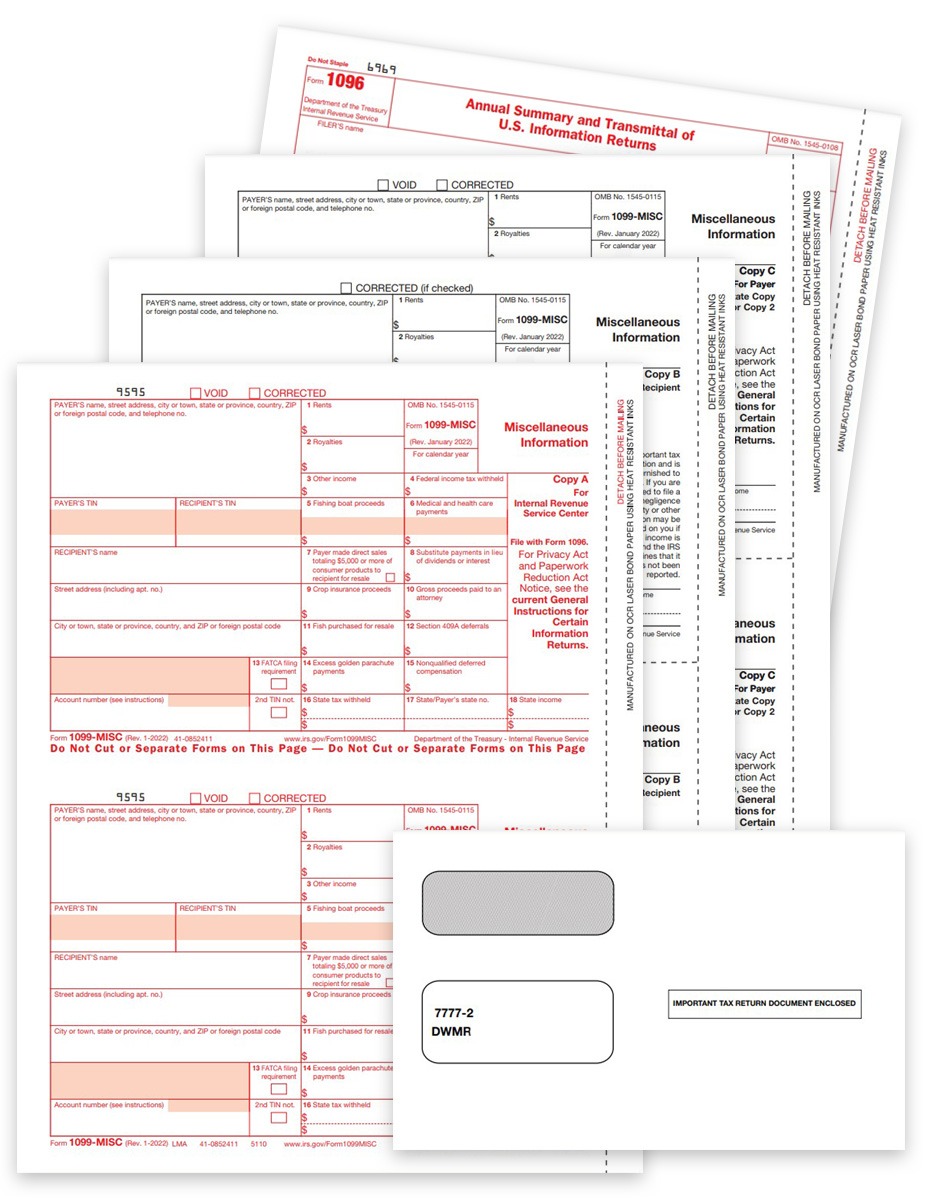

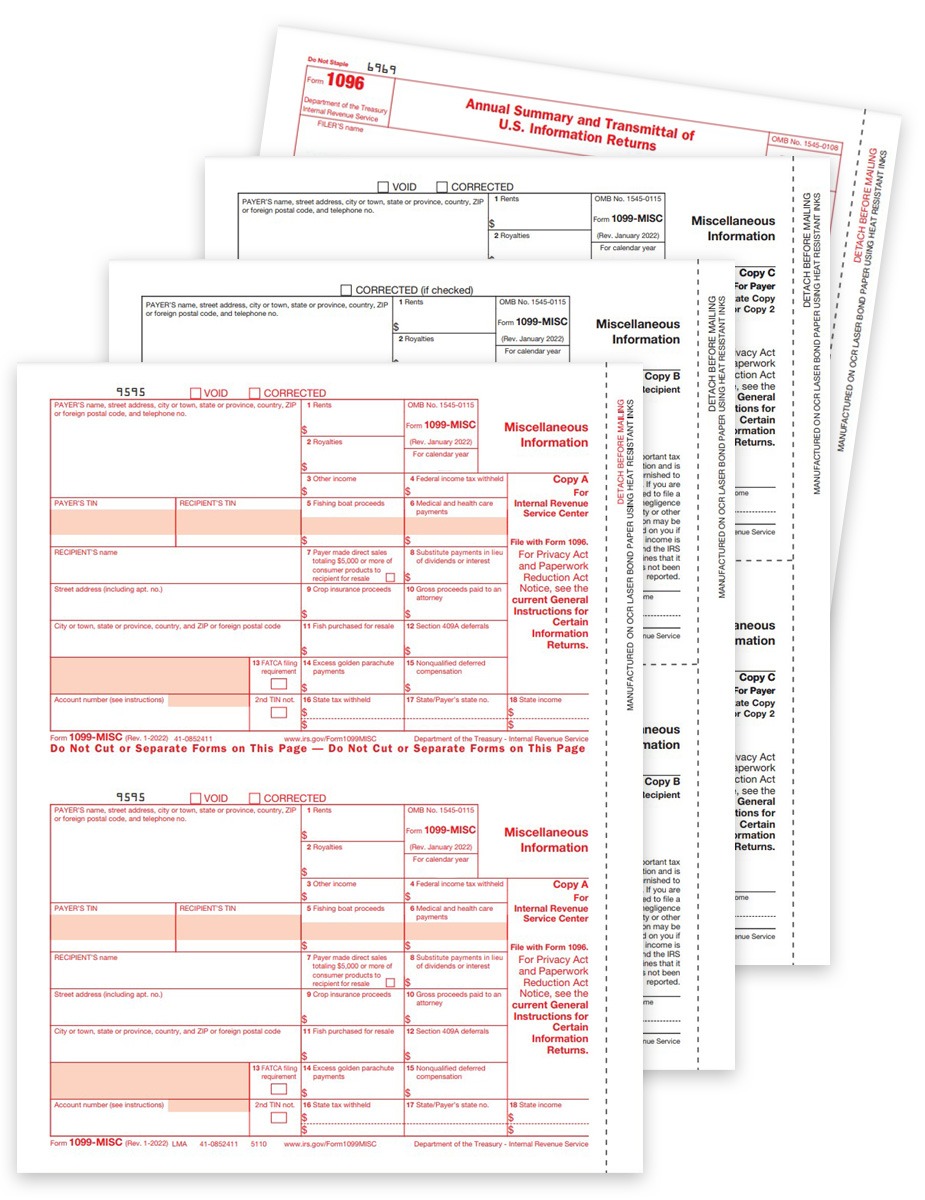

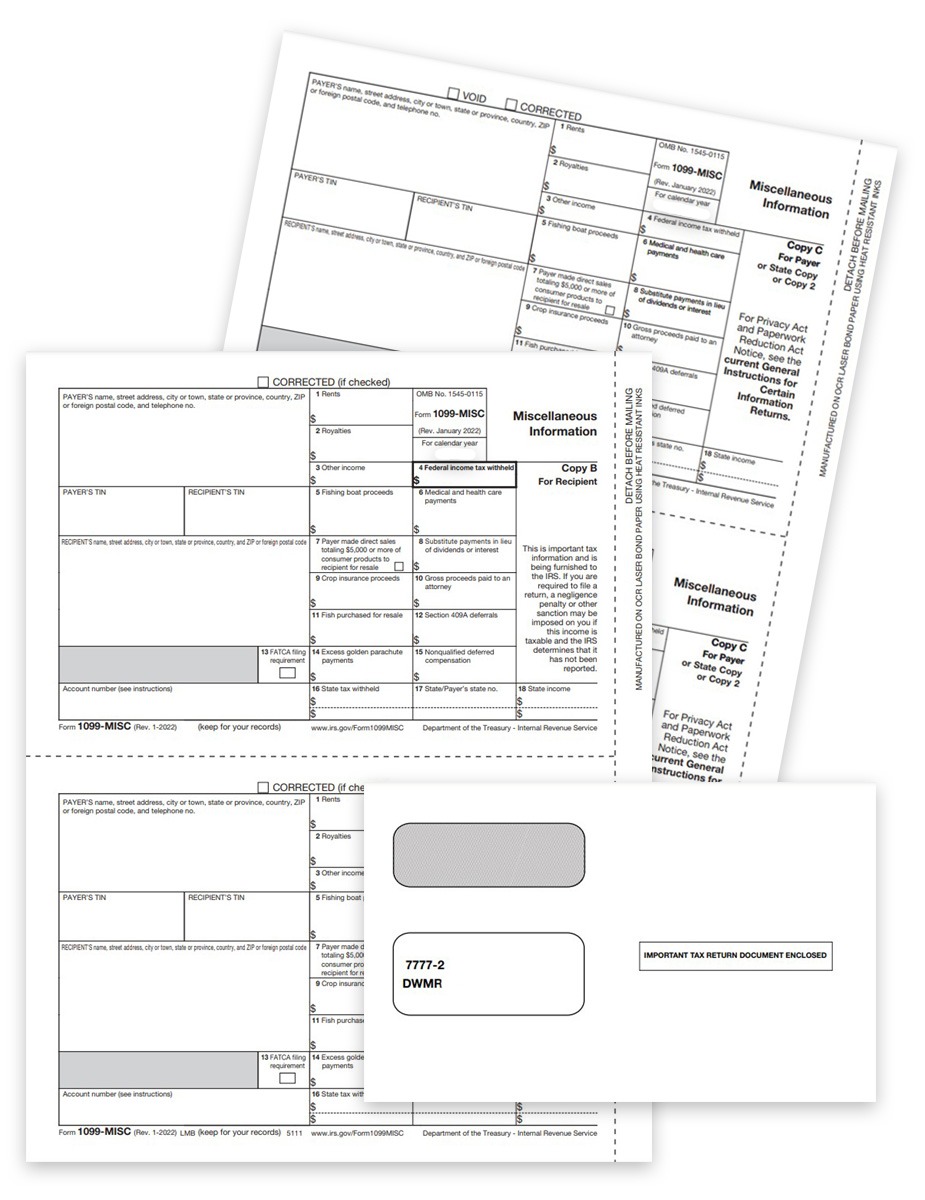

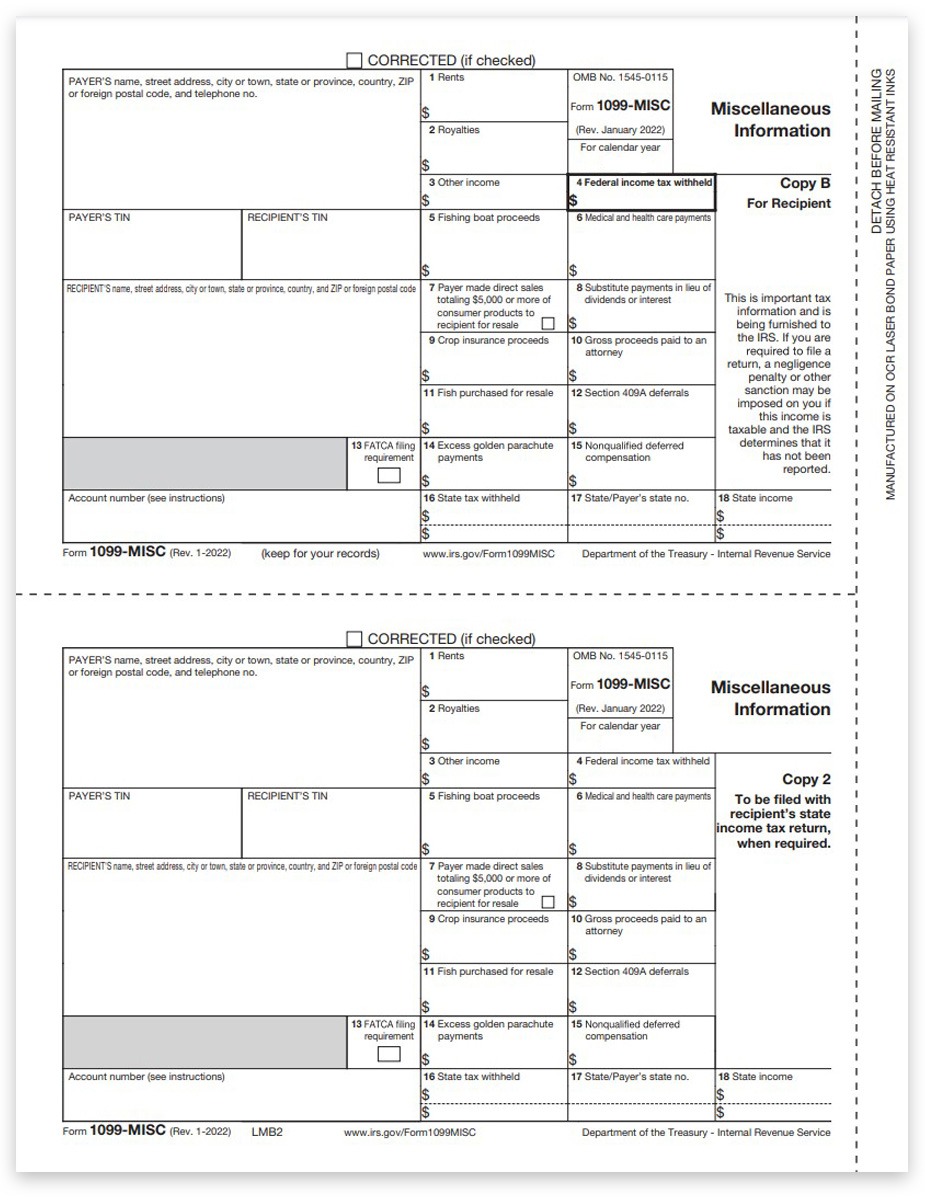

1099MISC Forms for TaxWise

-

1099 Envelope – 2up

-

1099 Envelope – 3up

-

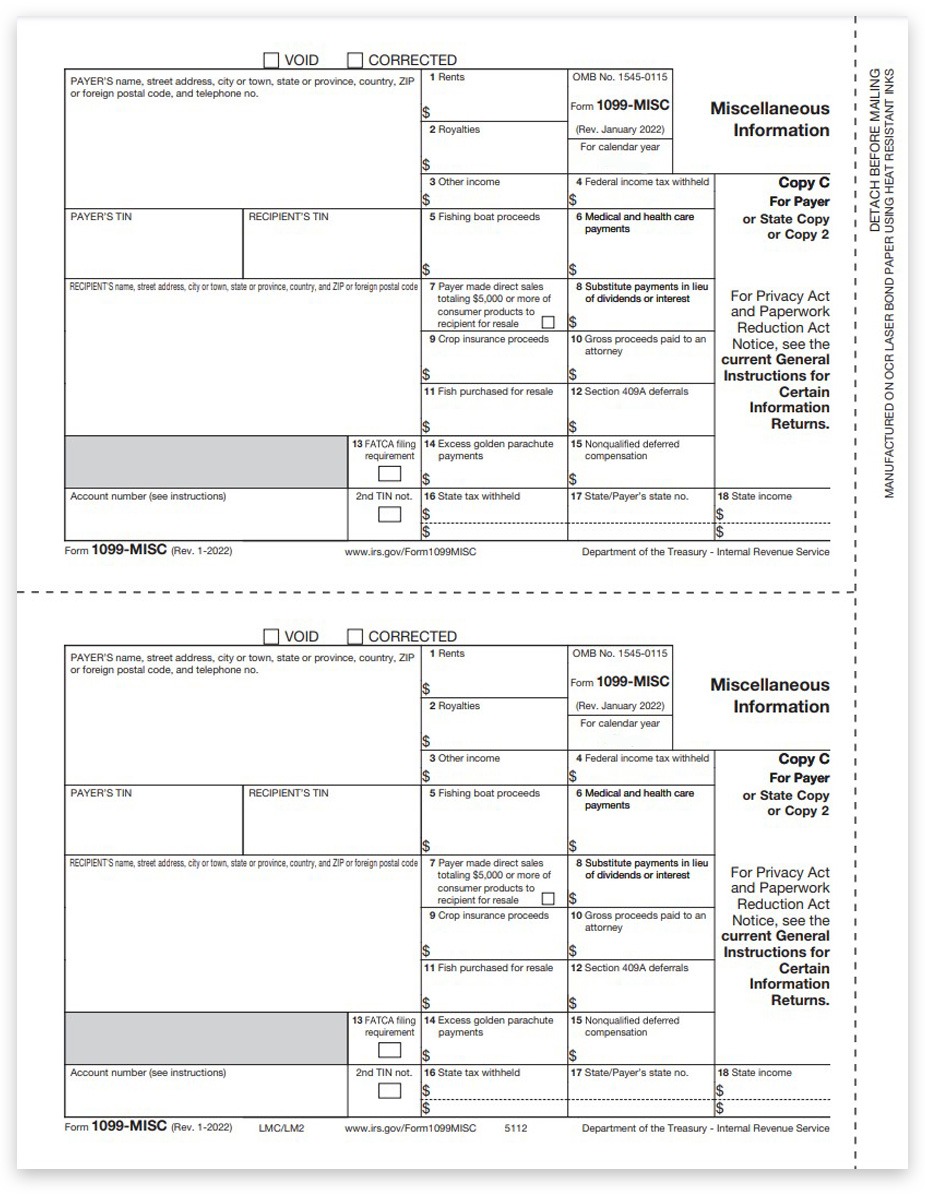

1099-MISC Form – Copy A Federal

-

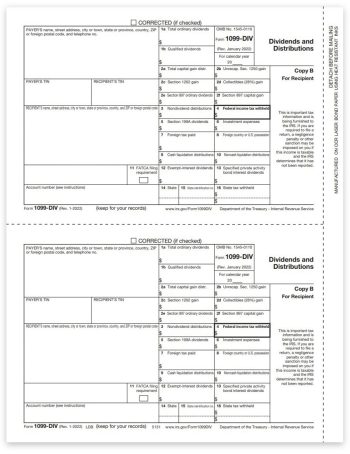

1099-MISC Form – Copy B Recipient

-

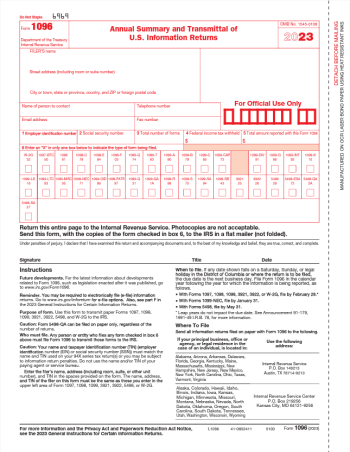

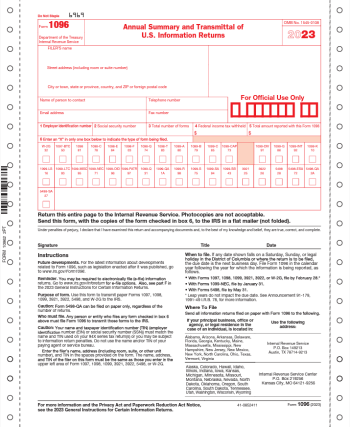

1096 Transmittal Forms

-

W2 & 1099 Universal Blank Perforated Paper

-

