Easily Comply with Affordable Care Act (ACA) Reporting Requirements with1095 ACA Software by ComplyRight™

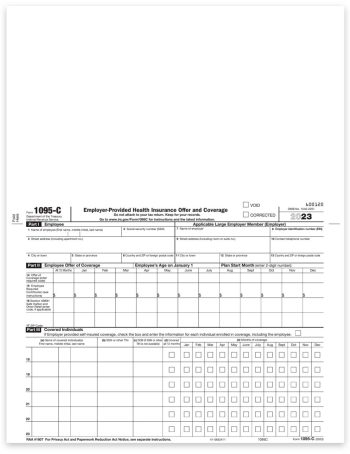

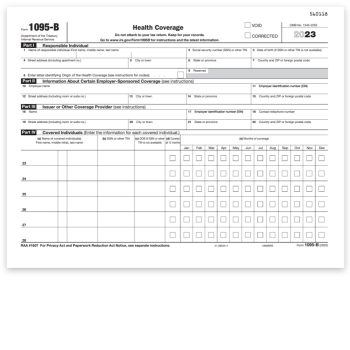

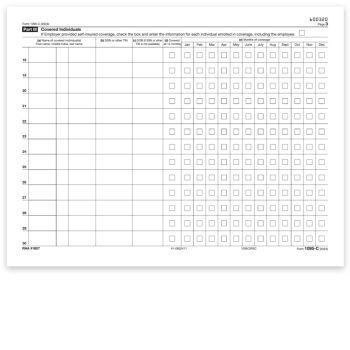

The Affordable Care Act (ACA) Employer Shared Responsibility Rule, under IRS Code Sections 6055 and 6056, requires employers to file annual information returns 1095-B and/ or 1095-C with the IRS and deliver employee statements with health plan coverage information.

Transmittal forms 1094-B and/or 1094-C will also need to be filed with the IRS.

The ACA Software by ComplyRight has been designed to accommodate users preparing to meet IRS regulations with the new requirements.

Backed by reliable, Windows-based functionality, this software provides all the tools you need to both create and print your forms, then deliver to recipients and file to the IRS.

The forms on-screen mirror the actual IRS forms, plus, with the ACA Software by ComplyRight you can be confident that all software features and forms meet strict IRS specifications.

SECURITY FEATURES

- Database protection – have peace of mind knowing your data files are password protected

- Easy backup and data restoration

DATA ENTRY FEATURES

- Unlimited number of payers and recipients

- Search by last or first name, TIN or company name

- Transmittal forms calculate automatically

PRINTING FEATURES

- Prints on TFP preprinted forms only

- Laser-generated forms can be printed on plain blank paper

- Vertical and horizontal alignment on pre-printed forms

- Print forms with laser or inkjet printer

OTHER SOFTWARE FEATURES

- Automatic updates – receive the latest software features with automatic updates available with Internet Connection

- Dedicated online support

- Step-by-step user guides to walk you through the filing process

- Enhanced reporting to see both payer and recipient summary and totals information

- Templates available in software to import form data from MS Excel® files

E-FILE FEATURES

- Quick and easy process to upload your files to send to the IRS

- Access your e-filing information for up to 4 years on the e-file platform

- Receive instant communication as forms are e-filed and accepted by the IRS

- Edit or make corrections on all forms before e-filing

- Take care of Affordable Care Act (ACA) reporting requirements quickly and easily with ACA Software by ComplyRight! Create and print forms to mail to recipients and file with the IRS.

Software System Requirements:

- Windows® 7, 8 & 8.1

- 1 GHz processor or higher, 1 GB RAM

- 45 MB of disk space

- CD-ROM drive

- Display optimized for 1024 x 768 screen resolution or higher

- Internet access for updates and e-filing process

- Works with MOST Windows compatible printers

- Recommended for use with laser printers

Item# 14035