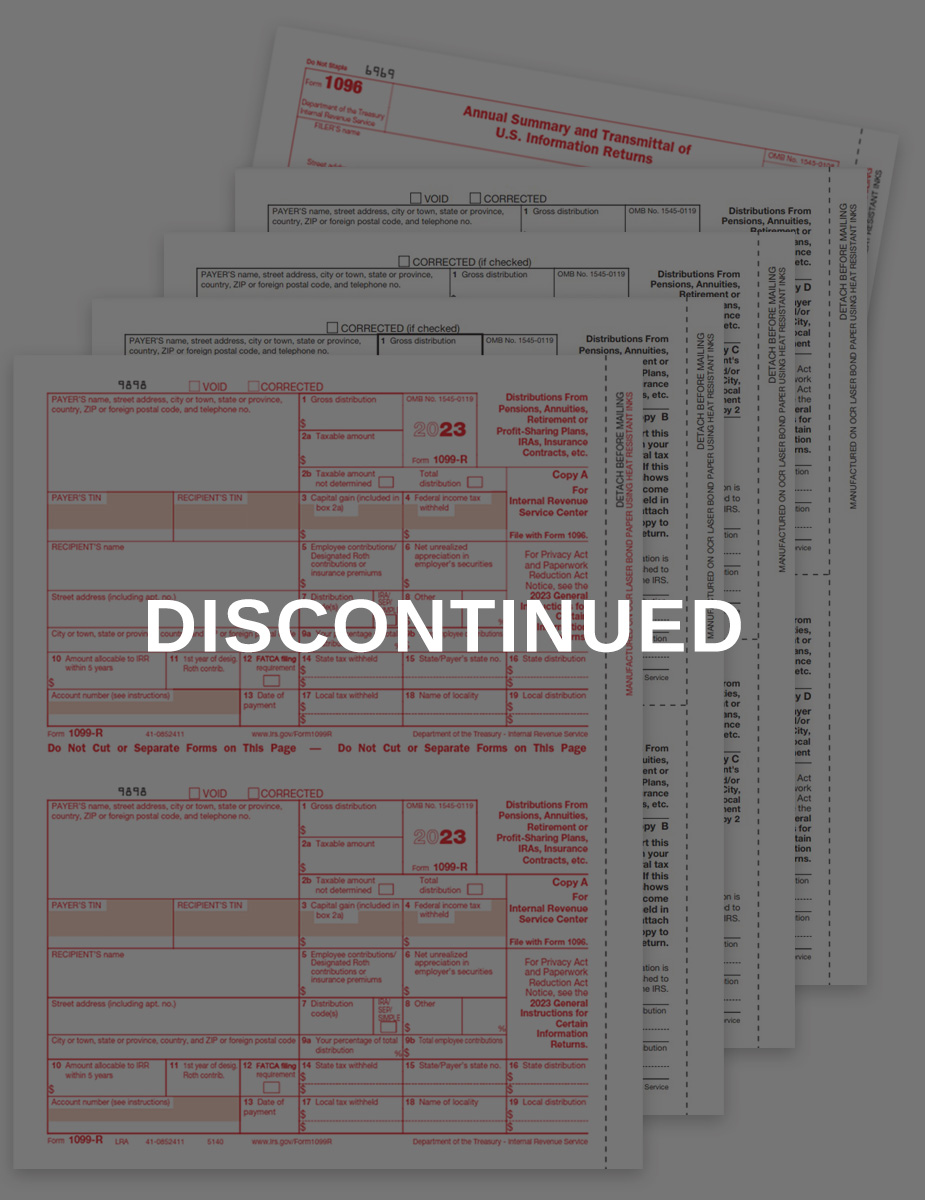

Product Details

A Complete Set of 1099-R Tax Forms

The set of 1099R tax forms has been discontinued (4-part SKU# 95944 and 6-part SKU# 95946).

Please order individual 1099R forms as needed:

- Copy A for Federal (LRA)

- Copy B for Recipient Tax Return (LRB)

- Copy C-2 Recipient State and File (LRCLR2)

- Copy D-1 Payer or State (LRD1)

- 1096 Summary & Transmittal Form

Order a quantity equal to the number of recipients you have.

Order 1099R Forms

How to Choose the Right 1099 Forms

OPTIONS FOR 1099 FILING

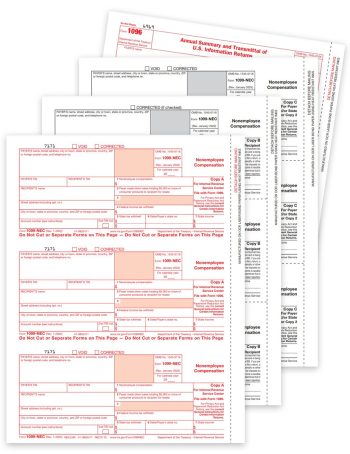

NEW 1099-NEC Forms for nonemployee compensation reporting.