Envelope for Universal 1099 & W2 Forms

-

1099-MISC Form – Copy C-2 Payer-State

-

1099-MISC Forms Sets with Envelopes

-

1099-MISC Forms Sets

-

1099-MISC Blank Paper – 3up with Side Stub & Instructions

-

1096 Transmittal Forms – Carbonless Continuous

-

1099-MISC Forms Sets with Envelopes for E-filers – 3-part

-

1099-MISC Form – Copy B-2 Recipient

Other 1099 Forms for TaxWise

-

1096 Transmittal Forms

-

W2 & 1099 Universal Blank Perforated Paper

-

1099-R Blank Paper 4up

-

1099 Envelope – 2up

-

1099 Envelope – 3up

-

4up 1099R Envelope

-

Envelope for Universal 1099 & W2 Forms

-

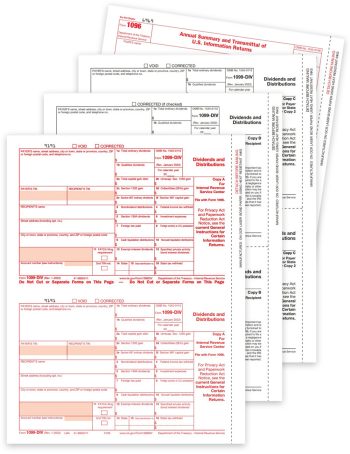

1099-DIV Forms Set

-

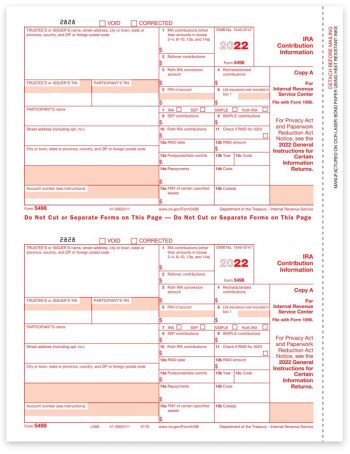

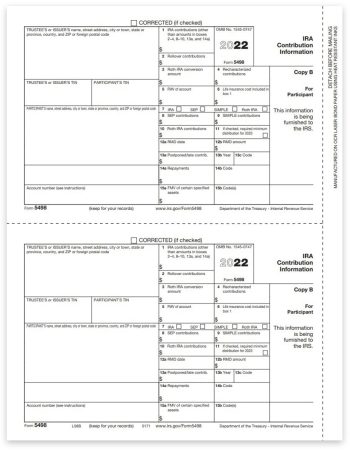

5498 Form – Copy A Federal

-

5498 Form – Copy B Participant

-

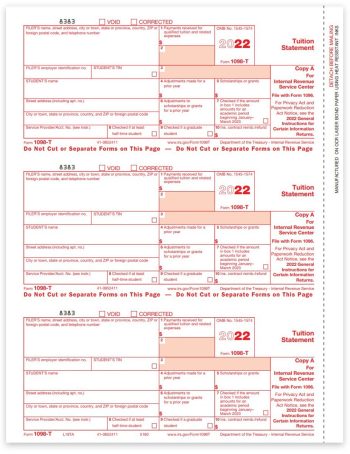

1098-T Form – Copy A Federal

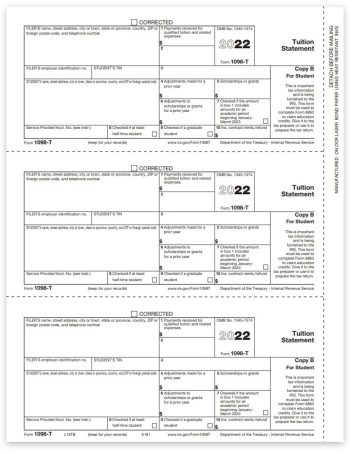

-

1098-T Form – Copy B Student

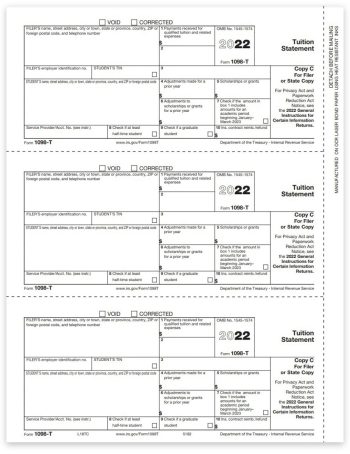

-

1098-T Form – Copy C Recipient

-

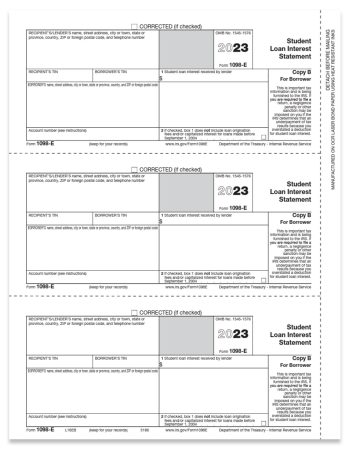

1098-E Form – Copy B Borrower

-

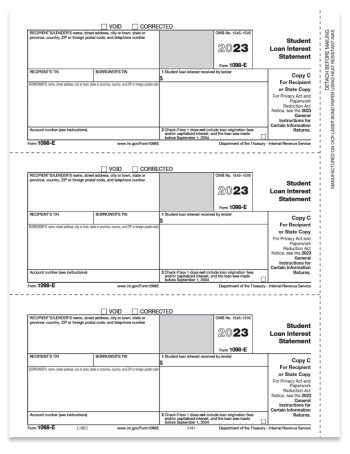

