Easy 1099MISC Filing

Forms, envelopes, e-filing and software for 1099MISC.

- Save big over retail prices

- Small minimum quantities

- Compatible accounting software

HUGE Changes to 1099 filing!

1099NEC replaces 1099MISC forms for nonemployee compensation.

If you used 1099MISC to report non-employee compensation in Box 7, you must use the new 1099-NEC form for 2020. It is designed specifically for contractors, freelancers and those are NOT employees.

If you file 100+ forms, e-filing to IRS is required for Copy A. (it changes again in 2021 to just 10+ forms).

STOP!

IT’S LIKELY YOU NEED DIFFERENT 1099 FORMS THIS YEAR…

If you have used 1099MISC forms to report payments to contractors, freelancers or any type of nonemployee compensation (using Box 7), you must change to the new 1099NEC forms for 2020.

SAY GOOD-BYE TO RED FORMS, AND HELLO TO E-FILING…

If you file 100 or more 1099 forms, you MUST E-FILE with the IRS in 2020.

This changes again next year, when anyone filing 10+ forms is required to efile.

LUCKILY, WE HAVE ONE EASY SOLUTION!

Instead of hassling with new forms, wondering if your software meets the new requirements – make the switch to online filing this year.

DiscountEfile.com is super simple and secure. Easily import data from QuickBooks and have us do the rest!

We’ll print and mail recipient copies and e-file with the IRS for one low price.

WHAT IS 1099NEC?

The 1099NEC Form is new for 2020.

It is used to report non-employee compensation that was previously reported in Box 7 of 1099-MISC form.

WHEN IS IT DUE?

Forms must be mailed to recipients by January 31.

They must also be mailed or e-filed with the IRS by February 1, 2021 (Jan 31 is a Sunday).

WHO SHOULD USE IT?

Businesses required to report payments of $600 to contractors, freelancers, attorneys and more.

If you have used a 1099-MISC form in the past to do this, use the 1099-NEC for 2020.

ONE MORE THING…

E-filing thresholds have also changed for 2020.

If you file 100+ forms, you must efile. (It used to be 250+)

That will also change again in 2021, with e-file required for 10+ forms per payer.

1099-NEC or 1099-MISC?

The IRS will require that businesses use Form 1099-NEC to report non-employee compensation in 2020.

Using the 1099MISC form to report payments to contractors may result in a penalty.

The new 1099NEC form replaces the 1099-MISC for reporting nonemployee compensation (Box 7), shifting the role of the 1099-MISC for reporting all other types of compensation.

The overall process for reporting nonemployee compensation is changing drastically for the 2020 tax year. We’ve compiled the essential details regarding the changes, so you know what to expect and how to handle each of the forms to avoid penalties.

NEW 1099NEC FORMS –

This is HUGE!!!

If you have used 1099MISC in the past to report non-employee compensation in box 7, you MUST USE NEW 1099NEC FORMS in 2020.

We have official forms, blank perforated paper, pressure seal forms, carbonless forms, compatible envelopes and everything you need for easy printing.

Online Filing Makes it All Easier

If you want to skip the hassles of printing and mailing forms, check out our Discount Efile system! You enter or import the data and we do the rest – including e-filing.

Plus, if you file 100 or more forms, you are required to e-file in 2020.

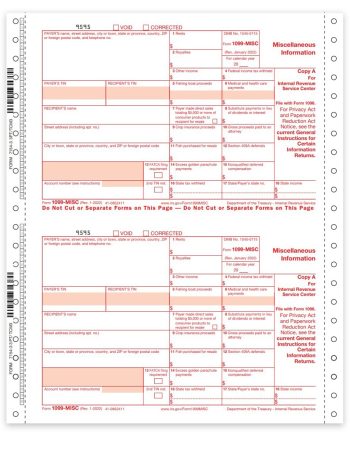

1099-NEC Forms

Use for nonemployee compensation, instead of 1099MISC.