Form 1099-NEC is used for payments of $600+ or more to non-employees, such as contractors, freelancers, some attorney payments and more. It replaced the 1099MISC in 2020.

1099NEC Forms changed to a 3up format for 2021 (instead of last year’s 2up format). You will need new forms and compatible 1099 envelopes. Learn about new 1099-NEC Forms.

POSSIBLE NEW E-FILING REQUIREMENTS

The IRS is considering changing the 1099 & W2 e-filing threshold requirement to 100 forms for a single payer in 2021. They will make this determination by November. Stay tuned to ZBP Forms for compliance information!

If you want to get a jump on the new requirements, we make it easy with DiscountEfile.com. Learn More.

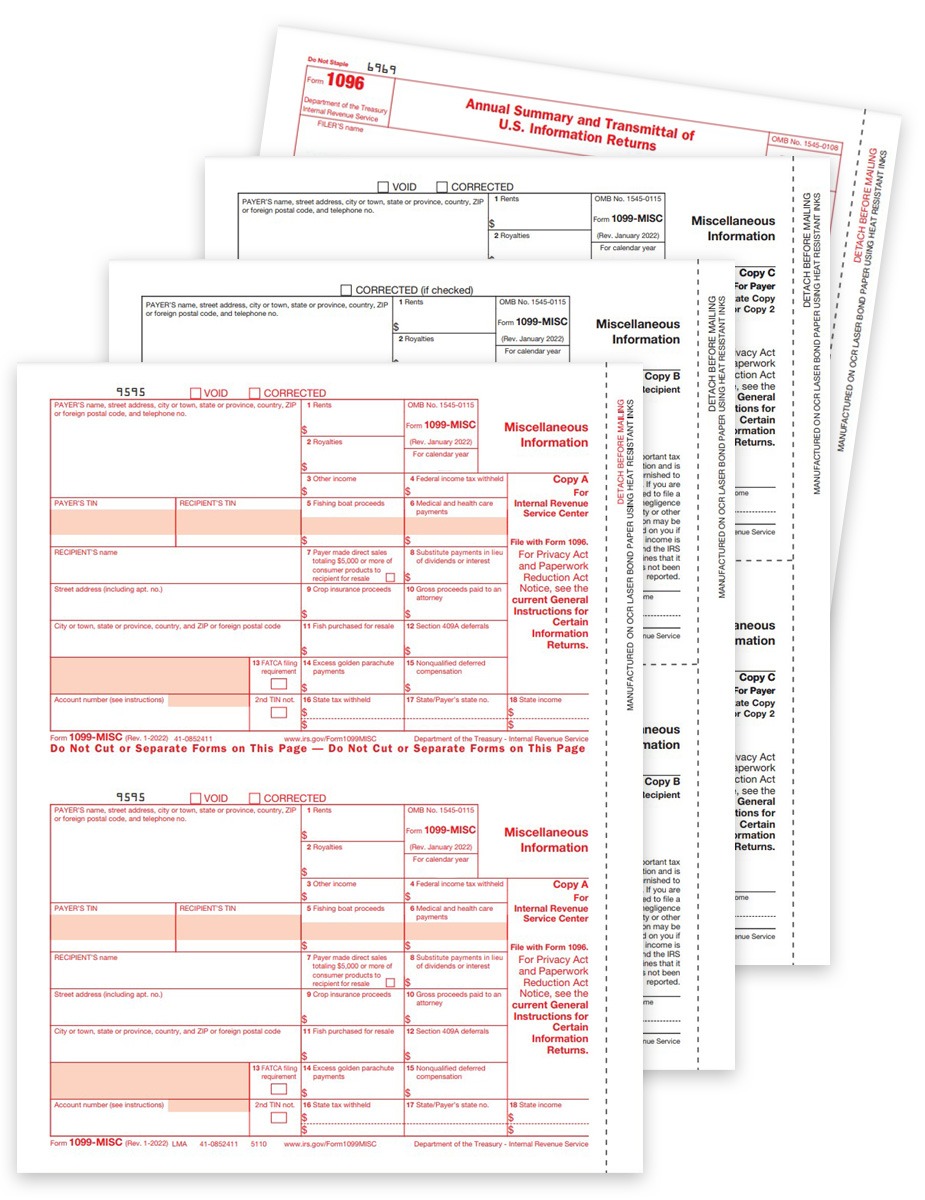

TYPE OF FORMS

NUMBER OF PARTS

The number of 1099 parts needed is based on government filing requirements.