1098-E Form – Copy C Recipient

-

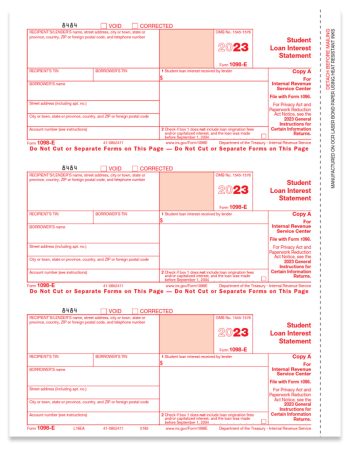

1098-E Form – Copy A Federal

-

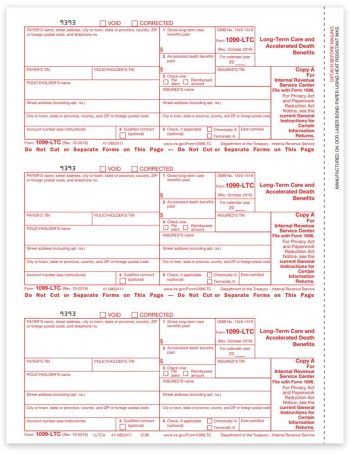

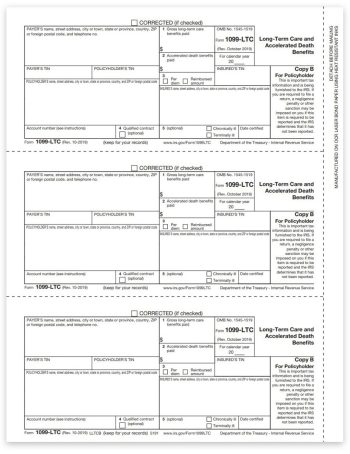

1099-LTC Form – Copy A Federal

-

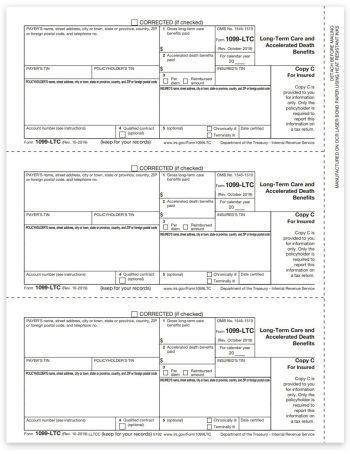

1099-LTC Form – Copy B Policyholder

-

1099-LTC Form – Copy C Insured

-

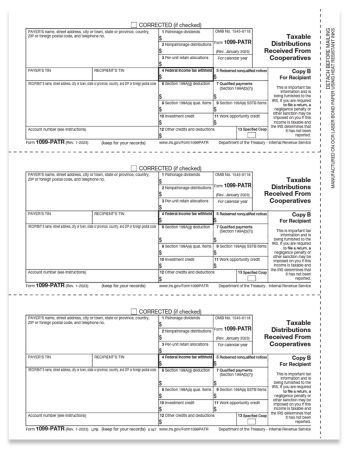

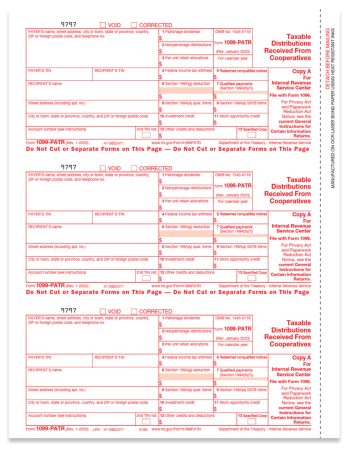

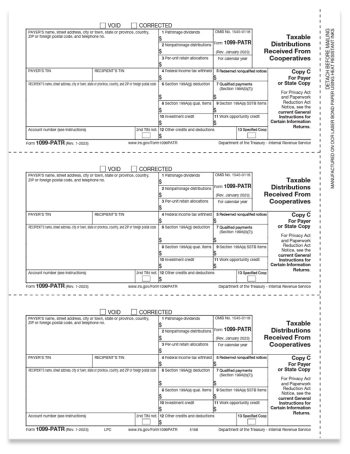

1099-PATR Form – Copy B Recipient

-

1099-PATR Form – Copy A Federal

-

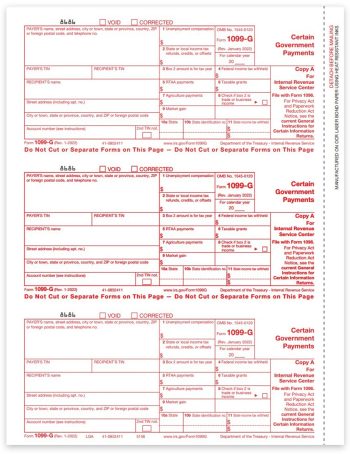