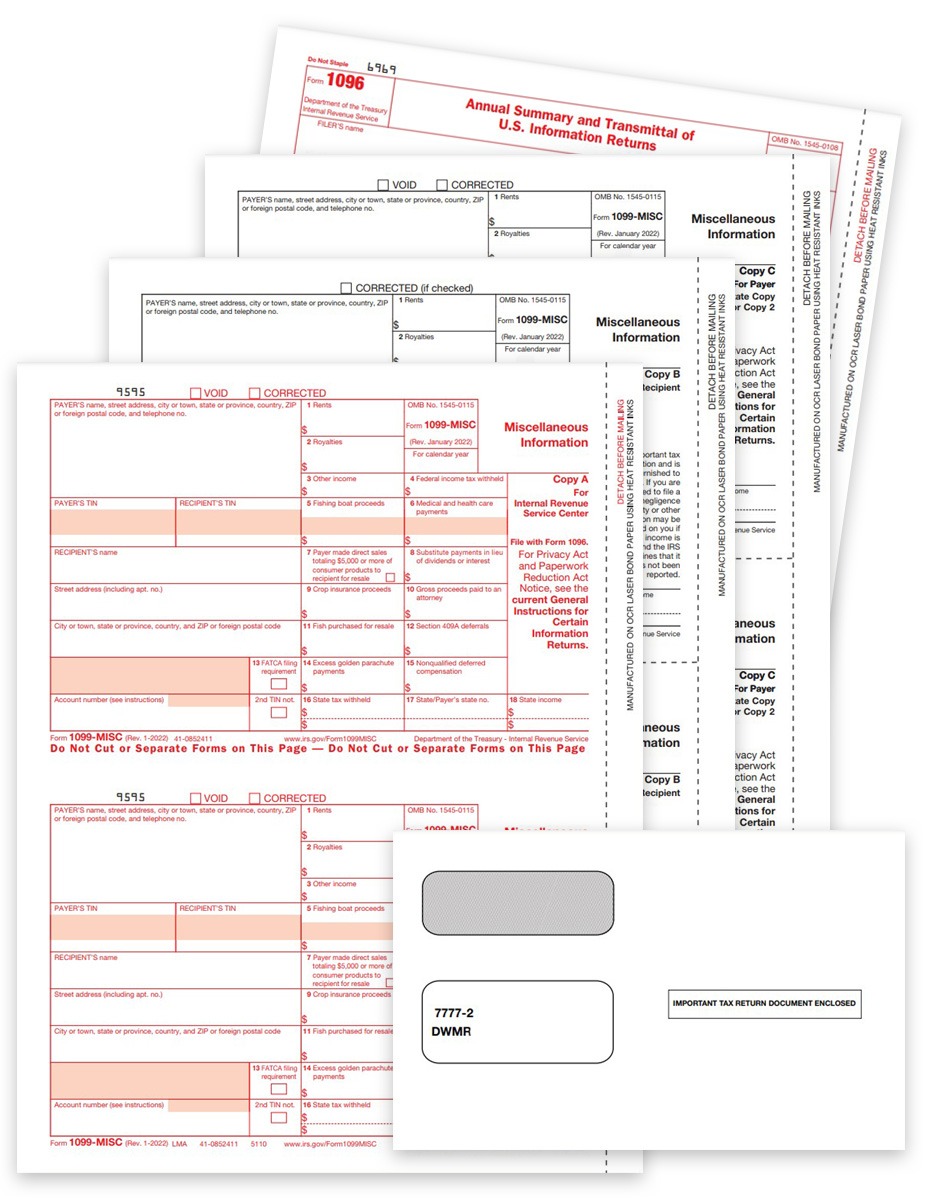

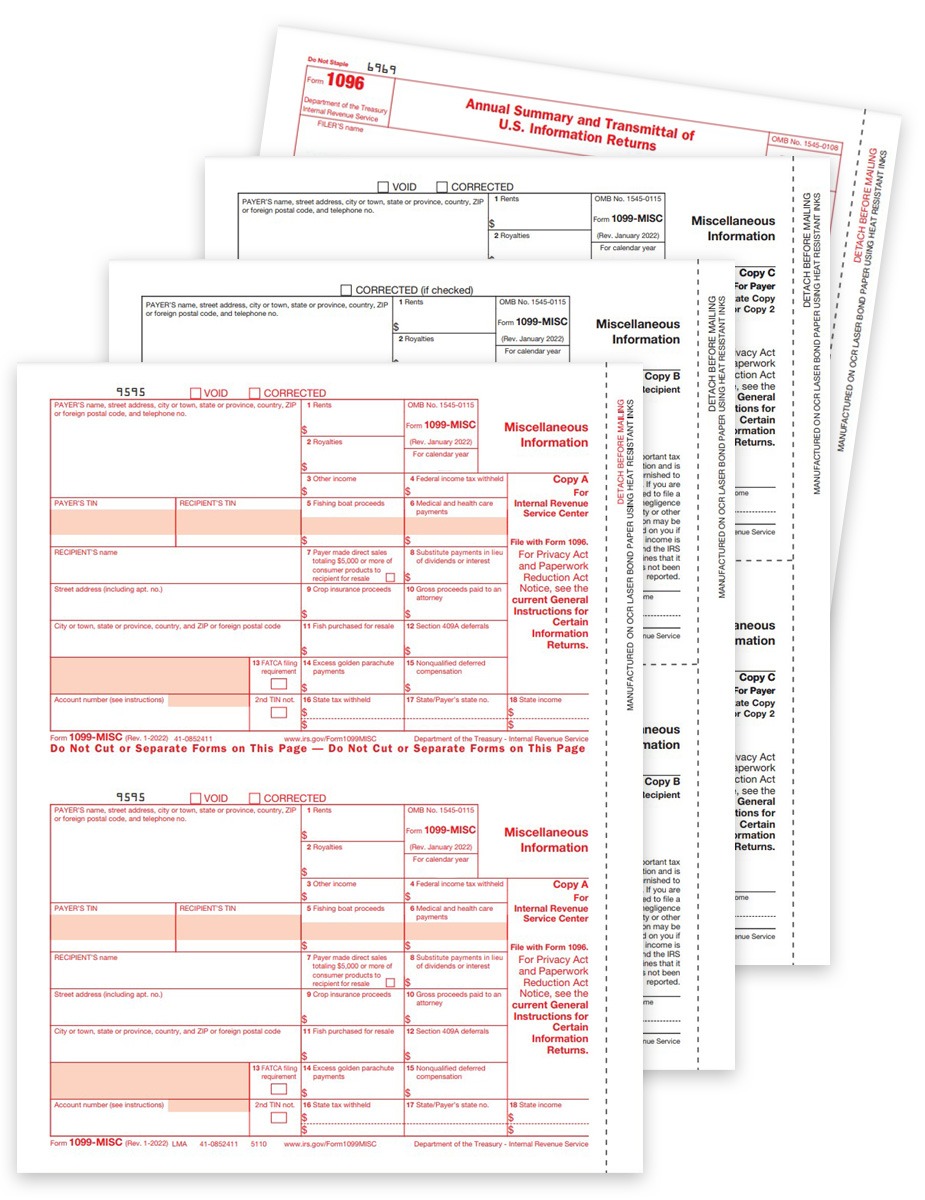

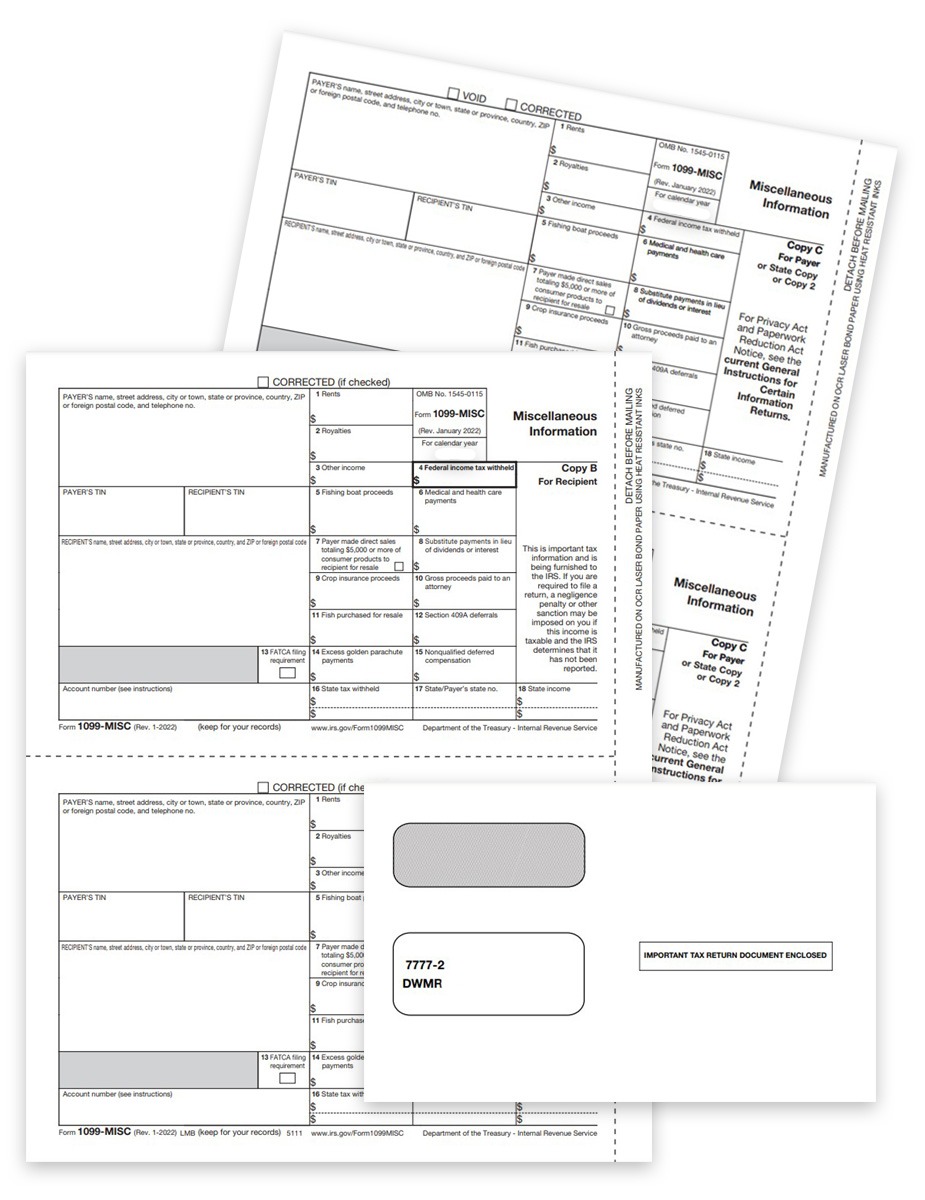

1099-MISC Form Sets

One kit with everything you need.

Blank Paper

Easy printing, always software compatible.

Preprinted Forms

Red Copy A forms and other formats too.

