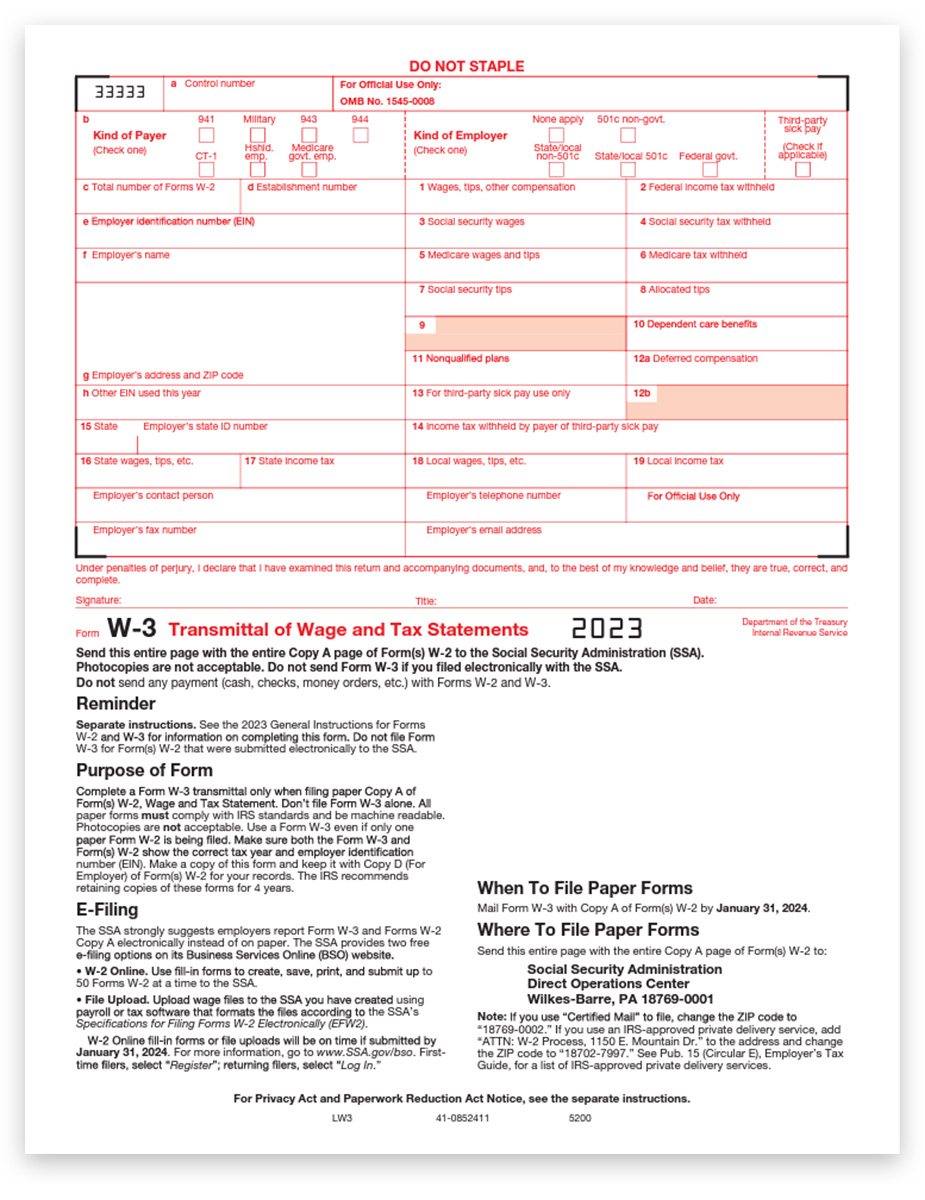

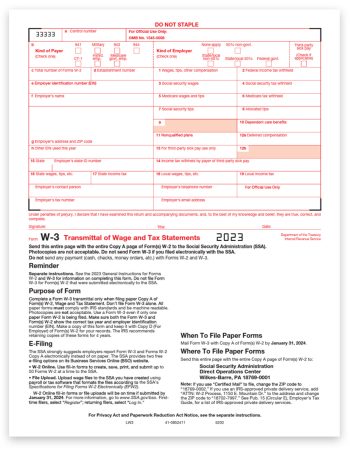

2-Part W3 Transmittal Forms for Typewriters

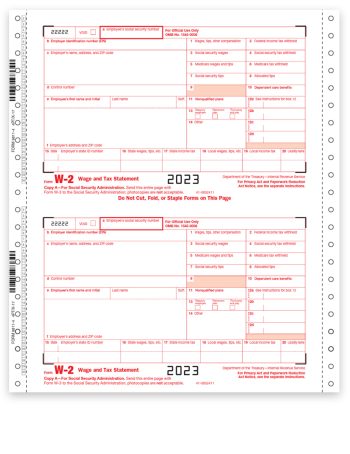

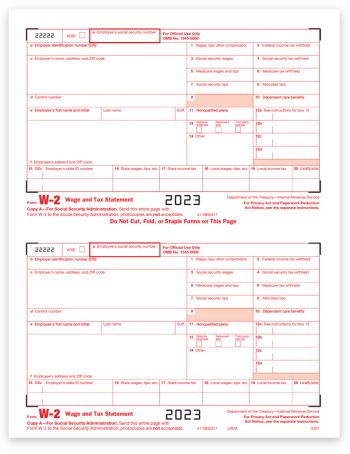

Easily file a few W-3 Transmittal Forms using