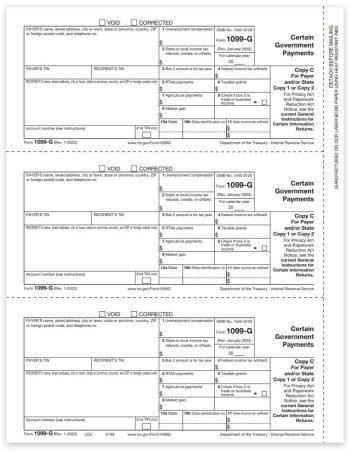

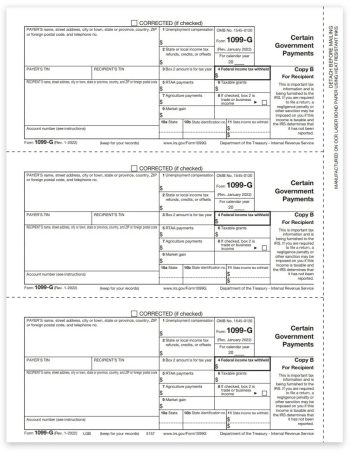

1099-G Form – Copy A Federal

-

1099-G Form – Copy C State

-

1099-G Form – Copy B Recipient

-

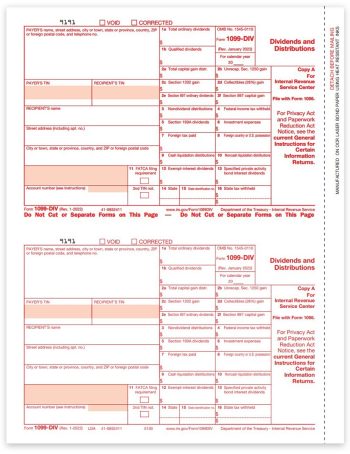

1099-DIV Form – Copy A Federal

-

1099-DIV Form – Copy B Recipient

-

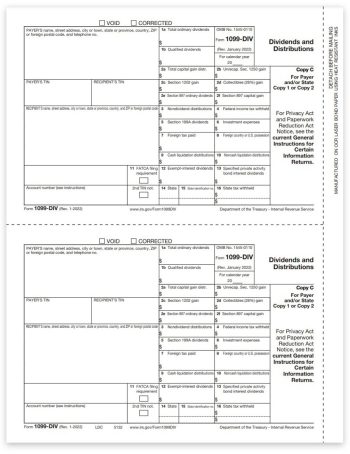

1099-DIV Form – Copy C-2 Payer

-

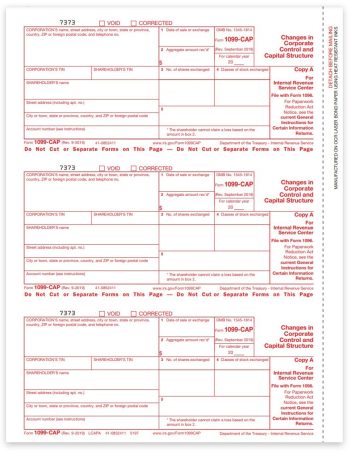

1099-CAP Form – Copy A

-

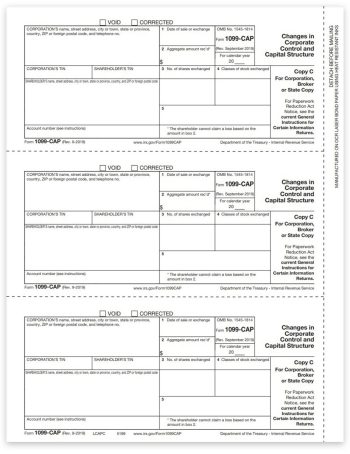

1099-CAP Form – Copy C

-

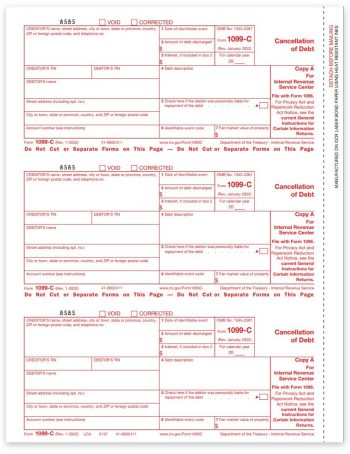

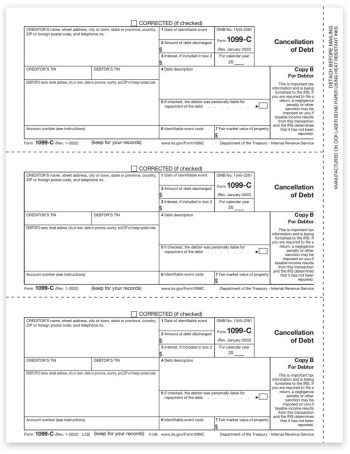