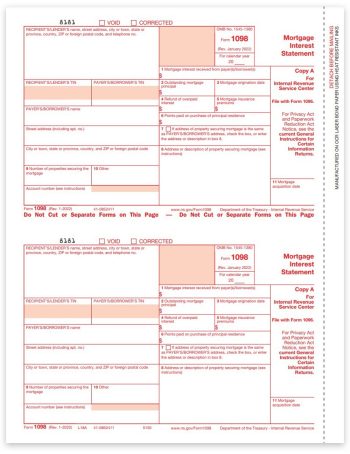

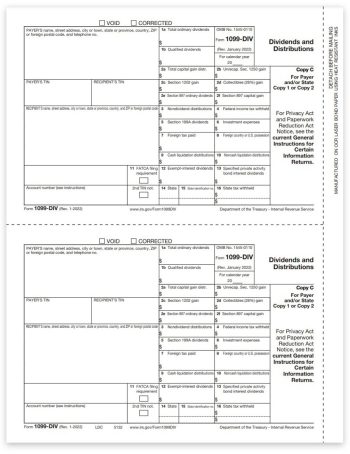

- Copy A: Federal Copy for the IRS

- Copy B: Recipient Copy

- Copy C/2: Payer or State Copy

Read more: Small business guide to filing 1099s

3-PART STATES: AK, CA, FL, GA, IL, IN, IA, KY, LA, MD, MI, MO, NV, NH, NM, NY, OR, SD, TN, TX, VT, WA, WY

4-PART STATES: AL, AR, AZ, CA, CO, CT, DE, DC, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MO, MS, MT, NE, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, UT, VT, VA, WV, WI

5-PART STATES: AL, AZ, CO, CT, DE, HI, ID, ME, MA, MN, MS, MT, NE, NC, ND, OH, OK, PA, SC, UT, WI

1096 FORMS

Transmittal 1096 forms are required only if you are printing and mailing 1099-MISC Copy A to the Federal Government. One 1096 is required to summarize all 1099s for a single payer.

1099 ENVELOPES

Order compatible 1099 envelopes to ensure mailing information aligns correctly in the windows.

1099 FILING DEADLINES

- January 31* – All 1099 Recipient Postmarked; 1099-NEC Federal Copy A Postmarked or e-filed with IRS

- February 28 – Paper Copy A filed with the IRS for all 1099s except MISC

- March 31 – E-filed copies to the IRS for all 1099s except MISC

These are Federal filing deadlines. Most states follow the same dates.

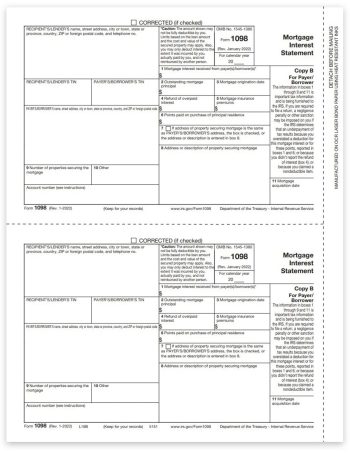

HOW TO CORRECT A 1099 FORM

If you need to correct a 1099 form because the original has errors, you will need to re-file the same 1099 form.

The only difference is a simple “Corrected” checkbox at the very top of the 1099.

Checking this box signifies to the IRS and recipient that there is different information than on the original 1099.

This is the approach for correcting any type of 1099 form, from the popular 1099NEC and 1099MISC to obscure types of 1099 forms too.

You can print and mail the corrected 1099 forms yourself, or file them all online to save time!

More on 1099 Corrections

E-filing Thresholds Have Changed Drastically!

For the 2023 tax year, businesses with 10 or more 1099 & W2 forms, combined, per EIN, MUST e-file Copy A forms with the IRS or SSA.

For example, if your business has to file 5 1099NEC forms and 5 W2 forms, you must e-file the red Copy A forms with the IRS and SSA by January 31, 2024.

This applies to ANY combination of 10 or more of ANY type of 1099 or W2 forms, except correction forms. Here is a great article with insights to the changes.

Penalties apply if you don’t – $60 per form if you file on time and up to $310 per form if you file late.

Get the Details

Easy e-filing from Discount Tax Forms!

Discount E-file is an online e-filing service that can also print and mail your forms for you! It’s so easy! Simply enter or import your data and we do the hard work for you. Learn More >

Reviews

There are no reviews yet.