these 2-part W3 forms for typewriters.

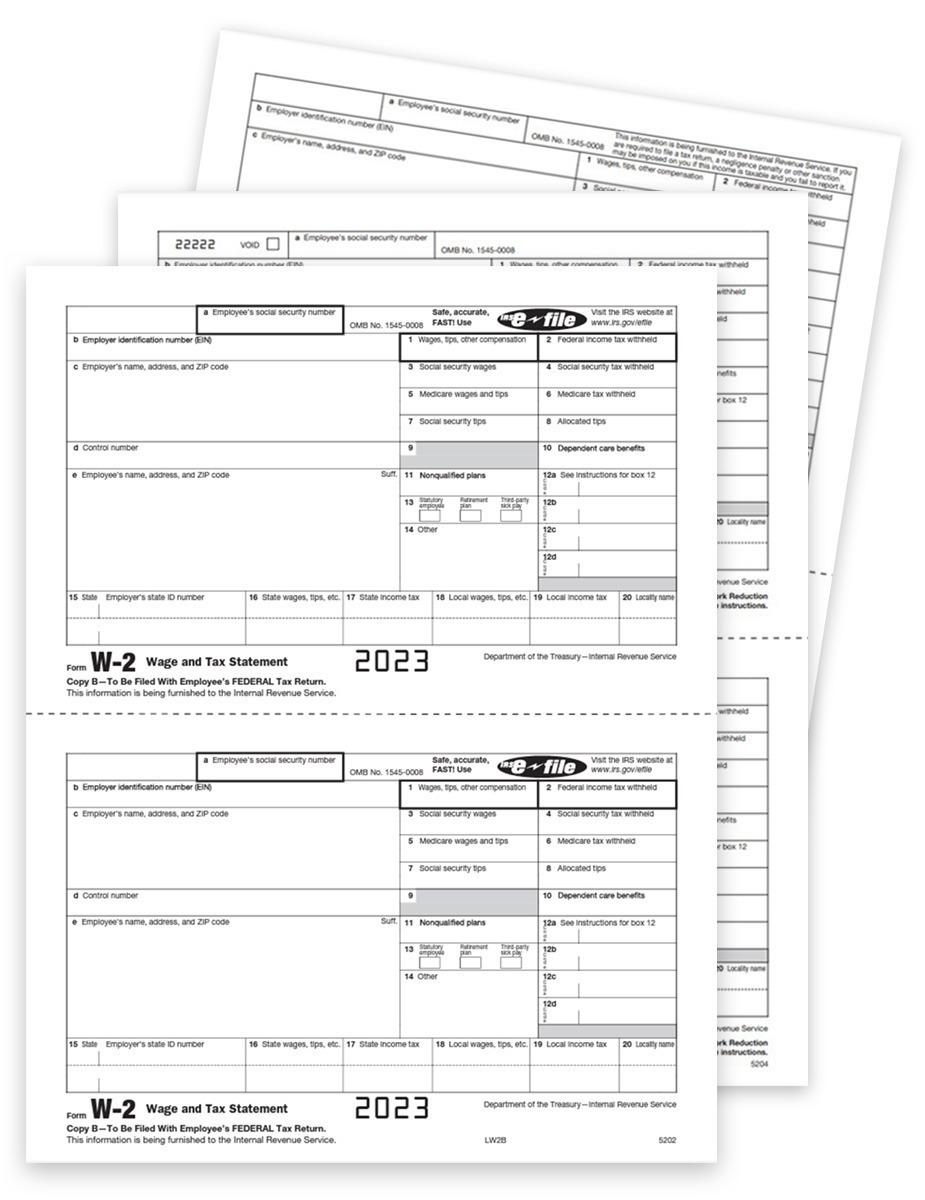

Rely on The Tax Form Gals for easy W2 filing!

Official W3 Summary Forms are filed with W-2 Copy A forms to the SSA. The W3 form summarizes all W2 forms from a single employer.