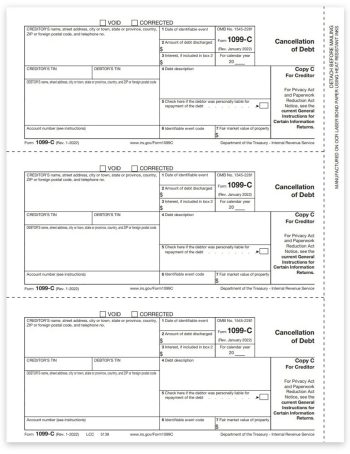

1099-C Form – Copy A Federal

-

1099-C Form – Copy B Debtor

-

1099-C Form – Copy C Creditor

-

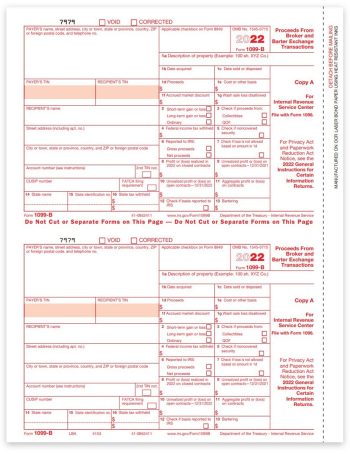

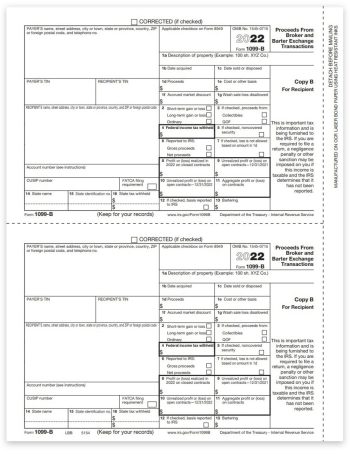

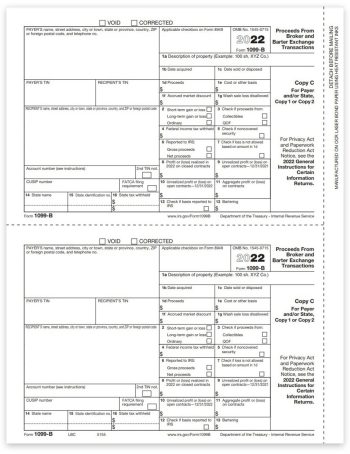

1099-B Form – Copy A Federal

-

1099-B Form – Copy B Recipient

-

1099-B Form – Copy C Payer

-

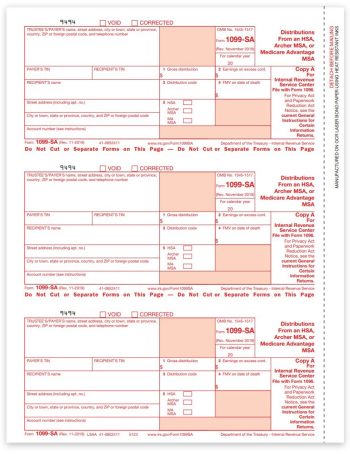

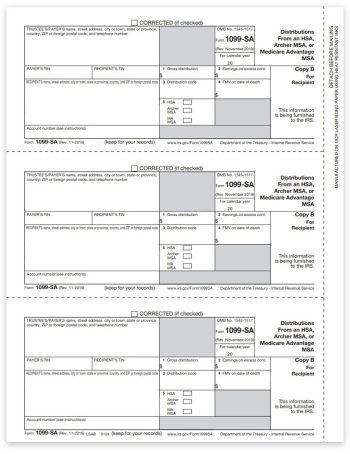

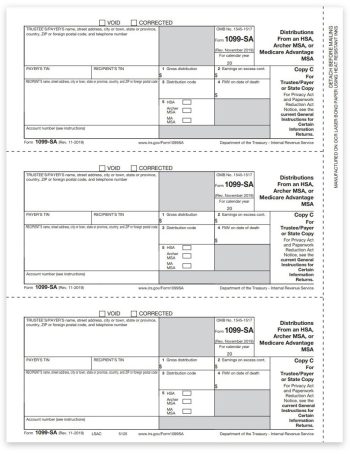

1099-SA Form – Copy A Federal

-

1099-SA Form – Copy B Recipient

-

