2023 FORMS

Order 1099 & W2 tax forms, envelopes, folders and other tax supplies now to have everything in time for the filing deadlines and tax season!

Most orders ship within 3-4 business days, UPS ground.

Major changes to 2023 e-filing requirements — If your business has 10+ 1099 and W2 forms combined you must e-file Copy A forms for 2023. Learn More >

Rely on The Tax Form Gals for easy 1099 & W2 filing and affordable tax supplies – 2023 forms are shipping now!

ZBP Forms helps you save more with special coupon codes + everyday discount prices on top-quality business forms.

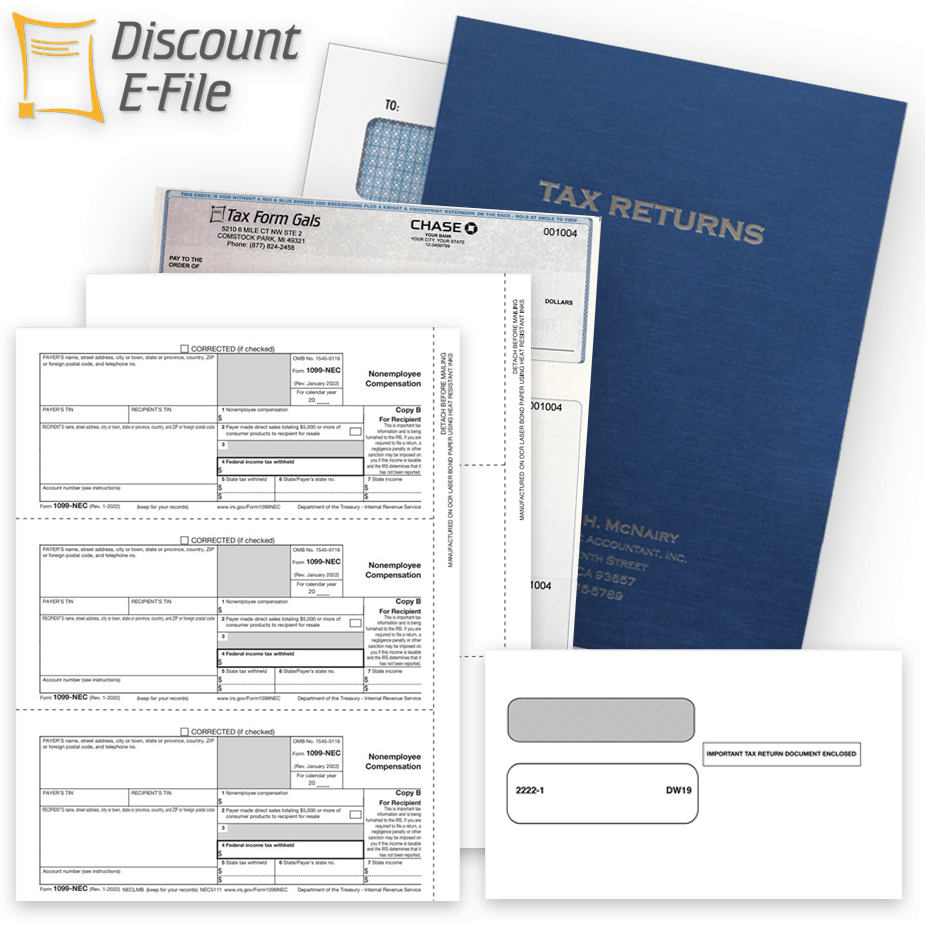

Tax Folders

Affordable, customizable tax return folders.

Specialty Envelopes

Large envelopes for tax returns and more.