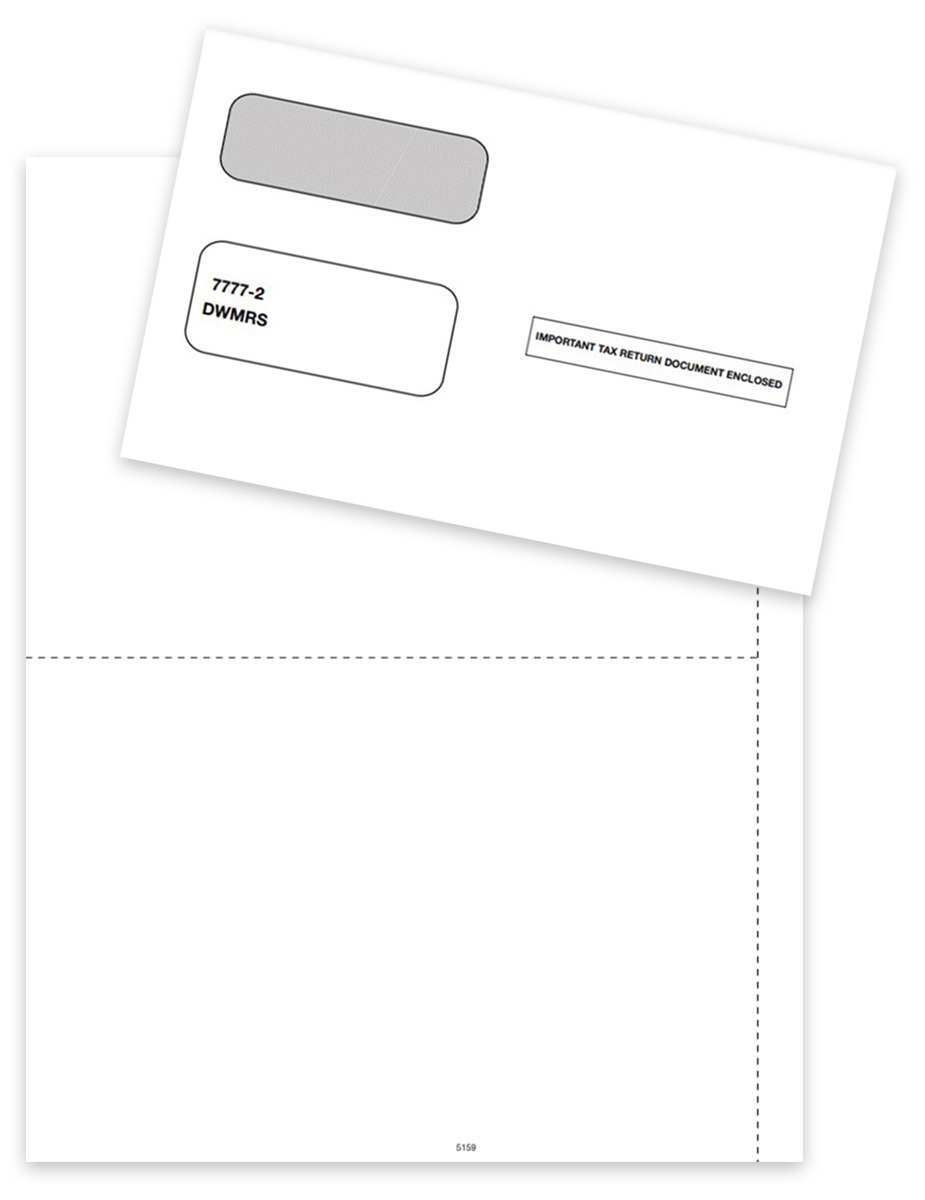

Envelopes

Security-tinted window envelopes for easy mailing.

Continuous Forms

Carbonless for pin-fed printers or typewriters.

1099 Software

Print, mail and e-file 1099-MISC forms and more.

Online & E-Filing

E-file and mail 1099-MISC forms instantly.

-

W2 & 1099 Universal Blank Perforated Paper

-

1099 Blank Paper – 2up with 1099MISC Instructions

-

1099 or W2 Blank Paper – 2up without Instructions

-

1099-MISC Blank Paper – 3up with Side Stub & Instructions

-

1099MISC Blank Paper – 2up with Instructions & Side Stub

-

1099MISC Blank Paper & Envelope Set – 2up with Instructions

Best way to file only a few 1099-MISC?

If you only have a few 1099-MISC forms to file, do it online!

DiscountEfile.com allows you to type in your data, or import it from your accounting software, such as QuickBooks.

Your forms are then automatically e-filed with the IRS and printed and mailed to recipients.

With just a few clicks, you’re done.