1099-SA Form – Copy C Payer State

-

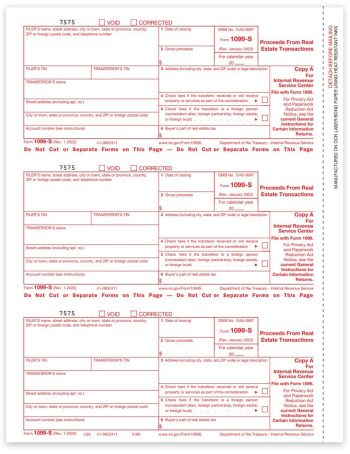

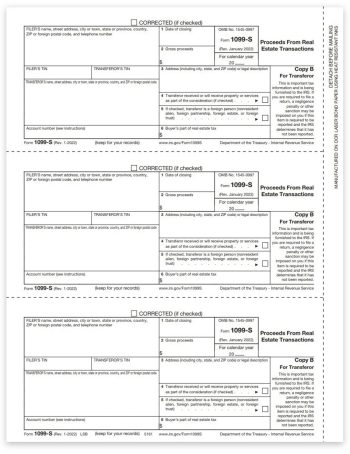

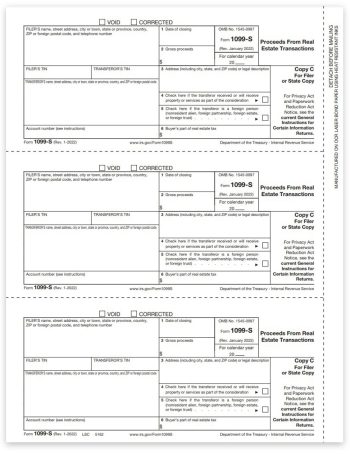

1099-S Form – Copy A Federal

-

1099-S Form – Copy B Transferor

-

1099-S Form – Copy C Filer State

-

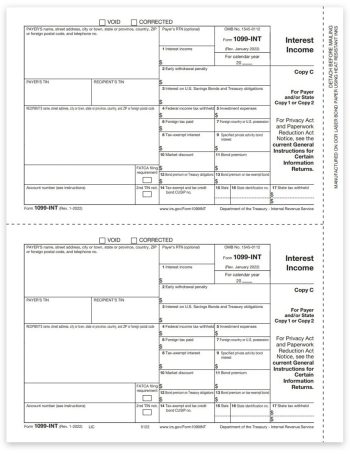

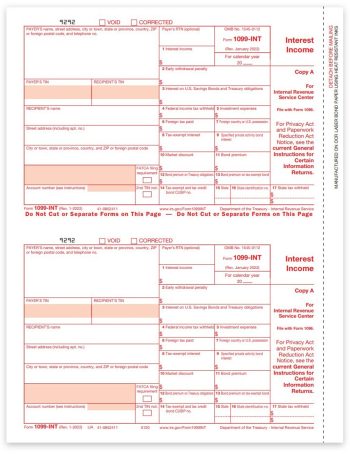

1099-INT Form – Copy C-2 Payer

-

1099-INT Form – Copy A Federal

-

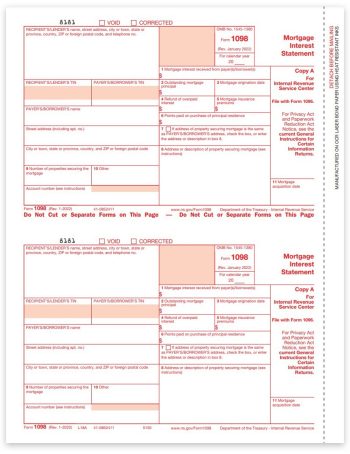

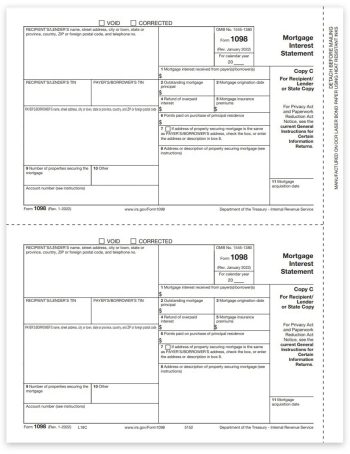

1098 Form – Copy A Lender Federal

-

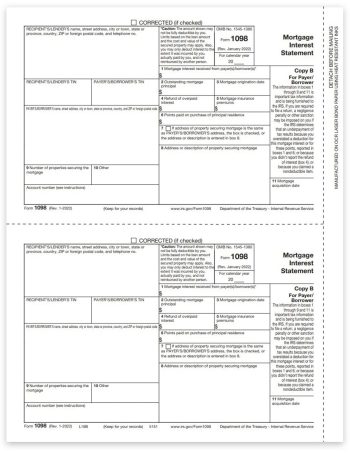