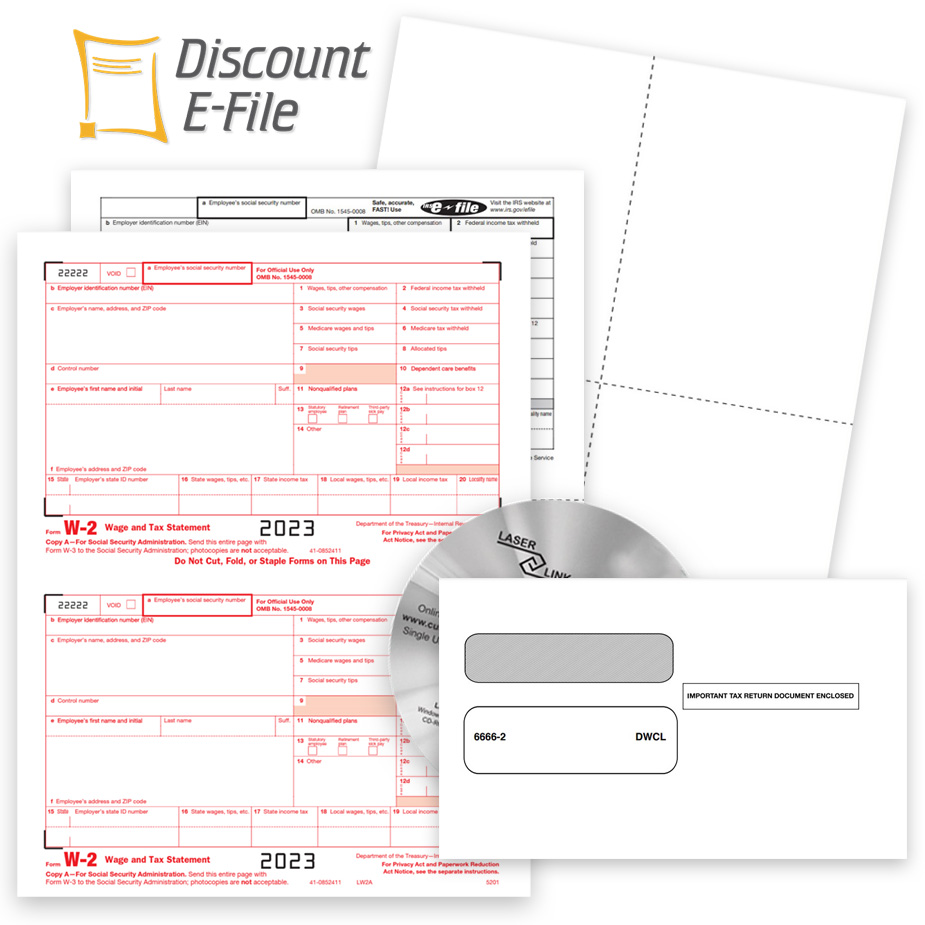

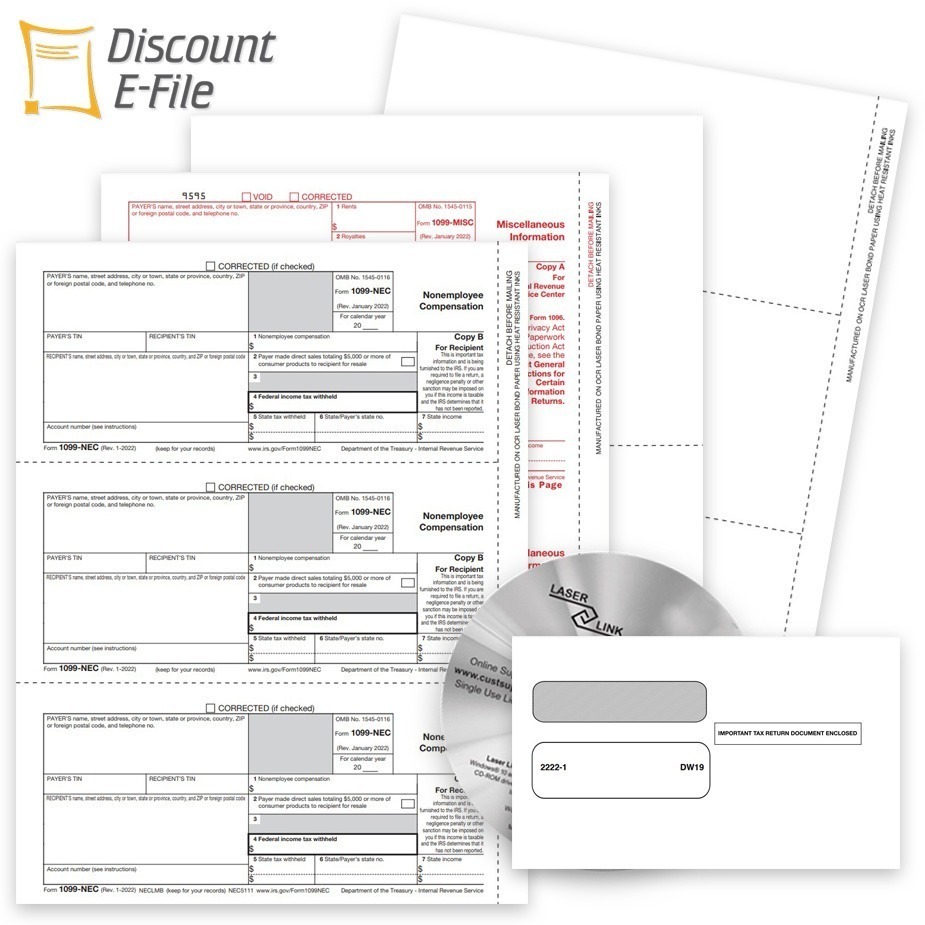

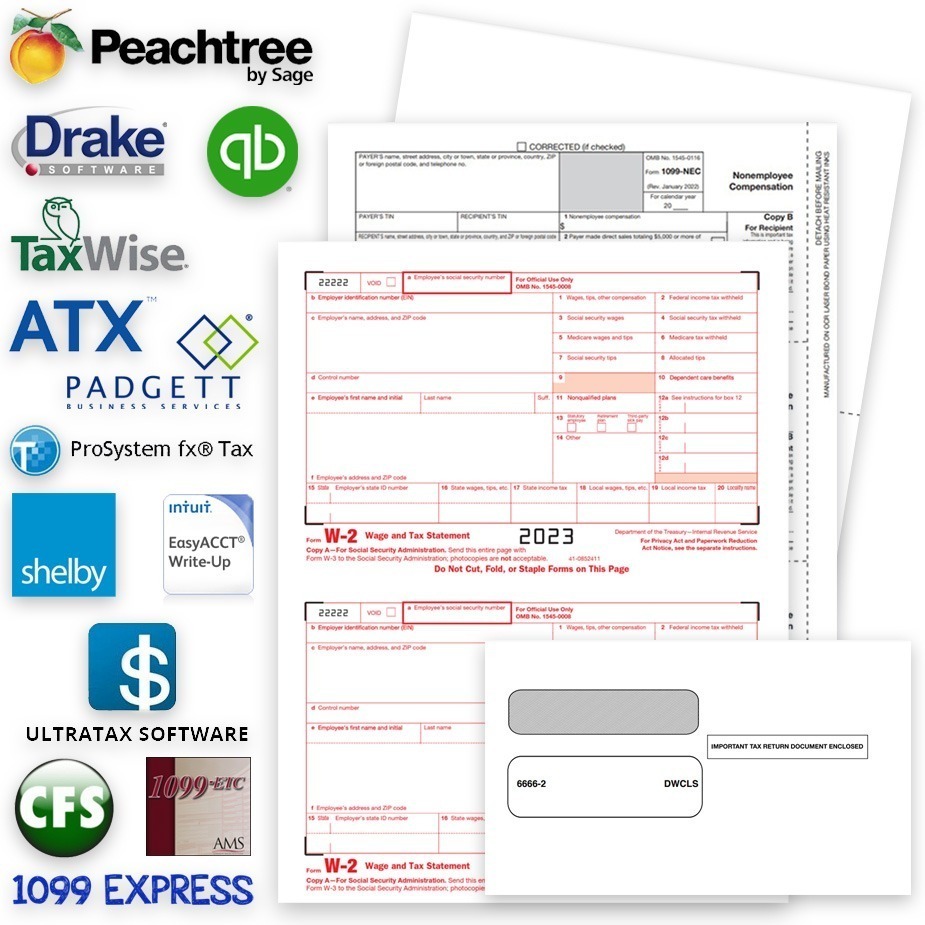

Software Compatible

1099 & W2 forms for accounting software.

Personal, friendly service and fast shipping.

Discount Tax Forms is small business ready to help yours!

As a women-owned and operated business, the Tax Form Gals at ZBP Forms work hard to help your small business get better prices on essential business supplies.

Our goal is to deliver the best value and best service for tax forms, checks and more that you rely on every day to make your small business run like a well-oiled machine.

Give us a call at 866.341.3799

or email hello@taxformsgals.com.