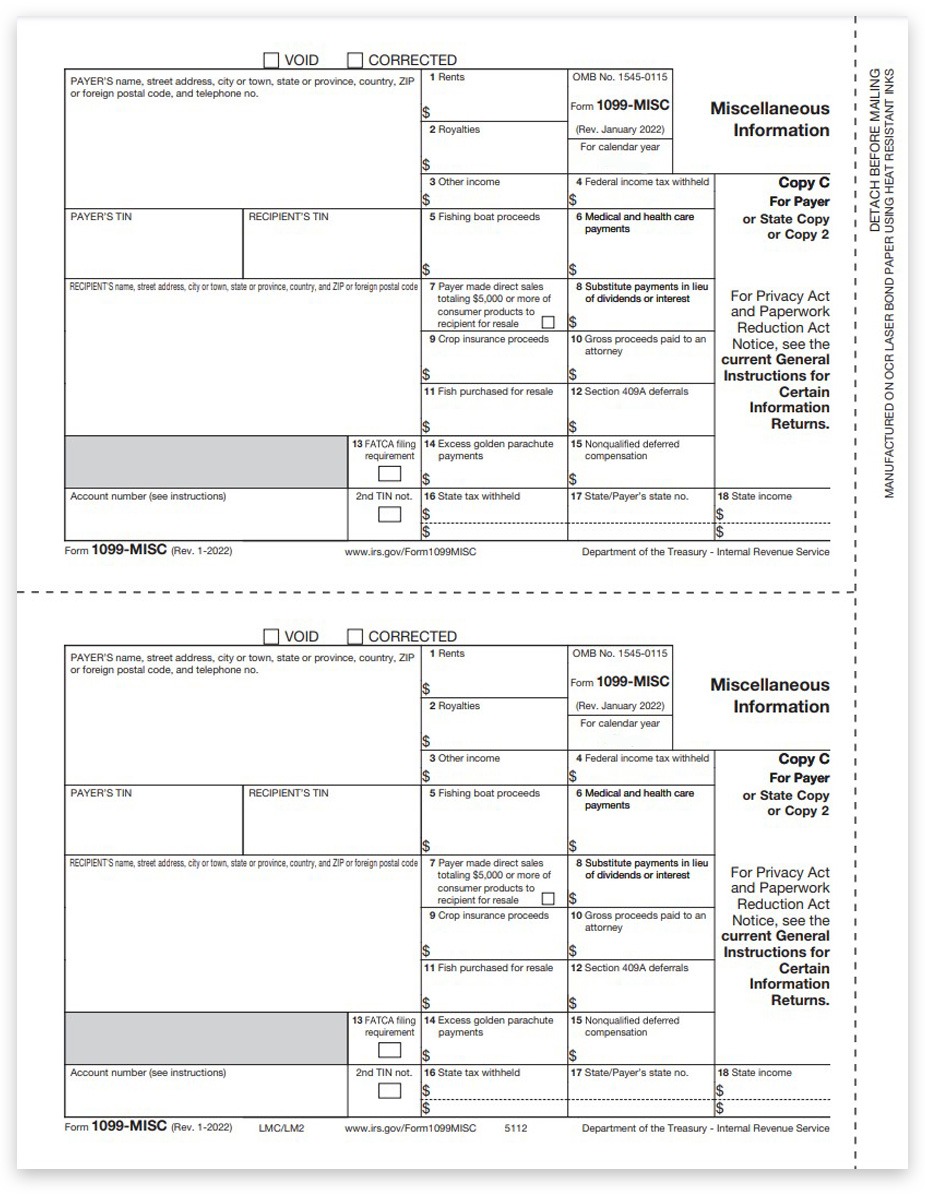

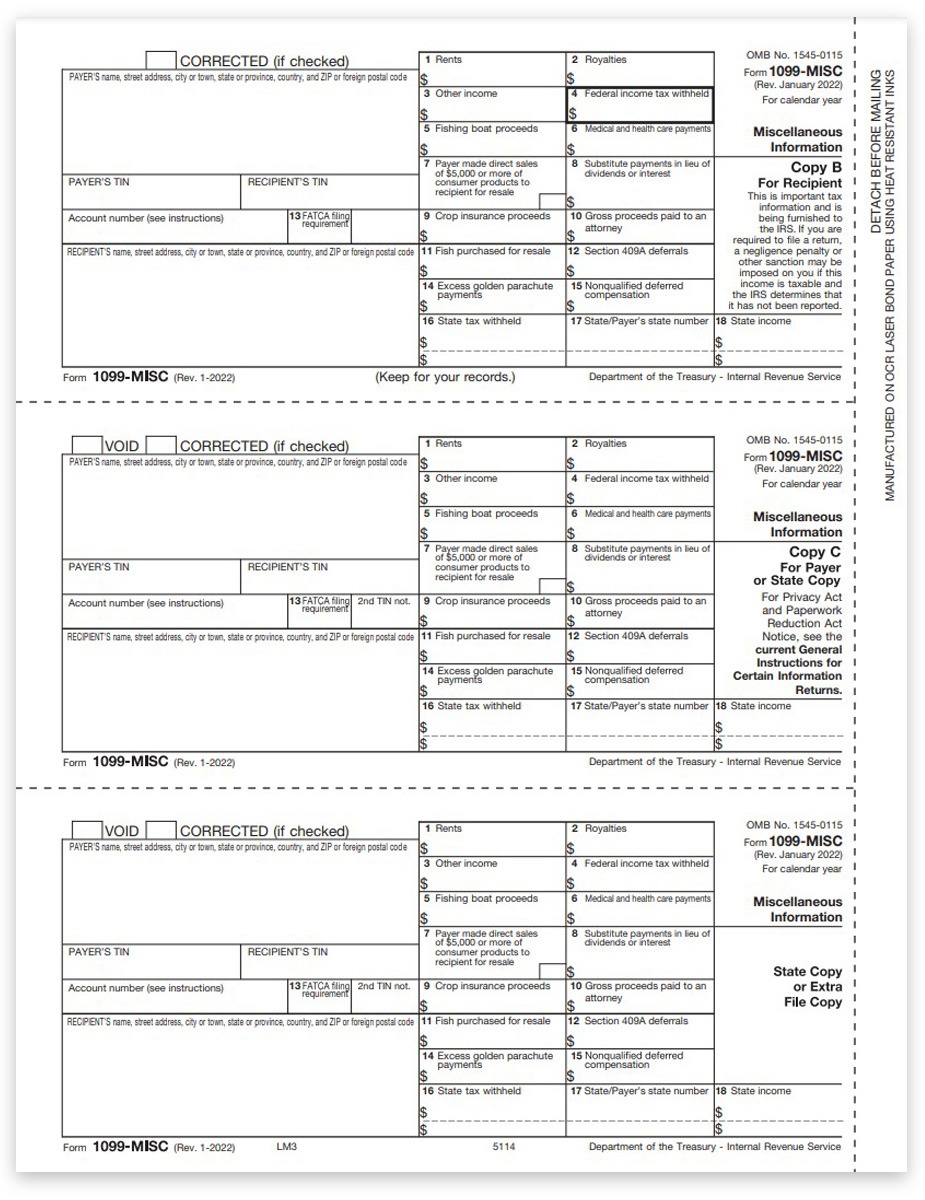

What forms do I need?

Payers must send forms to the IRS, as well as the recipient.