1098 Form – Copy B Payer-Borrower

-

1098 Form – Copy C Lender

-

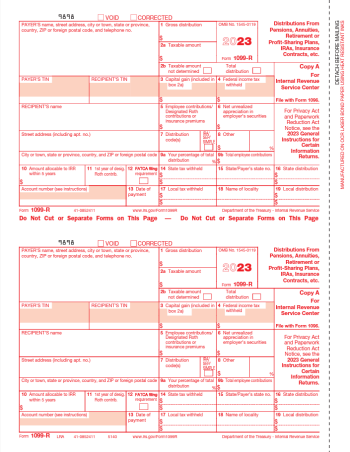

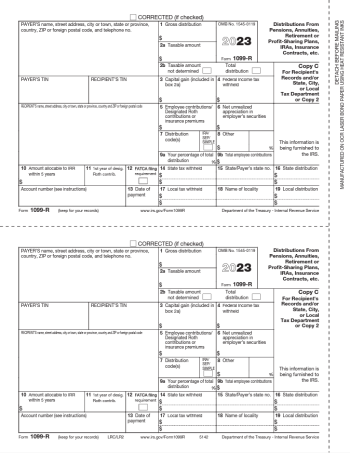

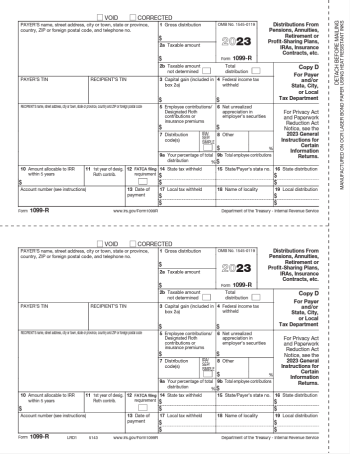

1099-R Form – Copy A Federal

-

1099-R Form – Copy C-2 Recipient

-

1099-R Form – Copy D-1 Payer-State

-

1099-PATR Form – Copy C Payer

Guide to Filing 1099 & W-2 Forms in 2023

Whether you need to file W2s for employees, 1099-NEC for contractors, or other 1099 forms, we can help!

Use this guide to understand how to file, when to file and the best forms, software and solutions for you.