Small Business Resources

Guide to Filing 1099 & W-2 Forms in 2023

Whether you need to file W2s for employees, 1099-NEC for contractors, or other 1099 forms, we can help!

Use this guide to understand how to file, when to file and the best forms, software and solutions for you.

1099 & W2 Filing Deadlines for 2023

Deadlines for 2023 1099 & W-2 Filing

January 31, 2024

All 1099 Recipient Copies B / C / 2 mailed to recipient

W-2 Employee Copies B / C / 2 mailed to employees

1099NEC Copy A forms to IRS*

W2 Copy A to IRS*

>> *NEW E-FILE RULES FOR 2023 << Businesses with 10+ 1099 and W2 forms combined MUST e-file Copy A forms with the IRS or SSA. Make it easy with DiscountEfile.com...

February 28, 2024 - Paper 1099 Copy A forms to IRS

1099 Form Copy A, along with 1096 Transmittals, mailed to the IRS for all 1099 forms except 1099-NEC with non-employee compensation, which are due January 31.

April 1, 2024 - E-file 1099 forms with IRS

1099 Forms E-filed to the IRS, except 1099-NEC with non-employee compensation, which are due January 31.

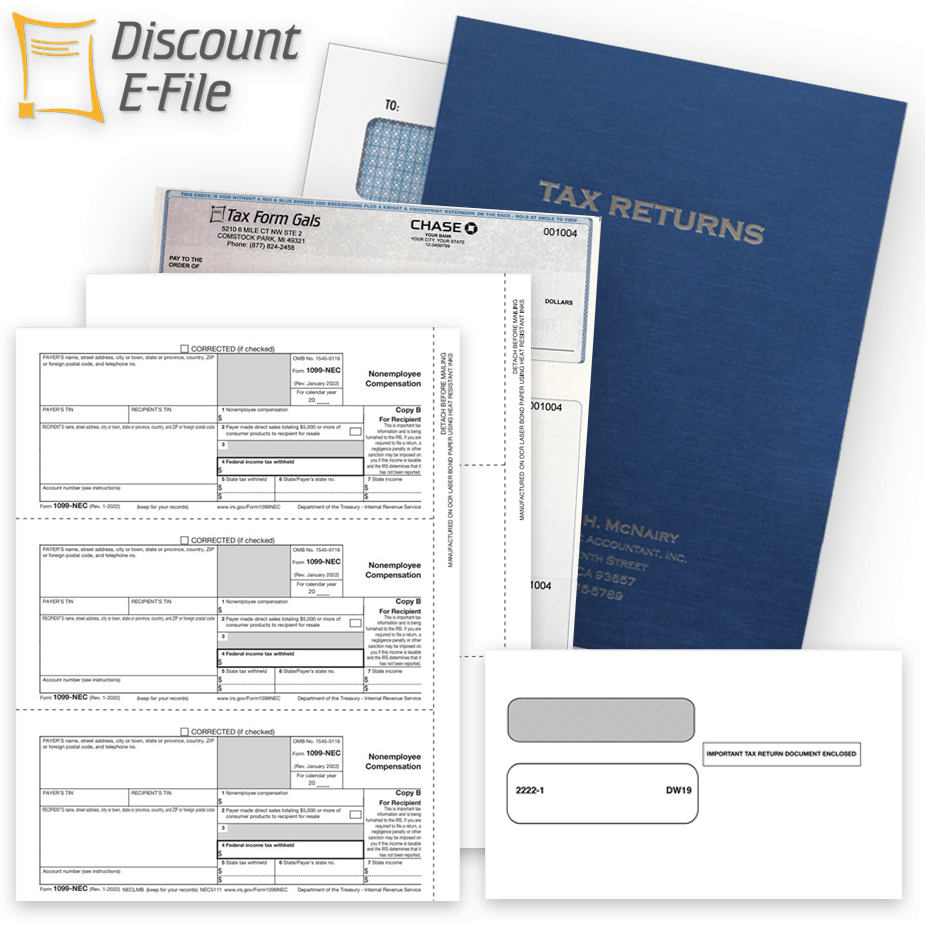

Instantly print, mail and e-file your 1099 and W-2 forms.

Simply enter or import your data, even from QuickBooks®, click a few buttons and you're done.

We print and mail recipient copies, plus e-file with the government, starting at about $4 per form and going down based on your overall quantity.