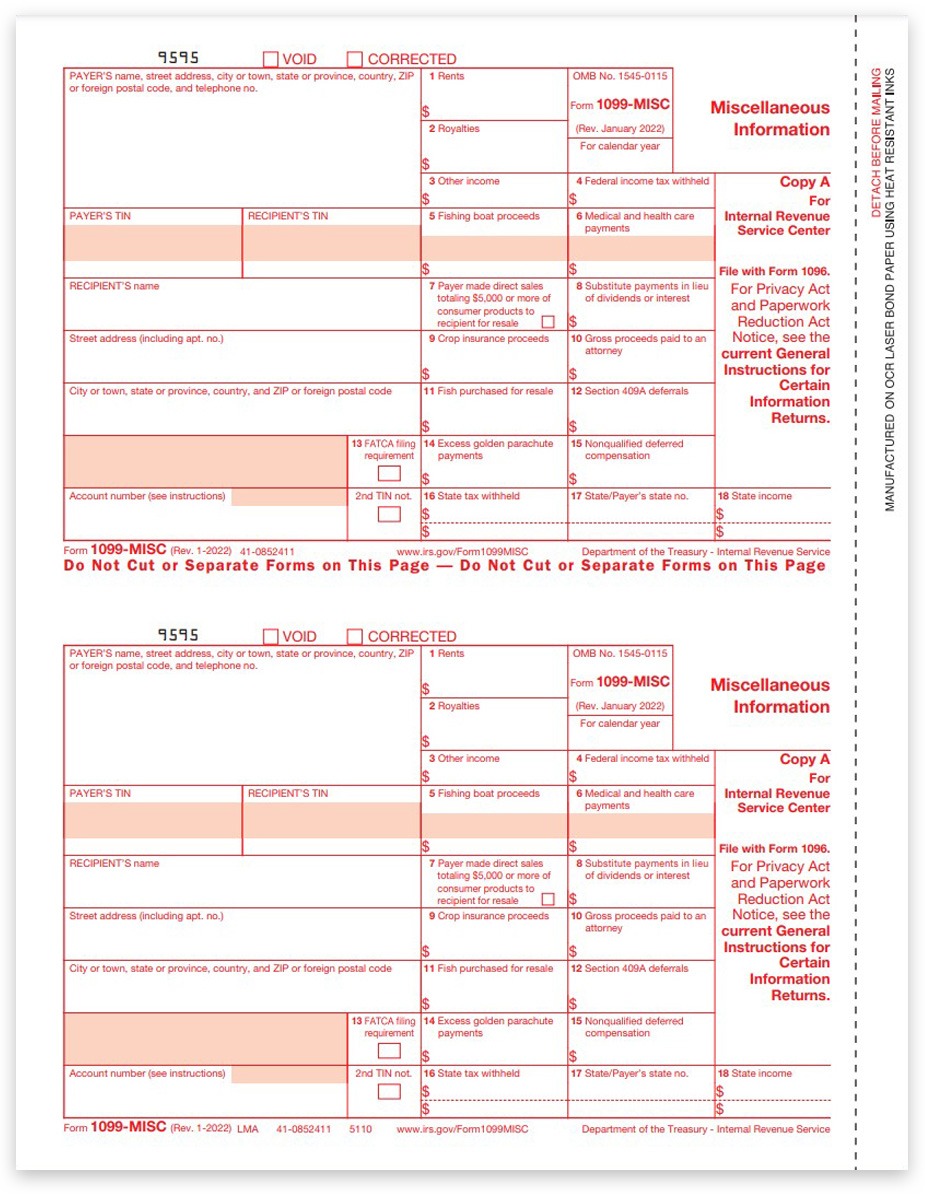

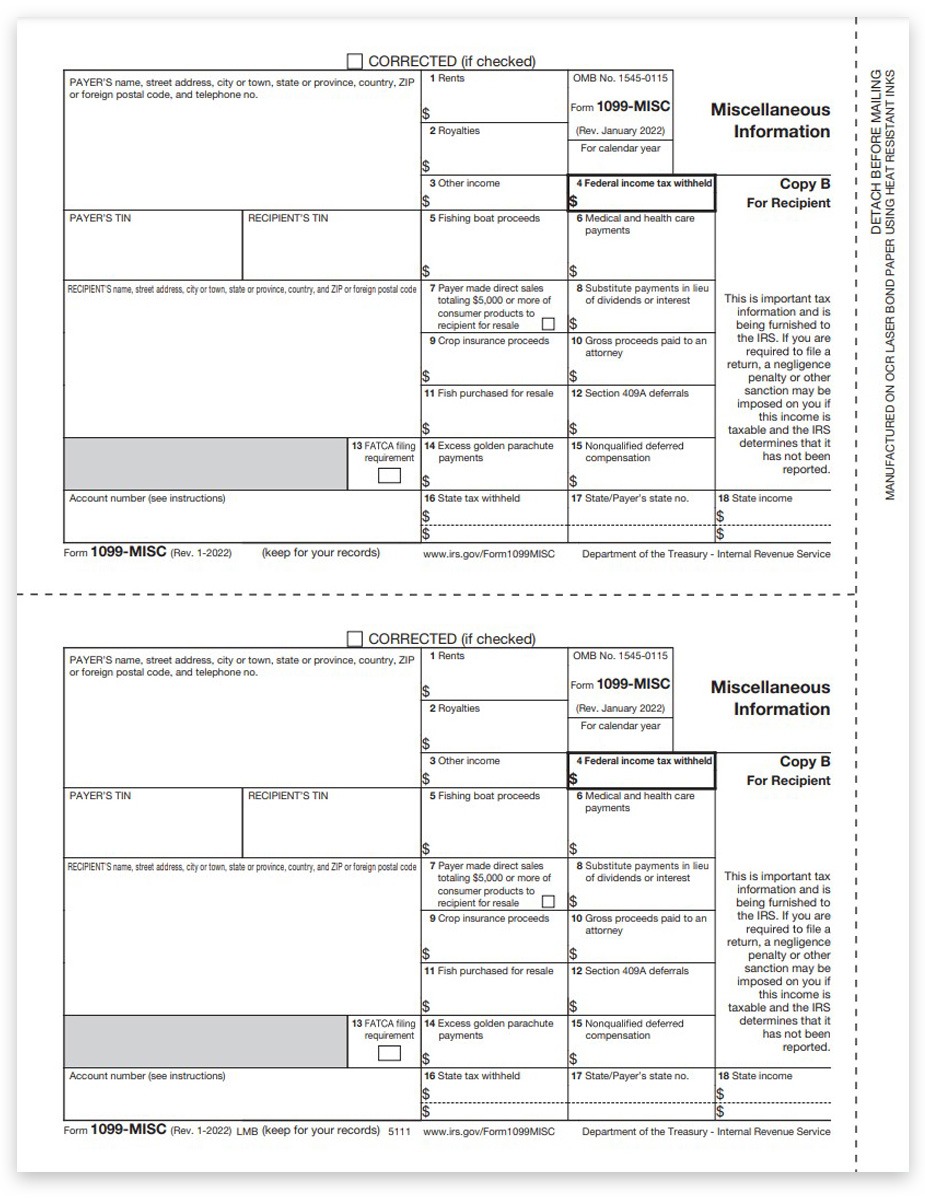

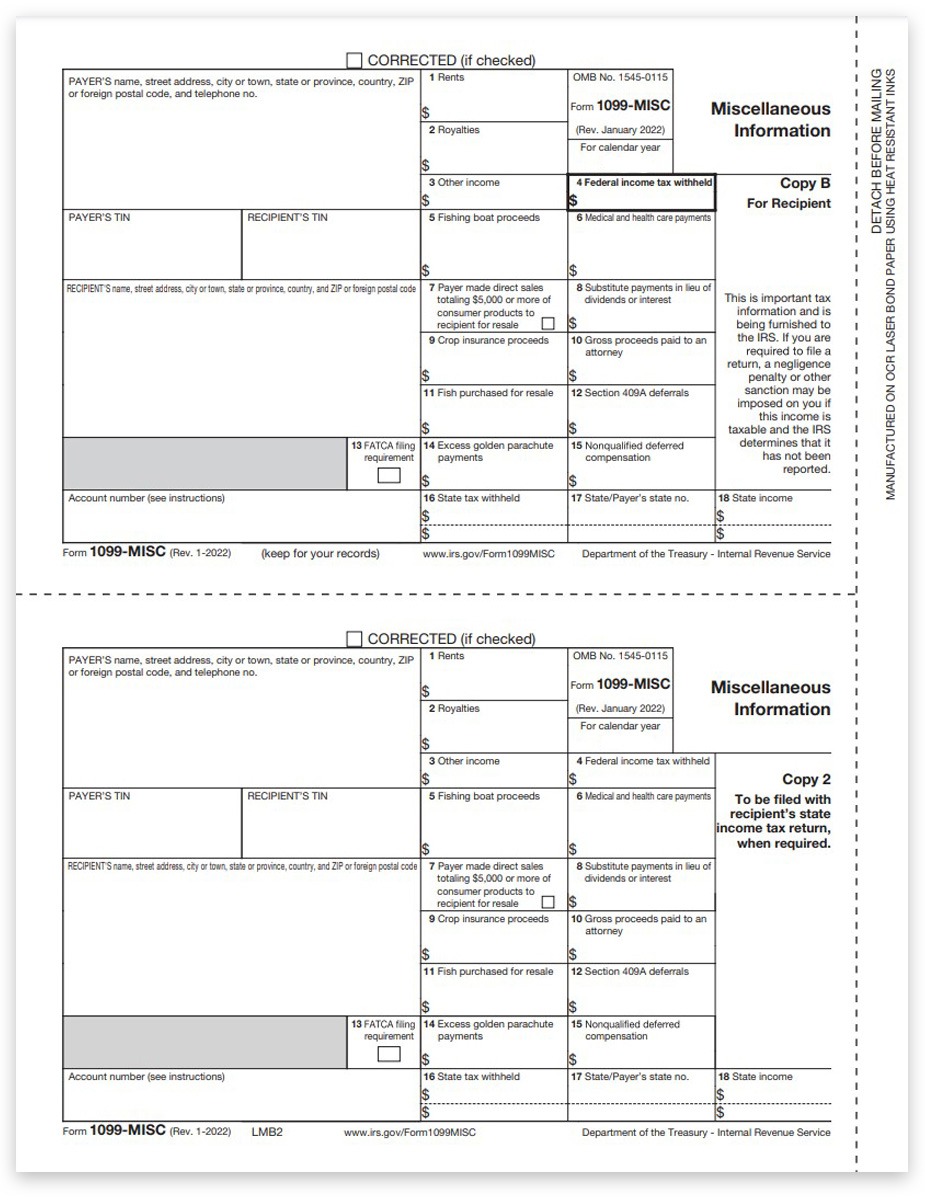

Decoding 1099-MISC form copies

- Copy A is sent to the Federal government by the payer.

- Copy B is sent to the Recipient for filing with their federal tax return.

- Copy 2 is sent to the Recipient for filing with state or local tax returns, or for their files.

- Copy C is kept by the Payer for their files.

A 3pt form is required for federal filing only.