You WILL NOT need this form if you must efile Copy A forms in 2023.

Item# W-3

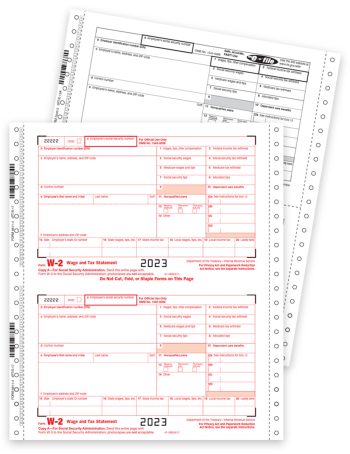

New E-filing Requirements for 10+ Recipients

If you have 10+ recipients for 1099 & W2 forms, combined per EIN, you must efile Copy A forms with the IRS in 2023.

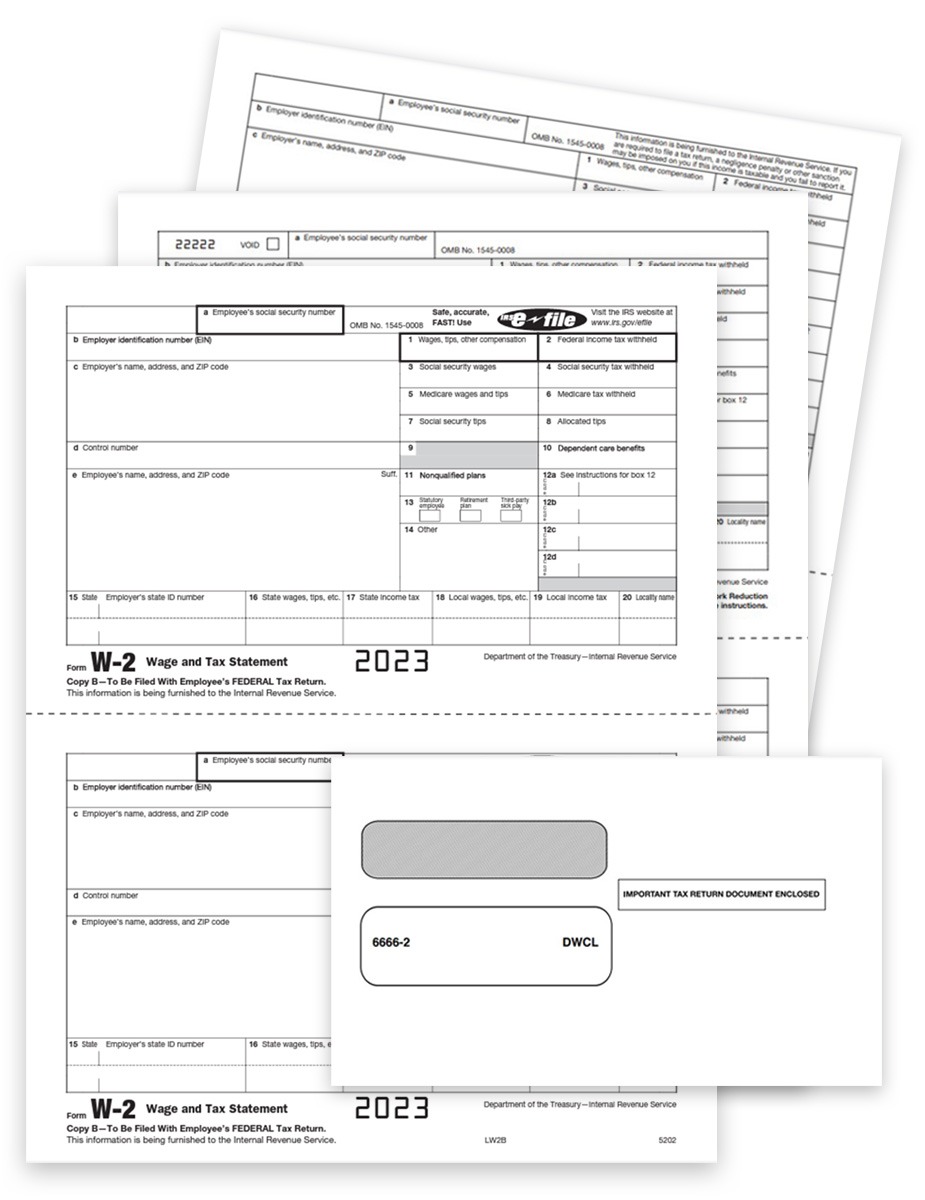

We make it easy with DiscountEfile.com… we’ll efile with the IRS or SSA and can even print and mail recipient copies for you in one easy step – no forms, envelopes or postage required!