A 4pt form is required for federal and state filing.

A 5pt form is required for federal, state and local filing.

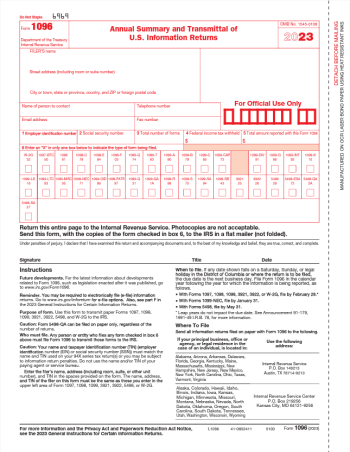

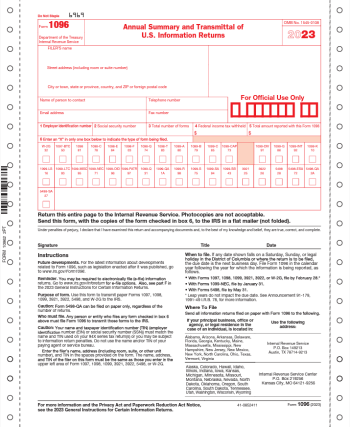

Don’t forget a 1096 Transmittal form to summarize the data for each payer for the tax year.

How to E-file 1099MISC forms

Most software that prints 1099MISC forms will also efile for an additional charge.

There are also online systems available, such as DiscountEfile.com, for easy e-filing too. You can enter data manually, or import from your accounting software.

E-file 1099-MISC forms for as low as $1.05 each.

What is a 1096 and do I need one if I efile?

They are automatically generated when e-filing with a system like DiscountEfile.com. A separate paper form is not required.

Print one 1096 form for each payer for a single type of 1099 form.

If you have multiple types of 1099 forms (MISC, DIV, R, etc.) you must print a separate 1096 form for each.